As the cost of living crisis continues, Britons are faced with managing their budgets amid rising bills, however, avoiding regular maintenance checks could prove more costly down the line.

An expert has exclusively shared with Express.co.uk some lesser-known tips people overlook that could actually help them save money on bills and avoid any cash leaks within the home.

The research conducted by Gas Safe Register, found that over 15 percent of Britons who have experienced the ‘cash leaks’ in the home, say they have been left out of pocket by more than £5,000.

One in five who were polled admitted to having avoided tackling regular home maintenance tasks, which have ended up costing them more in the long run.

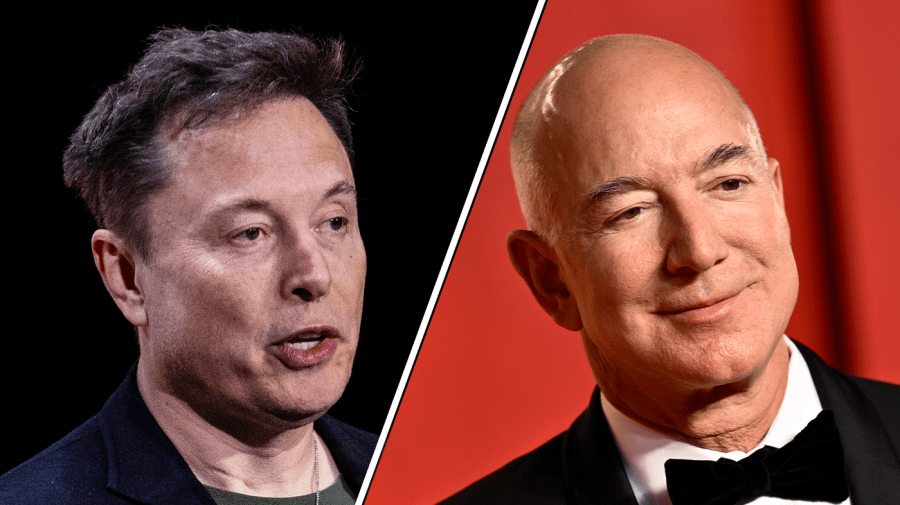

Financial expert Emmanuel Asuquo explained how the research by Gas Safe Register can affect households and warned what the biggest cash leaks in the home are.

READ MORE: Pensioner left puzzled after being slapped with ‘unexplained’ energy bills worth £1,508

Top of the list for the “biggest cash leak” was fixing a leaking toilet which, according to Checkatrade, can cost £40-£60 per hour to repair versus an emergency call-out fee of £100-120. This could lead to a devastating £2,633 on average if the leak is major and they need water extracted from the home.

This was followed by having gas appliances serviced and safety checked annually. The average cost is estimated at £100 now versus more than £400 further down the line if people wait and there’s a problem.

Another cash leak is clearing damp or mould. Experts at Checkatrade found that it costs £225 to draught-proof windows and doors now versus £850 on average if damp proofing is finally required.

Additionally, Britons should be checking the roof for loose tiles and leaking taps as costs could range from £300 to more than £7,500 and £0 to up to £1,500 respectively if there is a problem.

The personal finance expert explained how households can be confident with the simple ways in which they can save money around the home this spring.

Switch to frozen food

Ms Asuquo explained that a “good way to save money” and cut down food bills is to switch to frozen foods like fruit and vegetables as it avoids wastage and has a longer shelf life than fresh food. People could save up to £80 a year.

Get organised

Planning meals in advance can save up to £200 a year. Not only can planning meals save money, but asking children can help them feel involved. This will ensure that there is no extra spending during the week and less waste, he said.

Turn the tap off

He said: “Don’t leave the tap running when you’re brushing your teeth, or washing dishes (use a washing up bowl). This can reduce your water usage and save you around £80 a year for a family of four.”

Turn off standby

He explained that people can save around £65 a year just by remembering to turn their appliances off standby mode. He said: “At home, we have turned it into a game with our kids to see how many they remember to switch off.”

Ditch the tumble dryer

He urged people to dry clothes on racks inside where possible, or outside in warmer weather. Ditching a tumble dryer can save someone around £70 a year.

Mr Asuquo also explained the importance of getting annual gas safety checks and service.

He continued: “A regularly serviced boiler means it will run more efficiently, helping to save on bills.

“The average call-out cost is £100, but, if a boiler breaks down, an emergency call-out could cost £400 and replacing a boiler can cost thousands.

READ MORE:Free bus pass age rises in England – but new discount is available

“By following all the tips to avoid ‘cash leaks’ in your home this spring, you can accumulate savings of £495 a year in household cash – more than enough to cover your annual gas safety check, which is in average between £80-£100.

“The costs can be high if repairs or replacements are needed, but you can’t put a price on the health and safety of your loved ones.”

Additionally, Mr Asuquo suggested every family should get family plans for their mobile phone, rather than having individual plans for different family members – there’s often deals that will bring the mobile phone bill in much cheaper once it’s on a family plan.

He also urged Britons to “ditch electric heathers” as they are the most expensive way to heat one’s home as it takes a long time to heat up a room compared to their central heating system – which can be put on a timer.

Lastly, another way to save money this spring is to wash at cooler temperatures.

He said: “Set your washing machine to 30 degrees, or even a cold wash where possible – even if you save a couple of pounds per wash, over the course of the year that could save you hundreds.”