National Grocers Association President Greg Ferrara explains factors contributing to the rise in grocery prices in an interview with FOX Business Network’s Edward Lawrence.

‘Tis the season to gather and give thanks without breaking the bank.

High grocery prices and travel expenses may threaten to put a dent in this year’s holiday fun, but a full stomach doesn’t have to mean an empty wallet.

Thanksgiving should be about fun, family and festivities, not stressing over finances. While prices might be cumbersome, you can still enjoy the best parts of the holiday without blowing through your budget.

So, what’s the key to creating special holiday memories with your loved ones without emptying the piggy bank? WalletHub writer and analyst Chip Lupo shared some tips with Fox News Digital.

1. Simplify the menu

Healthy Homemade Thanksgiving Green Bean Casserole Ready to Eat (iStock / iStock)

“Focus on a few favorite dishes rather than preparing a wide variety of menu items, as this can reduce both food waste and costs,” Lupo advised. Instead of pairing your turkey and dressing with a spread of sweet potatoes, green bean casserole, mashed potatoes, deviled eggs and other sides, pick your family’s top two or three favorites and go from there. Shaving off one food item or two can mean cutting back on purchasing several ingredients, easily stacking up your savings.

If you opt to cut sweet potato casserole, for instance, you could slash marshmallows, pecans, and, of course, sweet potatoes from your shopping list. Other ingredients like eggs, brown sugar, and butter could be used for other dishes, perhaps in a glaze for your ham or mixed into your dessert ingredients, meaning you won’t have to buy these in larger quantities to make multiple dishes.

2. Host a potluck

Group of friends gather at a dining room table for Thanksgiving dinner. (iStock / iStock)

“Simply ask guests to bring specific dishes, which would lessen the financial burden on the host,” Lupo said. With this approach, hosting a Thanksgiving feast not only saves you money, but also time. It can also create opportunities to try a spread of more diverse dishes and create a more inclusive experience.

If only a couple of family and friends at the table enjoy green bean casserole, for instance, they can bring the dish to satisfy their own tastes. This way, everyone can have the food they enjoy. If one of your guests cannot eat a specific dish due to dietary needs, ask them to bring a variation of that dish they can enjoy at the table with everyone else.

What might this potluck look like? Ask your guests to bring items that meet specific criteria to prevent overlapping. One family member can bring a “green vegetable dish.” Another can bring drinks while a third brings dessert.

While the host also has more money left for Black Friday shopping and holiday gift-giving, they also have more time to themselves, watching football or chatting with loved ones instead of spending time in the kitchen.

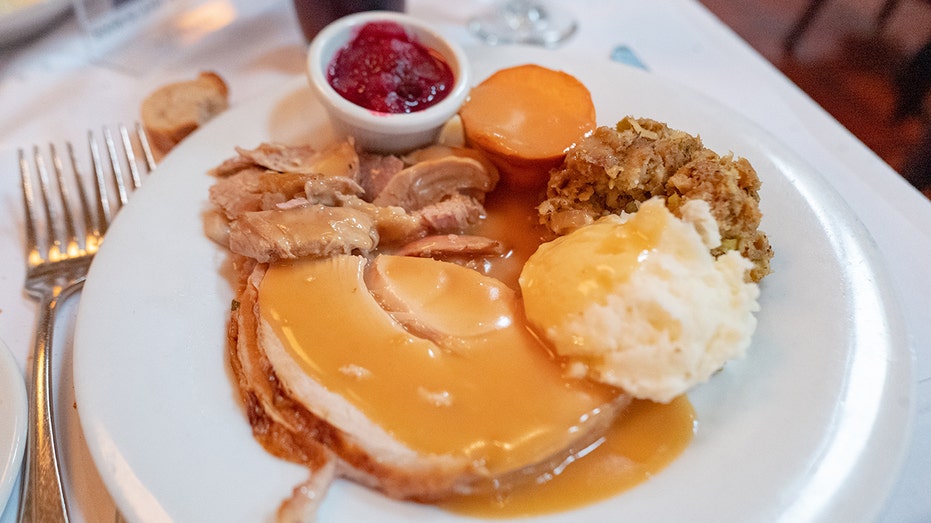

3. Watch your portions

Close-up of a plate with turkey, gravy, mashed potatoes, stuffing, yams and cranberry sauce — classic food items during a traditional American Thanksgiving meal in Danville, California, November 28, 2019. (Smith Collection/Gado/Getty Images / Getty Images)

“Be mindful of portion sizes, particularly with turkey, which is often the most expensive Thanksgiving item and leads to the most leftovers,” Lupo said. “Scaling back on the amount of food prepared can prevent overspending.”

Though a recent Wells Fargo consumer report indicates prices for turkeys are predicted to fall 16% since last year, the cost of your bird could come to an average of $1.37 per pound in 2024, bringing a 16-pound turkey to just under $22 before tax. If you have a budget on the tighter end, this main menu item could eat up nearly half of your planned expenses.

Another Thanksgiving staple, ham, is reaching record-highs this year, up 5.2%, now costing $4.56 per pound, the report stated.

Other price increases include russet potatoes with a 14% jump, canned green beans with a nearly 9% jump, sweet potatoes with a 4% jump, canned cranberries with a 7% jump and canned pumpkin with a whopping 30% jump since last year.

Scaling back on this year’s Thanksgiving spread – either by removing the pumpkin pie or a dish that isn’t necessarily the family favorite could help shave off the cost of some of these ingredients.

4. Get creative with leftovers

Turkey hash from Thanksgiving leftovers. (Liz Hafalia/The San Francisco Chronicle via Getty Images)

“If you do have leftovers, get creative by turning them into new meals, such as turkey soup or casseroles, to make them last longer without getting repetitive,” Lupo said.

The options are endless, and the hunt for recipes starts with a simple Google search that can give you ideas for turkey stir-fries, turkey tacos, turkey hash, shepherd’s pie, or slider sandwiches. Using up leftovers can even be as easy as putting together a turkey or ham sandwich or pouring multiple remaining dishes together for a turkey and dressing-based casserole.

This way, not only are leftovers used in ways that don’t get too boring, but you can also save money on groceries in the days following your Thanksgiving feast.

Sending leftovers home with your guests is also a viable – and generous – option for making sure the food doesn’t go to waste.

5. Go easy on decorations

Thanksgiving table setting with small pumpkins. (Anjelika Gretskaia/REDA&CO/Universal Images Group via Getty Images / Getty Images)

“You can also save money by going easy on decorations and focusing more on the meaning of the holiday rather than its commercial aspects,” Lupo advised.

In other words, avoid turning your kitchen into an Instagrammable Thanksgiving spread chock-full of pumpkins, crispy leaves, candles, cornucopias and meticulously selected floral arrangements to get the space looking perfect.

Instead, focus on creating a simple, minimalistic and welcoming atmosphere for guests that focuses more on camaraderie and creating memories rather than being overly concerned with aesthetics.

DIY decorations are another way to use materials already available at home – or purchase inexpensive materials – to decorate your Thanksgiving space.

6. Traveling? Book early

Booking travel early is a smart move if you’re planning to head off someplace for Thanksgiving. (Hannah Beier/Bloomberg via Getty Images / Getty Images)

Lupo’s advice for booking your travel? The earlier, the better.

“If travel is part of your holiday plans, book your accommodations early and use price trackers for flights to help you find the best deals,” he said.

Airfares tend to surge just before Thanksgiving arrives, so booking your flight in advance could be a smart move. Data from a recent Google Flights report suggests ticket prices tend to be the lowest for domestic destinations 38 days before departure.

“The historical low price range is 21-52 days before takeoff,” the report adds.

If you’re traveling abroad, average lows come 101 days before takeoff, with the historical low price range coming 50 days or more before takeoff in general.

As always, loyalty rewards programs with your airline of choice are good options for shaving off costs or finding good deals as well.

7. Be wary of online shopping

A woman browses the web while online shopping. (Nicky Loh/Bloomberg via Getty Images / Getty Images)

Holiday spending doesn’t end with Thanksgiving, of course. In many cases, it’s only the beginning of a more drawn-out, exorbitant stretch of indulgence.

Big holiday sales days like Black Friday and Cyber Monday could just pour gasoline on the fire.

“Be cautious about online shopping. Don’t let holiday sales dictate your budget,” Lupo warned, adding, “make sure to stick to a predetermined budget to avoid overspending.”

The average American is expected to shell out approximately $1,778 in holiday shopping this year, according to Deloitte, a consulting firm, cited in a recent CBS News report.

That’s an 8% increase from 2023, and with Black Friday deals starting earlier and earlier each year, it’s easy to get trapped in the digital sales pitches to ramp up spending even more.

Last year, Consumer Reports offered a number of tips for penny-pinching as well: take advantage of loyalty rewards programs, hunt for exclusive deals and promotions on social media, and create a hard budget and sticking to it, to name a few.

GET FOX BUSINESS ON THE GO BY CLICKING HERE