The agency could become critical to regulating crypto if politicians make good on promises to achieve regulatory clarity.

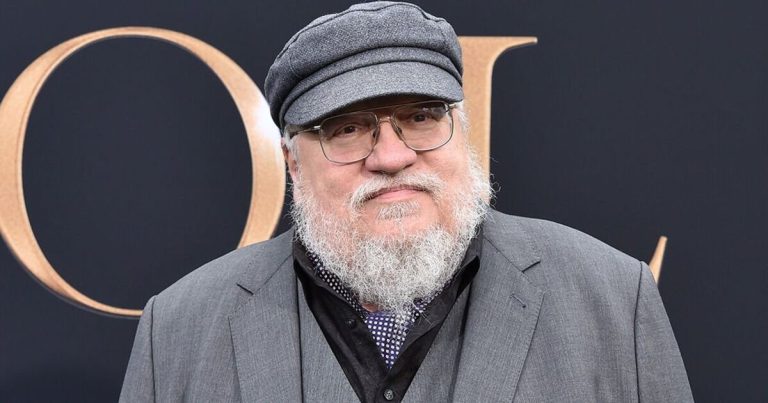

Brian Quintenz is currently head of policy for a16z crypto

(CFTC)

Posted February 11, 2025 at 9:44 pm EST.

President Donald Trump’s nominee to lead the CFTC is Brian Quintenz, who leads policy at a16z crypto and was formerly a commissioner at the agency.

He is expected to be a major advocate for the industry in the position and someone who will encourage it to be overseen primarily by the CFTC rather than the SEC. The news was originally reported by Punchbowl News.

A Big Win for Crypto

Quintenz, who served as a commissioner from 2017 to 2021, was reliably conservative and outspokenly supportive of the industry, despite Trump’s own skepticism at the time.

While at the CFTC, he was often covered alongside SEC Commissioner Hester Peirce, who is affectionately referred to as “Crypto Mom,” as another one of the biggest advocates of clearer regulation of crypto and that which fostered innovation. He also repeatedly called for the industry to create its own self-regulatory organization in order to avoid enforcement actions and also suggest workable guardrails.

“I would suggest that the community come together and try to form some kind of independent, oversight, regulatory body that has teeth, that can enforce some rules, that can add credibility to the marketplace,” he explained to CNBC in 2018.

Read More: Ahead of Debanking Hearings, Industry Is Divided on Political Strategy

Crypto’s More Important Regulatory Agency?

The agency which he once worked for, and now is set to lead, could become a key player in crypto regulation.

If the recently sworn in pro-crypto Congress passes market structure legislation that gives oversight authority to the CFTC, it will be up to Quintenz to spearhead the creation of interpretive rules outlining how the agency will execute on such laws.

Trump reportedly intends (through a potential crypto market structure bill passed by Congress) to encourage the expansion of the CFTC’s oversight authority to crypto and roll back the power of the SEC, which was hostile to the industry starting in Trump’s first term in office and even more so during the Biden Administration under the leadership of Chair Gary Gensler.

The crypto industry, which mostly backed president-elect Trump, has pushed for CFTC oversight authority of crypto over the course of several years, in addition to requesting clearer regulatory guardrails in the U.S. more broadly.

Crypto Legislation Incoming

Last week, David Sacks, President Trump’s crypto and AI czar, held a press conference alongside members of Congress, including Senator Tim Scott, Representative French Hill (the leader of the House Financial Services Committee), Senator John Boozman, and Representative GT Thompson. They announced their intention to work on a crypto market structure bill. (Rep. Hill said on the Unchained podcast in July that market structure legislation would be one of the first two bills he would try to pass through the committee.)

Sacks also announced a joint working group between the House and Senate that would collaborate on crypto legislation so as to maintain American competitiveness.

Read More: Rep. French Hill Says He’d Investigate Operation Choke Point 2.0 as Financial Services Chair

Quintenz’s Connections

A16z founder Marc Andreessen has reportedly had Trump’s ear throughout the campaign and transition process, and likely advocated for Quintenz, sources say. Andreessen is part of a group of Silicon Valley thought leaders who have become increasingly conservative in recent years, which also includes Trump’s newly appointed AI & Crypto Czar, David Sacks. It is safe to assume that Quintenz’s favorability amongst this group played a role in his nomination, three sources close to Quintenz explained.

Andreessen did not immediately respond to requests for comment.

Quintenz is also on the board of directors at the prediction market platform Kalshi which, while not a crypto company itself, is a top competitor to the blockchain-based prediction market Polymarket, a favorite of Trump’s.

Though some had surmised previously that Quintenz’s connection to Kalshi might be seen as a negative by Trump, two sources later explained that Kalshi’s rivalry with Polymarket was likely insignificant when considering him for the role.

More at issue would be Kalshi’s ongoing legal battle with the CFTC, three regulatory experts who spoke to Unchained explained. Quintenz would likely be required to recuse himself from CFTC matters having to do with Kalshi, leaving conservatives with only two votes on such matters.

However, Kalshi’s suing of the CFTC over whether such markets can legally host betting markets on elections — an action which would have likely been reviewed and approved by its board — also positions Quintenz as someone who has the pro-innovation regulatory perspective Trump likely wants to see from the agency. Donald Trump Jr. also joined Kalshi as a strategic advisor on Monday, strengthening ties between the firm and the incoming presidential administration.

The Trump-Vance transition team did not immediately respond to a request for comment.