Redfin CEO Glenn Kelman discusses the current state of the housing market, issues in the industry, Zillow offering 15% down payment loan program and why the company left the National Association of Realtors.

Redfin CEO Glenn Kelman reacts to the U.S. real estate market, warning homebuyers that relief from the “rock bottom” economic conditions remains uncertain in 2024.

EXPERT SAYS ‘SOME KIND OF MIRACLES’ NEEDED IN ‘WORLD OF REAL ESTATE’ TO REVERSE TRENDS

“You’ll have to ask the Fed when the market’s going to get better, because it seems very unlikely that interest rates will ease by the end of this year. So, the only real question is whether we’re going to catch a break entering the home buying season of 2024. But I think most people have written off the 2023 home buying season,” he said earlier this week.

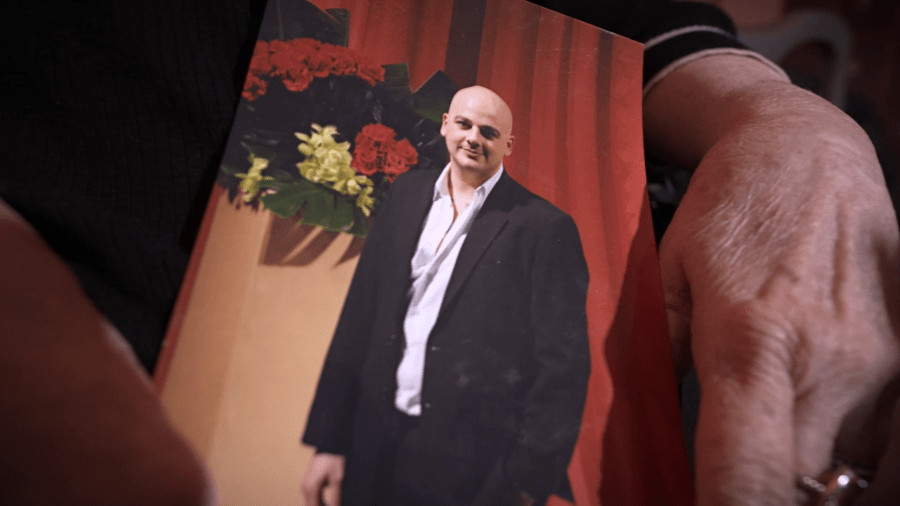

Pictured: Glenn Kelman, CEO of Redfin, in an interview during the eMerge Conference on May 4, 2015 — (Photo by: David A.Grogan/CNBC/NBCU Photo Bank/NBCUniversal via Getty Images) (Getty Images / Getty Images)

During an appearance on “The Big Money Show,” the CEO revealed that the circumstances that have led to “rock bottom” have less to do with the economy than some would suspect.

“Consumers really adjusted to higher rates coming into the summer. And so, we had so many people back out at the beginning of the home-buying season who decided, ‘I’m ready now, I’m going through with it no matter what.’ And then rates went up again. And so we saw 20% to 25% of deals being canceled over the past four to five weeks because rates cleared 7.5%,” he explained.

US MORTGAGE RATES WILL CREATE ‘DIRE’ SITUATION FOR REAL ESTATE MARKET, EXPERT WARNS

“The bigger implications are that so many people have stopped believing in the American dream. One in five millennials believe they will never own a home. And if you don’t have that conviction that you’re going to get your piece, it’s really hard to invest in the long term. It’s really hard to believe that society is going to work out for you. I think we have to come together as a society, build more houses and figure out a way that [the] next generation is going to be able to buy into our society.”

O’Leary Ventures Chairman and ‘Shark Tank’ investor Kevin O’Leary weighs in on a looming government shutdown, Gary Gensler’s digital currency hearing and stocks in trouble.

Real estate companies like Zillow are attempting to attract more homebuyers into the marketplace by launching a 1% down payment program that aims to help potential buyers who have been priced out of the market due to high borrowing rates, excessive rents and elevated home prices.

Co-host Jackie DeAngelis weighed in on the program, deeming it as a “recipe for disaster.” Kelman bolstered her claim, arguing that the program fails to address the “fundamental problem” within the real estate market.

‘SHARK TANK’ STAR WARNS REAL ESTATE DOOM LOOP HAS ‘NOT IMPROVED’

“Home affordability is a four-decade low. Prices are up 40% since 2019, and now interest rates have compounded that. And so I think the real issue for us is that this generation owns less than 20% of American wealth entering home-buying age. I’m talking about the millennial generation, whereas baby boomers own more than 30% of American wealth,” he continued.

Cushman & Wakefield Chairman of Global Brokerage Bruce Mosler provides his real estate outlook and addresses New York City’s office vacancy problem on ‘The Claman Countdown.’

“We can come up with creative financing. The piper always has to be paid when that happens. But fundamentally, we have to figure out how to build more houses. And, mostly, it has been the red states where we have figured that out, where through low regulation and through a real partnership with builders, places like Orlando and Las Vegas have just been building like crazy, and that’s where everyone’s moving. So, it used to be that about 18% of our customers were relocating. Now it’s more than 25% of our customers are relocating. That continued through the pandemic. It’s not going to stop.”

GET FOX BUSINESS ON THE GO BY CLICKING HERE