‘We’re insurance experts – here is why car insurance is shooting through the roof’ (Image: GETTY)

Car insurance premiums have experienced a significant increase since the beginning of the year, prompting many to wonder about the underlying causes behind this surge.

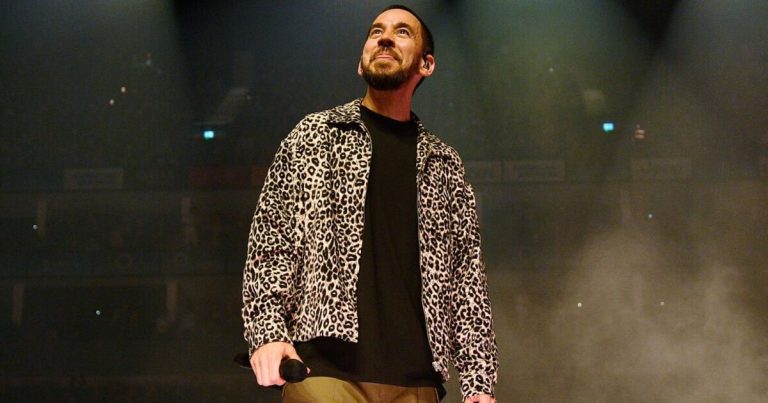

Martin Lewis warned in his Money Saving Expert newsletter this week, that car insurance renewal prices have grown “worse” since last month and the trend may continue well into 2024.

According to analysts at Consumer Intelligence, who assesses 17 million quotes a year, premiums have rocketed by 61 percent in the last year. London saw the biggest rise with 69.5 percent and the North West saw the smallest rise with 55 percent.

The Consumer Intelligence Car Insurance Price Index also revealed a record 22 percent increase in average quoted car insurance premiums over the three-month period from May to August. This marks the most substantial quarterly rise recorded for the index since tracking began in October 2013.

Delving into why this might be, financial expert Mr Lewis said: “Insurers say rises are partly due to general inflation [and] rising car repair costs – with garages charging more for parts and labour.

READ MORE: Martin Lewis issues car insurance alert on exact day you should renew policy

Martin Lewis warned car insurance renewal prices have grown “worse” since last month (Image: PA)

Mr Lewis attributed another factor to a greater number of payouts for written-off cars, due to the value of used cars increasing even more.

Telematics providers, which utilise devices to monitor a driver’s behaviour and adjust premiums accordingly, are also becoming less competitive and are leading to an increase in prices. According to Consumer Intelligence’s data, these are accounting for just 17 percent of the top five quotes compared with 21 percent just three months ago.

This has had a significantly greater impact on younger drivers, with telematics providers now representing only 41 percent of the most competitive quotes for individuals under the age of 25, down from 53 percent just three months ago. As a result, under-25s are experiencing substantial rises in their quoted premiums, with an average increase of 66.7 percent.

Max Thompson, insurance insight manager at Consumer Intelligence said: “Motorists of all ages have seen new business quotes soar over the last year and many will likely be feeling the pinch in their household budgets against a backdrop of other rising costs of living.

Car insurance premiums have increased by 61 percent in the last year, up from 40 percent last month (Image: GETTY)

“Competition from telematics has reduced for a second consecutive quarter. This drop-back in telematics delivering competitive quotes has likely triggered the sharper increases in competitive premiums seen this quarter, as telematics quotes are usually significantly cheaper than traditional quotes.”

According to the analysts, the fall in competitiveness for telematics is partly explained by changes implemented by leading providers.

Mr Thompson said: “Hasting Direct YouDrive, which was a market leader at the start of the year and particularly in the 20 to 24-year-old market, has increased premiums while QuoteMeHappy Connect, which only quoted ages 17 to 29 withdrew from the market towards the end of July.”

While insuring a car is both necessary and a legal requirement, car expert Sal Patel from Finest Car Mats says that the majority of us overpay for car insurance every year without knowing, and one “simple” and “legal” trick could save hundreds of pounds.

- Advert-free experience without interruptions.

- Rocket-fast speedy loading pages.

- Exclusive & Unlimited access to all our content.

Mr Patel said: “While paying for your premium annually rather than monthly can save you a few hundred pounds, most of us haven’t got thousands saved up for car insurance. The same can be said for increasing your excess policy.

“Increasing your excess from £100 to £500 could save you money on your initial premium, but if you were to make a claim you could struggle to pay the excess in the event of an accident.

“If you want to save money on your car insurance without limiting your experience as a car owner you have to buy your car insurance ahead of time.”

According to Mr Patel, buying a car insurance policy a few weeks in advance can help “save hundreds of pounds”. He explained: “It’s thought that insurance companies see those who buy car insurance ahead of time as sensible, organised and risk-averse, which can lead to lower premiums. Buying car insurance on the day you need it suggests the opposite.”

Car insurance websites will typically let people purchase car insurance up to 30 days before they need their policy to start.

Mr Patel said: “Buying 30 days before you need your premium however could cause it to be more expensive, but buying your car insurance between 20 to 27 days before you need it could reduce your costs considerably.

“In our testing, buying car insurance 26 days before you needed the policy to start was the best way to save on your car insurance.”

When taking out a new policy, there are several other tips to get the price even lower, too. From adding experienced drivers to trying different but accurate job titles in the same field, read more about how to reduce car insurance costs further here.