As Express.co.uk reported yesterday, this “nasty tax” gums up the housing market at every level, and causes particular problems for pensioners living in family homes that are now too big for them. An older person downsizing from a £750,000 property to one that is costing £500,000 would pay a hefty £12,500 on their new purchase.

That’s on top of estate agency fees when selling their property, removals costs, doing up their new place, and all the other expenses of moving.

Total costs can add up to £20,000 to £30,000, and while stamp duty is only part of this, it does add to the burden.

The added expense puts many off, even if it means they end up living in homes that are simply too big for them.

Others feel pushed into finding alternative ways of raising the money they need to make their retirement income stretch, such as equity release.

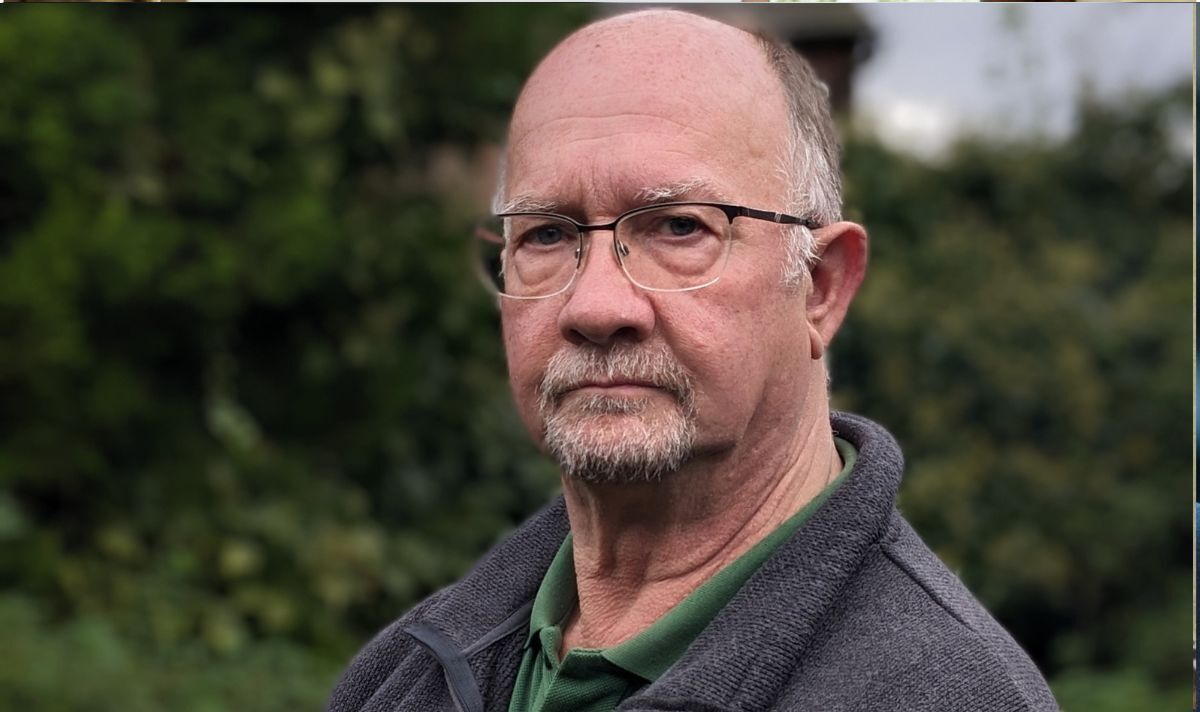

Retired accountant Keith Robinson has done his sums and reckons downsizing is a better way of raising money from your home in retirement than resorting to equity release.

He said: “Equity release is costly, you are effectively taking on debt and the interest rate compounds pretty quickly and it erodes any inheritance.”

Keith, who has had free financial coaching sessions from Bestinvest to help him manage his money, said the downside of downsizing is that it is expensive and having to pay the stamp duty land tax on the new property purchase is the final straw.

He said: ”The risk is that it all eats up most of the money you generate.”

The 66-year-old, who lives in a three-bedroom cottage in Pattingham, Shropshire, with partner Niki, backs a stamp duty cut for older downsizers.

He said: “Too many of them are rattling around big old homes that cost a fortune to heat and a fortune to maintain.”

Keith said they would be better moving somewhere smaller and freeing up larger homes brings another benefit. “It might go a small way towards easing the UK’s chronic housing shortage, too”.

He himself has no such plans to move just yet but added: “I’d much rather do that than equity release.”

Older homeowners aren’t the only ones who find themselves having to downsize, plenty of younger people do it too.

It’s a common issue for divorcing couples, who not only have the emotional and financial strain of separation, but have to buy stamp duty when purchasing something smaller.

The expense can cause them just as many problems, if not more.

Hannah Waghorn Roe, 46, would love to buy out her ex-husband from their three-bed semi in Nailsea, Somerset, but can’t afford to keep it on her own so has to sell up and downsize.

READ MORE: Rishi Sunak confirms tax cuts are coming in Autumn Statement

Today’s uncertain property market means their old home is proving hard to shift and, even if Hannah does gets an offer it is likely to be less than she hoped for. Worse, rising interest rates mean lenders will only give her a £50,000 mortgage.

And stamp duty will add to the cost of her new place, which feels like the final insult for Hannah.

The child-minder said: “It’s cut my deposit to the bone. While I wait, I’m finding it hard to make ends meet as a single person and getting more into debt.”

A stamp duty cut for downsizers in the Autumn Statement will not clear all of the obstacles in the way of Hannah moving, but may just swing the balance.

Stamp duty raises around £15billion a year but has been widely condemned as a tax on mobility.

Homebuyers pay it if their home costs more than £250,000. It kicks in at five percent and rises with property values to a maximum 12 percent for homes costing more than £1.5million.

It now adds £2,980 to buying the average home, valued at £309,616 in August, says the Land Registry.

Tim Walford-Fitzgerald, private client partner at HW Fisher, said a stamp duty cut may boost property sales but warned it may have dangers, too. “Downsizing relief may drive more empty nesters to sell up and increase the number of larger properties coming onto the market, but these downsizers still need to live somewhere.

“This could drive competition over properties that are classic first-time buyer territory, pushing up the prices for a demographic that the government should be supporting.”

Walford-Fitzgerald said Hunt should offer more tax breaks to help encourage homebuilders to deliver more homes and ease the housing shortage instead.