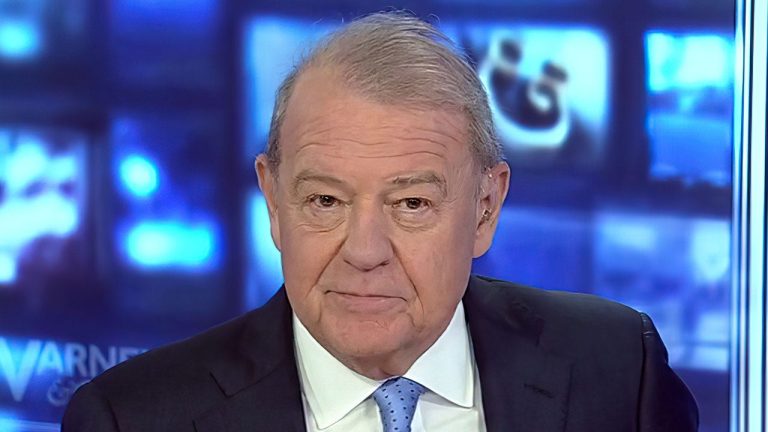

The Governor of the Bank of England has been “running around like a headless chicken” from the day he got the job, a finance expert has claimed.

Andrew Bailey has come under fire after a new report from the Lords’ Economic Affairs Committee (EAC) published on Monday (November 27) found the Bank has been over-reliant on “inadequate” forecasts and should have its remit “pruned” by the Treasury.

Amit Patel, an adviser at mortgage broker Trinity Finance, said Mr Bailey “should have gone months ago” and called for a shake up over how members of the central bank’s rate-setting Monetary Policy Committee members are elected.

He said: “Andrew Bailey has been running around like a headless chicken from day one at the helm of the Bank of England. He should have gone months ago.

“What we can see with the current set-up (of the MPC) is that each member has similar life experience, education and background. What we need are people from diverse backgrounds who can bring their life experiences to the table.”

Mr Patel urged “real solutions” to the challenges Britons face, not “some hypothetical forecasting model”, adding there is a lot of theory on Threadneedle Street but not enough real-world practice.

The Lords’ committee report said over the last two years, as inflation ran out of control, the Bank seemed unable to produce accurate forecasts of what was to come.

According to the EAC, public confidence in Threadneedle Street’s bankers has plunged after inflation peaked at more than 11 percent last year. The rate at which prices are rising dropped to 4.6 percent in the year to October, down from 6.7 percent over the 12 months to September.

The report said many factors, including the wider invasion of Ukraine in February 2022, had contributed to inflation. Mr Bailey’s officials have long argued the invasion wasn’t possible for it to forecast.

But the Lords said the persistence of above-target inflation over this period also reflects errors in the conduct of monetary policy, including an over-reliance on inadequate forecasting models.

The Bank has previously recognised its forecasts have been lacking during this period. In July it appointed former US Federal Reserve chairman Ben Bernanke to review its forecasting

The Bank’s job is not to prevent inflation, but to keep inflation at as close to two percent as possible, with the main tool being its base interest rate, which acts as a guide for how much interest people and companies pay to borrow and how much savers should be paid by High Street banks.

Interest rates used to be set by the Government, but in 1998 Tony Blair’s Labour Government decided to hand the power to the Bank and make it independent from Government interference.

The EAC said this independence has worked well, but added since 1998 the Bank’s remit has expanded without a corresponding increase in oversight from Parliament.

A Bank of England spokesperson thanked the EAC for the report, adding the BoE will be giving the recommendations careful consideration.

Samuel Mather-Holgate, an advisor at Mather and Murray Financial, said the BoE was slow to act as inflation began rising. Britain’s base rate is currently 5.25 percent, after the BoE hiked it 14 times. The next interest rate announcement will be on December 14.

Mr Mather-Holgate said: “Not only has Andrew Bailey done a woeful job, but he was the wrong appointment to the position. The Bank acted too late on inflation and, as a result, had to go too far too quickly. It’s also too early to really understand the consequences of such steep rate hikes, but we will see significant repossessions and homelessness. Bailey has caused a winter of discontent for so many.”

Chris Barry, Director at property law firm Thomas Legal, said the Bank of England should have started increasing base rate much earlier than it did.

He added: “Due to their lack of decisiveness, borrowers across the country have seen steeper rises at fast increments, which has been catastrophic for anyone trying to plan.”