The approval of a spot Bitcoin ETF in the United States is likely to help spot ETF offerings — as well as Bitcoin’s overall development — in other parts of the world, too.

Other countries already offer spot Bitcoin ETFs, but an approval in the U.S. will have a major impact.

(Shutterstock)

Posted January 3, 2024 at 7:00 am EST.

One of, if not the most anticipated developments for the cryptocurrency industry in the new year is the prospect of an SEC-approved spot Bitcoin ETF coming to market in the United States. As the likelihood of this seems to be getting increasingly close, with applicants including BlackRock and ARK Investments submitting updated proposals in late December, approval in the US will likely have ripple effects globally.

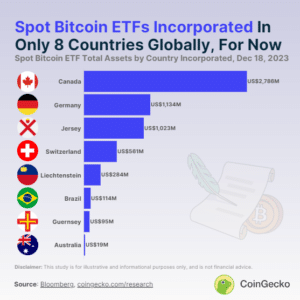

Currently, spot Bitcoin ETFs are traded in Canada, Germany, Brazil, Australia, the island of Jersey, Liechtenstein, Guernsey, and the Cayman Islands. According to data from CoinGecko, Canada is the global leader for investment in spot Bitcoin ETFs, with $2.79 billion invested in six exchange-traded products, accounting for 46.3% of the total global market for these products.

US approval could actually provide a growth opportunity for issuers of spot Bitcoin ETFs in these countries. Fred Pye, CEO of 3iQ, which offers the 3iQ Bitcoin Fund (QBTC) and 3iQ CoinShares Bitcoin ETF (BTCQ), both of which are spot products, in Canada, told Unchained that “we started to see increased flows in our spot BTC funds and ETFs in anticipation of SEC approval in the States, and expect this to continue as attention, adoption and price increase.”

Mark Connors, head of research at 3iQ, added that “SEC approval unlocks 40% of the world’s financial buying power. Its impact is hard to overstate.”

Impact in Latin America and Hong Kong

Looking towards Latin America, Andre Portilho, head of digital assets at Brazil-based banking institution BTG Pactual, said that “even if we see some flows from Brazil to the US, crypto ETFs are still a small market. Having spot ETFs in the US will make this market grow exponentially and it might benefit all other ETFs in other jurisdictions.”

United States policy often sets a precedent on the global stage and a spot BTC ETF approval “will help other countries that are behind to be more confident in following with crypto regulation,” said Portilho.

Read more: Bitcoin Pushes Past $45K on Expectations of Mid-January SEC Approval of ETFs

As an example of this dynamic, in late December, Hong Kong’s financial regulator, the Securities and Futures Commission (SFC), issued a joint statement with the Hong Kong Monetary Authority (HKMA), outlining requirements and protocol for intermediaries of digital-related products, with specific reference to spot exchange-traded funds. The regulator, which has previously authorized crypto futures ETFs, cited “the latest market developments” as the reason for the updated release.

In a separate statement, the SFC wrote that “both in-kind and in-cash subscription and redemption are allowed for SFC-authorised spot VA ETFs.” This contrasts the stances of the U.S. SEC, which prefers an only in-cash model based on updated application filings and expert insights.

This has not gone unnoticed by those vying for approval in the United States, as VanEck’s Director of Digital Asset Strategy, Gabor Gurbacs took to X (formerly Twitter) to discuss this announcement, citing a “competition” in the global market.

Gotta love that even Hong Kong SAR (China) is more open minded than U.S. regulators. The competition is on. Relaxing rules will lead to a capital/competitive advantage. https://t.co/e3GbcRO6nr

— Gabor Gurbacs (@gaborgurbacs) December 28, 2023

Impact in Africa

If institutionalized products like the BlackRock iShares Bitcoin Trust are made available to investors in the United States, a cascading impact in regions of the globe where grass-roots crypto adoption is burgeoning is likely as well. The African continent is home to some of the emerging market leaders in crypto adoption such as Nigeria and Morocco, according to Chainalysis.

Africa Blockchain Institute Head of Research Oluwaseun Adepoju said to Unchained that if a spot BTC ETF is approved and provides an entry point into Bitcoin for new institutional and retail, “this development could amplify both positive and negative dynamics.”

Read more: Should First-Time Bitcoin Investors Buy Now or Wait for the ETF?

Taking an optimistic view, Adepoju said the legitimacy and accessibility of a US-approved spot Bitcoin ETF “could attract increased global investment in cryptocurrencies,” noting that this influx of capital could, in turn, contribute to the growth of African crypto projects and stimulate the emergence of new initiatives within the region,” he noted.

At the same time, however, “the diverse and often uncertain regulatory environment surrounding cryptocurrencies in Africa may face heightened scrutiny and potential adjustments in response to global developments. Increased regulation could pose hurdles for existing crypto businesses and users on the continent,” Adepoju said.

Outlook

One thing that seems certain is that the growth of investments in Bitcoin — Van Eck anticipates inflows of over $2.4 billion into spot Bitcoin ETFs in Q1 of 2024 should approval be granted at the beginning of the year while fellow applicant Bitwise predicts that within five years, spot Bitcoin ETFs in the United States will hold $72 billion in assets under management — will help increase the cryptocurrency’s legitimacy worldwide.

“From cargo shorts to federal courts is how we characterize the maturity of Bitcoin in 2023,” said 3iQ’s Connors, referring to the plight of FTX’s Sam Bankman-Fried. “Bitcoin’s proponents have moved from the unregulated fraudster, to the largest regulated asset managers in the world.”