Bitcoin Foundation Chairman Brock Pierce discusses Bitcoin’s performance following an ETF selloff and former President Trump’s concern over digital currencies.

Sen. Elizabeth Warren’s anti-crypto crusade suffered a serious blow during a House Financial Services Committee oversight hearing this week, FOX Business has learned.

While escaping the attention of most of the media, crypto industry insiders were buzzing following testimony from a top official in the Treasury Department’s Terrorism and Financial Intelligence office that debunked Warren’s past claims that cryptocurrency is chiefly responsible for funding Middle East terrorist outfits.

According to a transcript reviewed by FOX Business, Brian Nelson, the undersecretary for Terrorism and Financial Intelligence, told the committee that terrorists’ use of digital assets for funding purposes is not as prevalent as previous media reports suggest. His comments contradicted Warren’s main argument for pushing legislation that could have a chilling effect on the future of crypto in the U.S.

“We assessed that terrorists still prefer, frankly, to use traditional products and services,” Nelson said during an exchange with House Majority Whip Tom Emmer, R-Minn.

A spokeswoman for Warren did not respond to a request for comment.

CRYPTO WORLD, WALL STREET AWAIT POTENTIAL SPRING APPROVAL OF SPOT ETHER ETF

Sen. Elizabeth Warren, D-Mass., speaks during a Senate Banking Committee hearing on Capitol Hill on June 13, 2023 in Washington, D.C. (Photo by Michael A. McCoy/Getty Images / Getty Images)

The exchange was initiated after Emmer asked Nelson to speak about his assessment of data reported in October by The Wall Street Journal that showed Middle Eastern terrorist groups receiving north of $100 million in cryptocurrency payments between August 2021 and June 2023.

That number was revised down to just $12 million two weeks later, when the Journal issued a correction after a claim by crypto research firm Elliptic said that the outlet misinterpreted data it had provided.

Nelson confirmed that terrorist groups like Hamas are using crypto in relatively small amounts compared to what has been reported.

CRYPTO CRIME FELL OVERALL IN 2023, BUT EXPERTS WARN OF RISING THREATS

However, the numbers that appeared in the original Journal article prior to the correction went on to become the source of Warren’s increased hostility toward the crypto industry, and the renewed driving force behind her bipartisan Digital Asset Anti-Money Laundering Act, which 19 other senators have since agreed to co-sponsor.

Emmer tells FOX Business that the Treasury Department is culpable for failing to provide the correct data when the erroneous report began gaining traction.

“For months, lawmakers, business leaders and the American public were persuaded to believe that crypto was a significant fundraising tool for Hamas because the press misinterpreted on-chain data and vastly inflated the figures,” he said in an interview. “Treasury had the correct data the whole time and had a responsibility to correct the false narrative created by the press, but it failed to set the record straight until the damage was already done.”

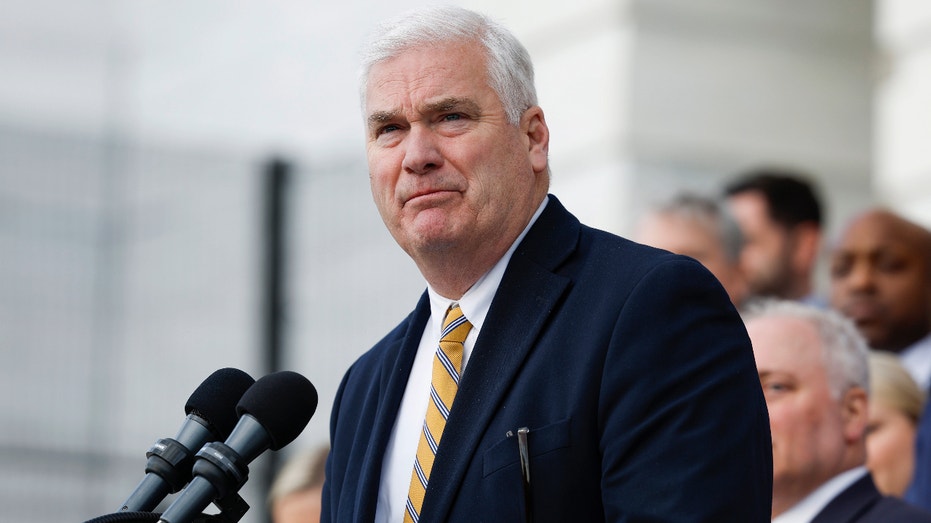

House Majority Whip Tom Emmer, R-Minn., speaks at an event celebrating 100 days of House Republican rule at the Capitol Building on April 17, 2023, in Washington, D.C. (Anna Moneymaker/Getty Images / Getty Images)

A press official from the Treasury Department did not immediately respond to a request for comment.

Warren’s push to vilify the crypto industry as the predominant medium for criminal activity has been met with opposition from some of her Senate counterparts.

Wyoming Republican Sen. Cynthia Lummis recently challenged Warren’s citing of a Government Accountability Office report that found an infamous Mexican drug cartel recently laundered $900,000 using cryptocurrency. Lummis pointed out that Warren failed to acknowledge the nearly $1 billion the report found was laundered through traditional financial systems.

Sen. Cynthia Lummis, R-Wyo., speaks during the Bitcoin 2021 conference in Miami on Friday, June 4, 2021. (Eva Marie Uzcategui/Bloomberg via Getty Images)

“Crypto is clearly not the problem. Criminals and bad actors are,” Lummis said in a post on X. “It would be a historic mistake to crush an entire emerging industry based on incorrect data.”

Warren’s bill would require all crypto industry participants, including miners, network validators and decentralized wallet providers, to comply with “know your customer” (KYC) rules that were originally established to prevent money laundering at banks.

The bill would command crypto firms to provide KYC information (names and addresses) for computer servers and codes and subject them to enforcement action if they fail to comply.

In a separate House Financial Services hearing on Thursday, Michael Mosier, the former acting director of Treasury’s Financial Crimes Enforcement Network, explained to Rep. French Hill, R-Ark., that requiring miners and validators to comply with traditional KYC laws would not be effective in preventing terrorist financing because there is no actual customer to vet. Rather, they are merely computers engaging in data processing.

Rep. French Hill, R-Ark., leaves a meeting of the House Republican Conference at the Capitol Hill Club on Jan. 30, 2024. (Tom Williams/CQ-Roll Call, Inc via Getty Images / Getty Images)

Meanwhile, the crypto industry and its supporters are fighting back against what they see as a thinly veiled attempt by Warren and other anti-crypto lawmakers to regulate the disruptive industry out of existence.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

Crypto trade groups like the Chamber of Digital Commerce and the Blockchain Association have been lobbying members of Congress to block the bill on the grounds that its passage would threaten thousands of jobs and drive innovation further out of the U.S., all while having little effect on apprehending the illicit actors it’s meant to target.

Now, the renewed push from trade groups will include alerting supporters of Warren’s bill to the Treasury’s confirmation that the merits of the bill they have signed their names to are founded on incorrect data.

“The hearings served as a platform for committee members to put the final nail in the coffin of the hyperinflated fears surrounding crypto and illicit finance, marking a turning point towards developing practical solutions,” said Taylor Barr, senior policy associate at the Chamber of Digital Commerce.