Wild weather has some home insurance companies either not accepting new applications or leaving certain states altogether.

California reportedly had America’s most homes at risk for extreme wildfires in 2022 and the unexpected weather has some home insurance companies either not accepting new applications or leaving altogether.

“If my homeowner’s insurance was to drop me, while I owned a home, to be completely honest, I would be frazzled and probably spend the time trying to find a new insurance carrier. And not going to lie, the idea would cross my mind of maybe it’s time I leave,” said California homeowner Chris Sidlow.

This idea is not a novel one. Chris Sidlow says home insurance rates have shot up for him and his neighbors, who also live in fire zones.

HOME INSURANCE PRICES INCREASED NEARLY 25%: POLICYGENIUS

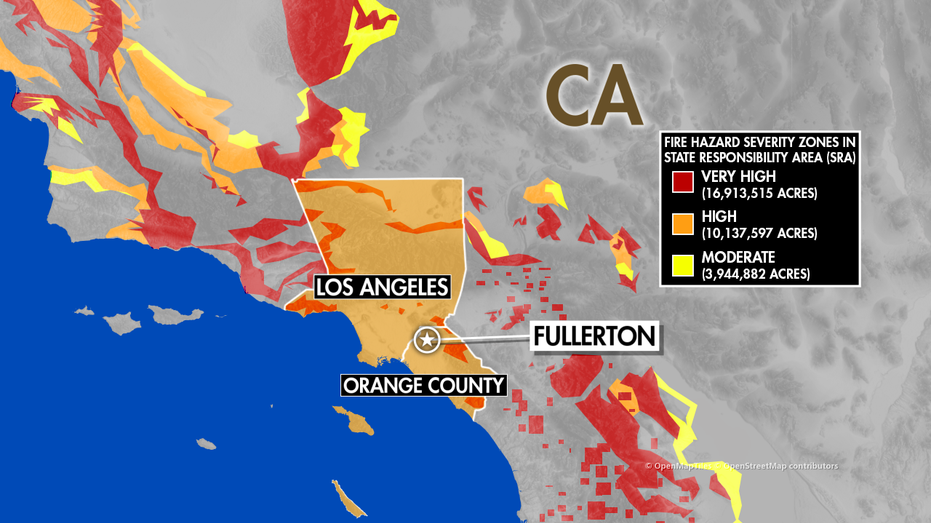

Fire zones are categorized by the probability of the area burning. There are three different levels: moderate, high, and very high.

Fire hazard severity zones in Southern California (Fox news)

“After last year’s occurrence and the fires that got so close to some of the homes in Orange County, it’s been insane. It’s literally increased my premiums by double, and then for homeowners, that’s like doubling a part of your payment and it’s unexpected and there’s nothing you can do about it,” said Sidlow.

HOME INSURANCE COSTS ARE RISING: HERE’S WHY

To make matters worse, there are only a few major companies left to insure homeowners in California.

“Their prices are based on market rate, but the market obviously changed because there’s less companies here. So because of that, rates have gone up, and because they see a higher potential of fire risk, therefore prices are going to go up anyway. But there’s no one there to counterbalance that, then they can basically just charge whatever they see fit,” said real estate agent Dom Morra.

Although California has had relatively mild wildfire damage this year, insurance companies are still recuperating from past disasters. (Sunny Tsai / Fox News)

Although California has had relatively mild wildfire damage this year, insurance companies are still recuperating from past disasters.

PROPERTY INSURANCE GOING UP OR AWAY FOR MANY IN BREWING CRISIS

“In the last couple years, there have been a lot of losses for them, especially in Northern California, so because they’ve been giving away so much money, they have to get their money back somehow. And so the way to do that is to up the premiums, get the prices a little higher and get their money back. Because it is statewide, it affects us even though we might not have had the losses that other places have had, we still get to see the higher premiums,” said Morra.

CLICK HERE TO READ MORE ON FOX BUSINESS

According to Insurify, home insurance prices rose by 7% last year and are slated to rise by 9% in 2023. Inflation and increases in natural disasters and severe weather are the main reasons.