Memecoins were already crashing post-$TRUMP. But the $LIBRA fiasco has caused key stats to plummet up to 40%.

Posted February 19, 2025 at 6:12 pm EST.

Memecoins were never a perfect antidote to the issues plaguing previous token launches like ICOs and airdrops, which were rife with inside deals, sybil attacks, and special bulk pricing for institutions. But to many people they seemed like a step in the right direction. Things were supposed to be fair and transparent—or at least less adversarial than previous token fads.

However, multiple high-profile flops may have shattered whatever is left of that illusion. President Donald Trump’s launch of $TRUMP on the eve of his inauguration left many supporters holding heavy bags.

Then last week Argentine President Javier Millei issued a promotional tweet about another memecoin called $LIBRA, which also quickly collapsed, revealed excessive sniping on behalf of insiders, and caused the bottom to fall out of the memecoin market.

“When the president of the United States launches a memecoin, that is probably the max attention you could possibly get out of any celebrity,” says Toe Bautista, Research Analyst at GSR. “Trump was kind of the final firework, and now you’re seeing a lot of traders opt out of the market.”

Dump Not Fun

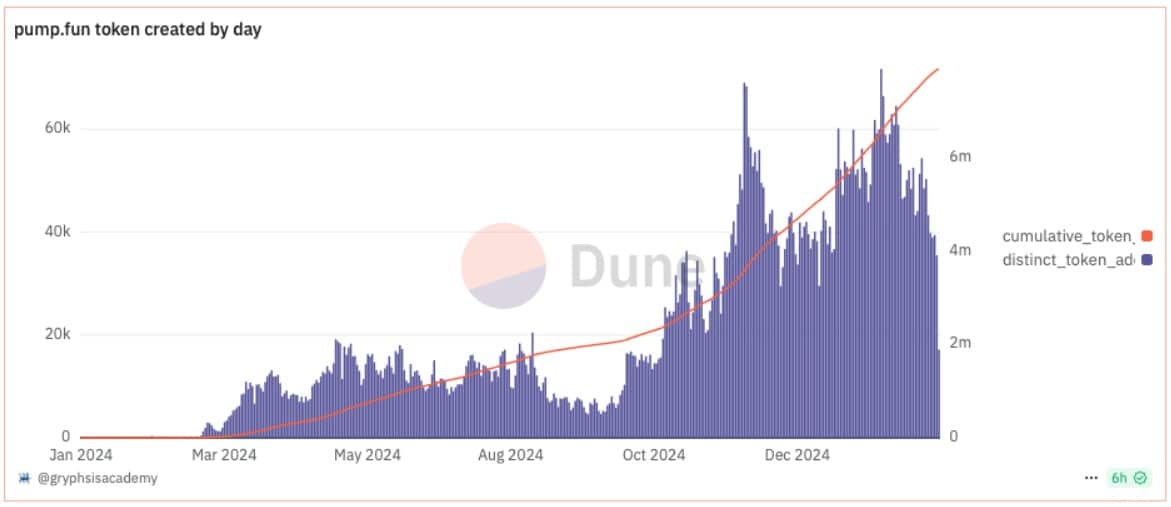

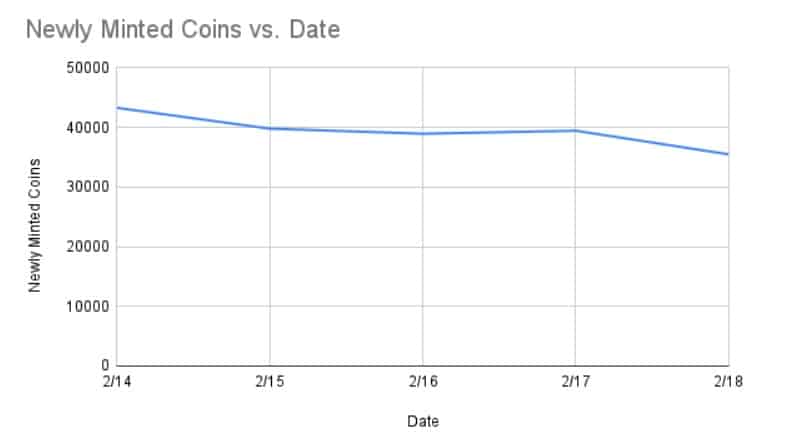

The best way to visualize this shift is in data from memecoin launchpad Pump.fun. The launch of daily new tokens reached a local top of 66,471 on January 24th, just six days after $TRUMP went live. On February 18th, the last day of full data available, that number dropped to 35,482, a decline of 46%.

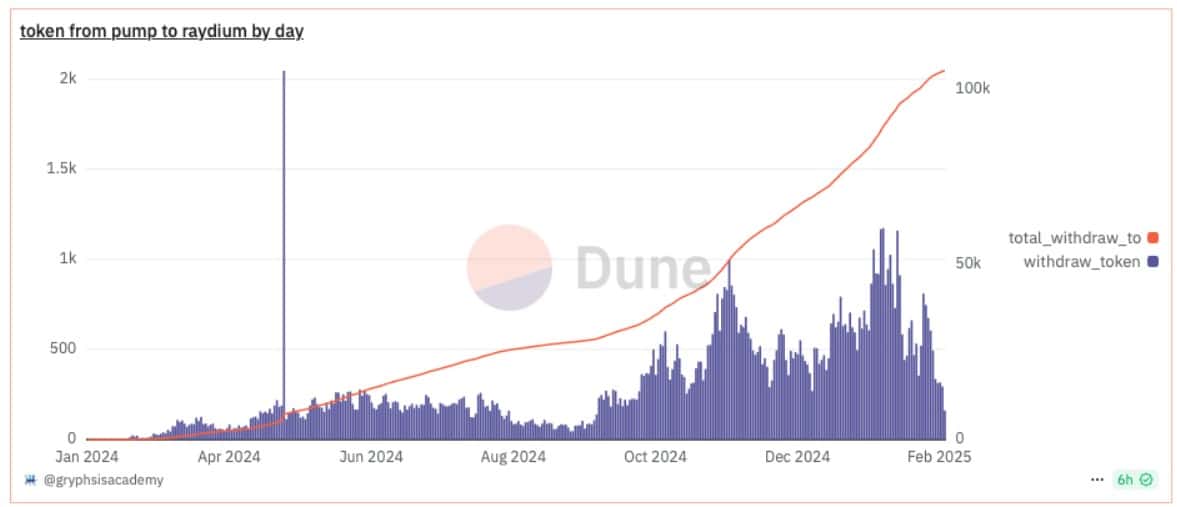

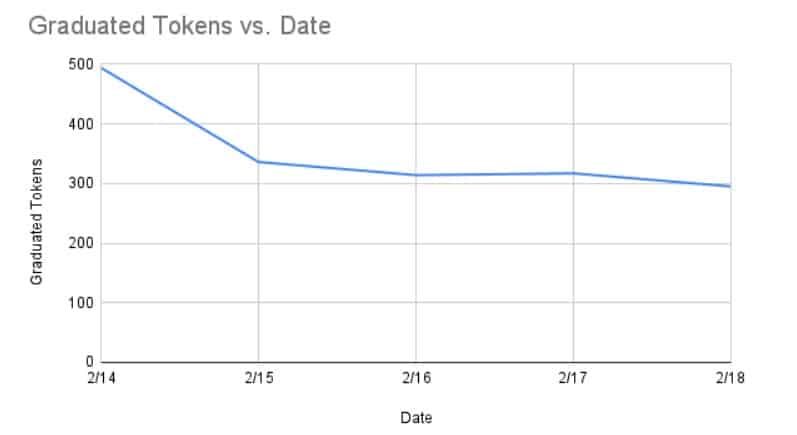

More tellingly, the number of tokens reaching the required $90,000 market capitalization to graduate from Pump.fun onto the Solana-based DEX Raydium fell from 1,174 tokens to 295—a drop of 74.8%.

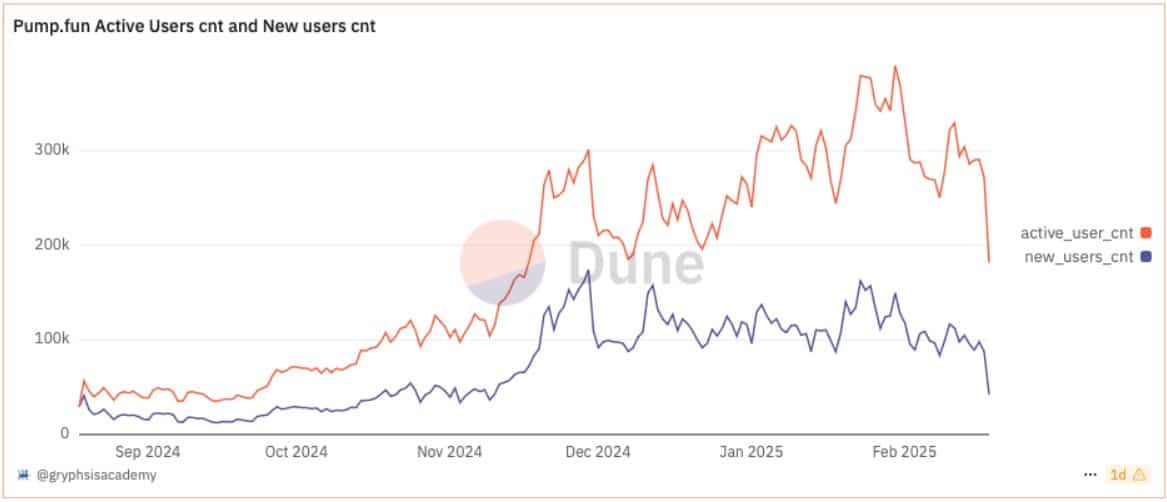

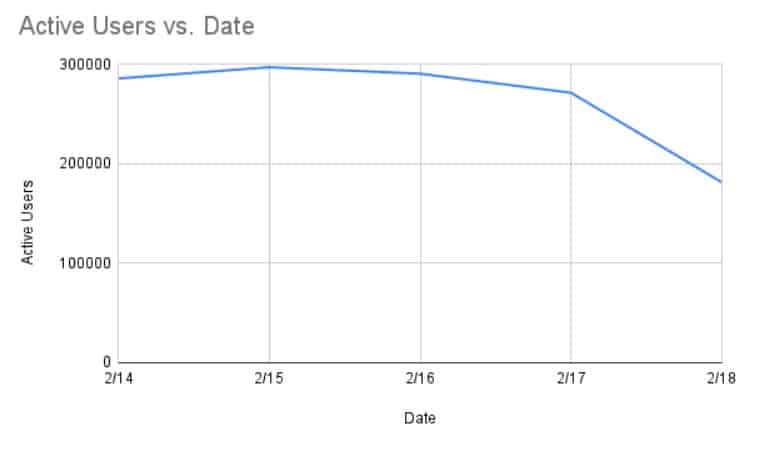

Users are also falling precipitously. Pump.fun had 378,029 active users on January 24th. As of Tuesday that number had dropped 52% to 181,436.

$LIBRA’s Last Straw

While these trends may have begun with the launch of $TRUMP on January 18th, they clearly accelerated after $LIBRA’s debut and collapse that started on February 14th. In the five days since, the number of active users on Pump.fun fell by 36%, dropping from 285,928 to 181,436. Additionally, the number of tokens graduating to Raydium fell by 40%, slipping from 494 to 295. These two statistics are the best indicators of demand for Pump.fun products.

Interestingly the supply side did not see the fall-off, as the number of newly created tokens on a daily basis only dropped 18% from 43,297 to 35,482.

Damage Extends to Raydium and Solana

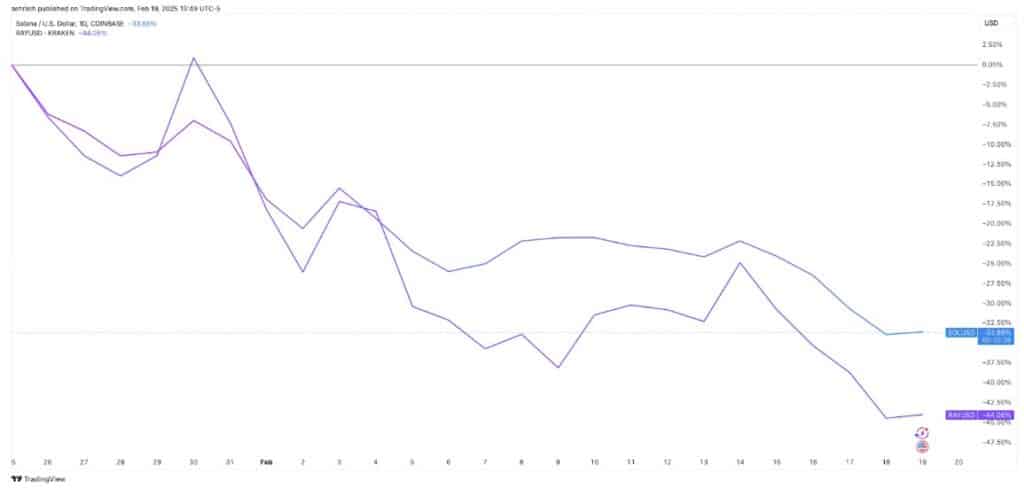

These drops are now being reflected in the prices of SOL and Ray, the token for Raydium, which both rode Pump.fun volumes to massive highs in 2024. Since January 24th, the tokens are down 33.7% and 44.06% respectively. In fact, both tokens are facing key price thresholds, which if broken could lead to further drops and threaten most of their 2024 gains.

(TradingView)

It may be too soon to write off memecoins entirely, but it seems clear that the industry is going to need a new source of stimulus.

“I think people have now realized how predatory memecoins are. Part of the allure was that as you were early, you had the same access to getting in as anybody else,” says Bautista. “Now that people have realized that that’s not the case, it’s left a very sour taste in their mouth. However, underneath there is still that speculative fervor that I think definitely ebbs and flows in cryptos.”