Posted February 28, 2025 at 6:27 pm EST.

The Trump Administration has provided the crypto industry with a number of gifts in 2025.

The Securities and Exchange Commission (SEC) halted enforcement actions and investigations into major crypto exchanges and companies like Coinbase, Gemini, Uniswap, OpenSea, ConsenSys, and others. The White House issued an Executive Order to promote American leadership in the digital asset industry, and it has made musings about building a bitcoin stockpile.

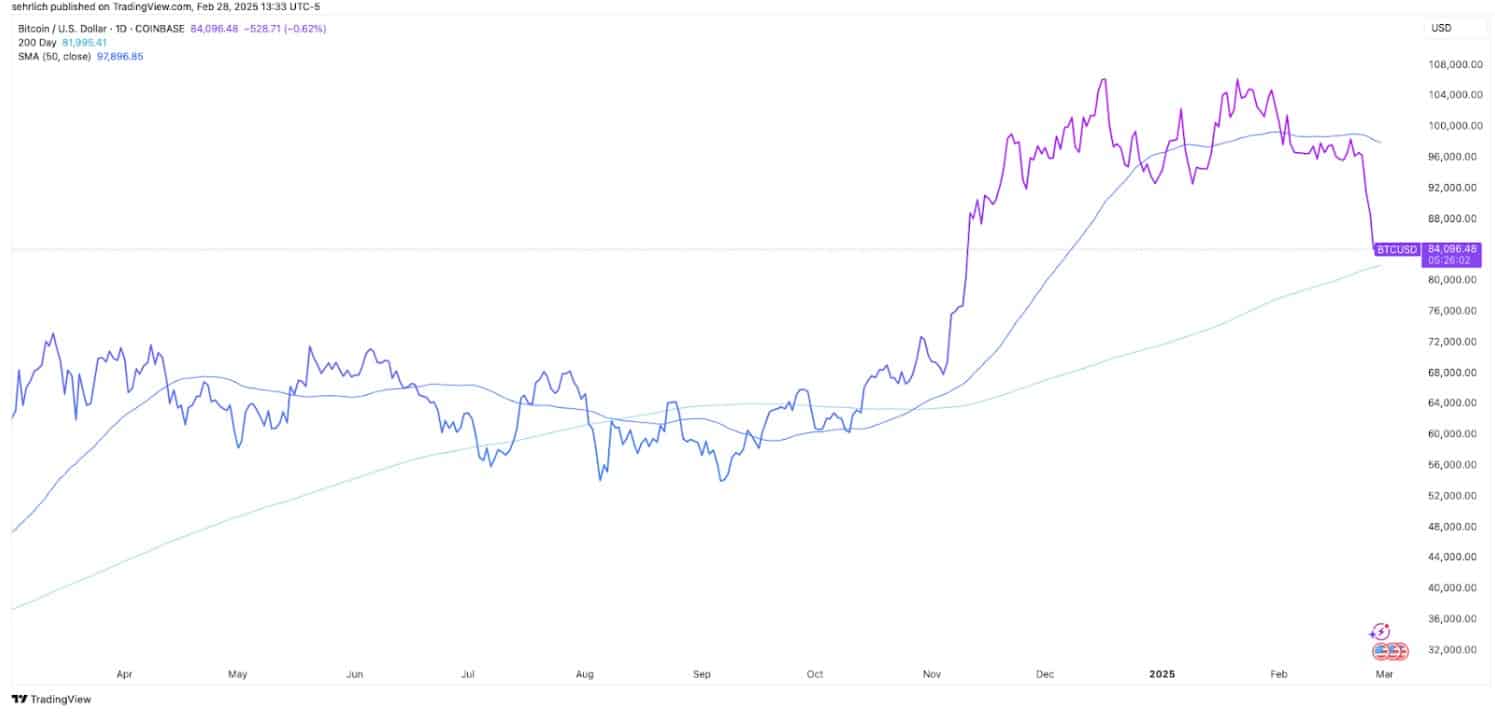

However, none of these actions has been consequential enough to stem the recent decline in the price of bitcoin and negative sentiments in the crypto industry overall. Currently priced at $84,000, Bitcoin is down 18% since Donald Trump’s inauguration, almost 23% since its all time high, and the broader crypto market has fallen by 21%.

Kavita Gupta, founder and general partner at Delta Blockchain Fund said, “It feels like all of the positive things in crypto are happening because the top people in politics are like, “Let’s just do it.’ There is no due process, there’s no due diligence … and this movement can [shift] at any given point of time. It doesn’t seem like sustainability’s there.”

Three main forces driving the market down could push it still lower before it regains footing and starts to climb back. In fact, the industry may need to wait until 2026 before it sees sustained bullish momentum again.

Crypto’s Self-Inflicted Wounds

There is no shortage of reasons to choose from when explaining the recent downturn. First would be the actions of crypto participants.

For instance, the industry did itself no favors with multiple memecoin fiascos like $MELANIA and then $LIBRA, which ensnared Argentine President Javier Milei in scandal. Now memecoin launches and trading activity are dropping across the industry, leaving questions about its sustainability over the long term. For example, the launch of daily new tokens reached a local top of 66,471 on Jan. 24, just six days after $TRUMP went live. On Feb. 27, the last day of full data available, that number dropped to 27,741, a decline of 58%.

Brian Rudick, head of research at GSR, said of these debacles, “Folks had looked at memecoins as the most fair and efficient form of speculation in crypto, but $LIBRA demonstrated that this actually was not true. Now you are seeing a lot less onchain volumes, and [while] memecoins are taking the brunt of it, it’s bringing down the whole crypto space.”

The other punch that really hurt the industry was North Korea’s $1.5 billion hack of Bybit, the largest theft in crypto history, which once again is forcing people to ask whether it is safe to put their money into crypto. “All that these hacks do is make people who are sitting [on the] outside think that this industry, even [over] the last 10 years, has not really gotten mature enough,” said Gupta.

Exogenous Headwinds

All of this negative sentiment within the industry is being turbocharged by reduced risk appetites among investors more broadly.

Typically consumer optimism surges with the dawn of a new administration, and business leaders initially cheered Trump’s election because of his pro-business mindset. However, multiple new data points suggest that consumer confidence is weakening, likely due to the threats of 25% tariffs from President Trump directed towards trading partners like China, Canada, Mexico, and the European Union

The February report from the nonprofit think tank Conference Board’s Consumer Confidence Index fell for the third straight month and reported its lowest reading since August of 2021.

These findings dovetail with findings from a University of Michigan survey on consumer sentiment that has shown a major drop-off in consumer confidence. According to the report, “Consumer sentiment extended its early month decline, sliding nearly 10% from January. The decrease was unanimous across groups by age, income, and wealth.”

It went on to say, “Year-ahead inflation expectations jumped up from 3.3% last month to 4.3% this month, the highest reading since November 2023 and marking two consecutive months of unusually large increases. The current reading is now well above the 2.3-3.0% range seen in the two years prior to the pandemic.”

These expectations for inflation, which the survey reported span across multiple age groups and income brackets will be especially crucial to watch, since inflation can become a self-fulfilling prophecy. Rudick noted, “The last I looked, the CME Fedwatch tool was pricing in two rate cuts this year. I think if those got fully priced out [because of concerns around tariffs], there’d be more downside in the traditional markets than in crypto.”

How Low Can BTC Go?

It is difficult to price out exactly where bitcoin can go from here. Steve Sosnick, chief strategist at Interactive Brokers said that even among commodities, bitcoin stands alone. “You know the supply and demand for crude oil, coffee, or cocoa. Bitcoin doesn’t have the same type of inherent demand. It exists purely for speculative or investment purposes.”

However, Sosncik pointed to a couple of technical charts that could provide some insight into price thresholds that investors should pay attention to. One looks at bitcoin’s 200-day Simple Moving Average. At its current price, the asset is close to testing this important marker for the first time since a definitive break back in mid-October. If that happens, which would mean that the asset falls below $80,000 then Sosnick believes the next threshold would be in the “high $60,000’s/low $70,000’s range.”

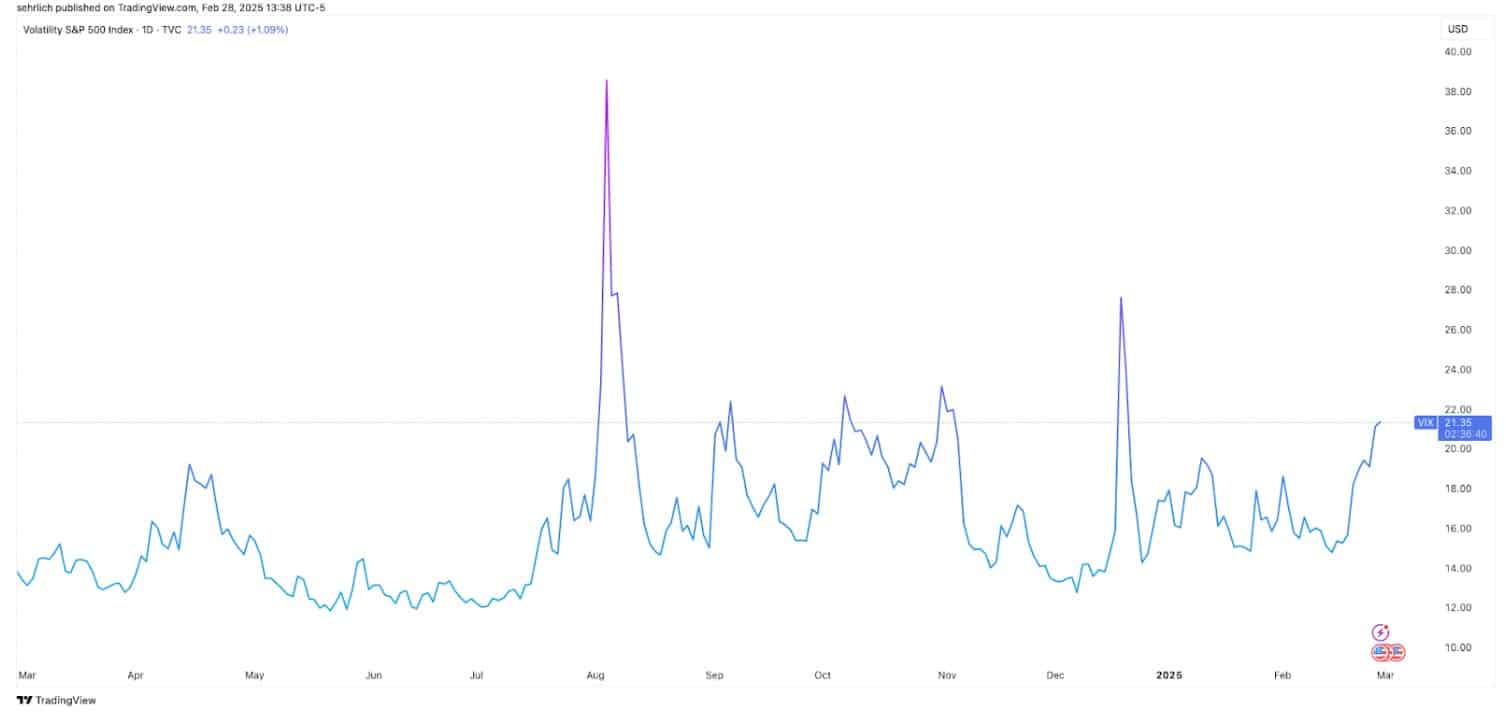

Although not a guarantee that bitcoin could fall that far, Sosnick noted that for all of the negative sentiment right now among investors, total fear has not set in just yet, at least according to Wall Street’s primary fear gauge, the S&P 500 Volatility Index (VIX). Although it is climbing, it is still within a normal range over the past 12 months. “It’s not crazy high, and in some ways it means that we’re not necessarily out of the woods because these rallies tend to stop when VIX gets crazy.”

With regards to bitcoin, this means that it could still fall because investors have not reached peak fear. For instance, the VIX surged in August when the Bank of Japan raised its interest rate and unwound the yen carry trade; it is currently much lower.

Waiting for 2026?

Given all of these negative forces impacting the price of bitcoin, it appears that the industry may need to wait until 2026 for bitcoin and the industry to regain substantial forward momentum. When asked what types of internal or external factors could play a role here, the answers were two-fold, a strategic bitcoin reserve or legislation that sets the rules for the industry once and for all.

Although the crypto community had wanted a strategic Bitcoin reserve, the White House Executive Order set an intention to evaluate something different: a federal stockpile, in which the government would choose to hold onto bitcoin that it obtained through law enforcement actions—not a strategic reserve in which it would buy new bitcoin. (However, many states are evaluating their own strategic reserves, though few are making meaningful progress.)

Rudick feels something like a bitcoin stockpile or reserve could be a boon for the industry, but it is far from a guarantee: “[A reserve] in my mind always had low odds, but I think bitcoin would easily move to $500,000. Even if we don’t get it in the form of a Strategic Bitcoin Reserve, I do think there is some potential for the US to create a sovereign wealth fund and add Bitcoin.”

But for Rudick, the more sustainable path towards growth is the crafting of market structure legislation that legitimizes regulated firms to enter the space, but he feels like the industry will have to wait until next year for meaningful progress: “It [legislation] is probably a 2026 event. But the reason why this is so important in my mind is because this is what you need for institutions to come in in a big way.”

As evidence he pointed to recent statements from Bank of America CEO Brian Moynihan saying that his crypto-reticent bank would consider launching a stablecoin if the rules for that industry became clearer. (At least one source closer to the negotiations in D.C. believes stablecoin legislation could even be signed in 2025.)

But until that time the industry will need to stay steady in the face of these headwinds. After all, this investor whiplash is part of the grand bargain that comes from investing in crypto.

“There’s an old saying that markets take the stairs to the attic and the elevator to the basement,” said Sosnick. “In this case, I would say Bitcoin took the elevator to the roof, and now the elevator down to the basement… It’s a volatile asset. Volatility is great if it’s going your way—I call that socially acceptable volatility. But volatility sucks when it’s going the opposite direction.”