The Bitcoin ecosystem is experiencing a surge in energy, with BTC’s price returning to levels since Nov. 2021, new spot BTC exchange-traded funds shattering volume records, and market sentiment reaching extreme greed.

Bitcoin’s rise appears to be being driven by the massive flows into spot bitcoin ETFs.

(Shutterstock)

Posted February 28, 2024 at 5:44 pm EST.

The Bitcoin ecosystem witnessed a surge in energy on Wednesday, with BTC’s price returning to levels not seen since Nov. 2021, new spot BTC exchange-traded funds shattering volume records, and market sentiment reaching extreme greed.

The price of BTC has increased 6.6% in the past 24 hours and 18.7% over the last seven days to as high as $63,636, before settling to around $60,455 at presstime, data from CoinGecko shows.

Read more: Bitcoin Price Surges Past $60,000

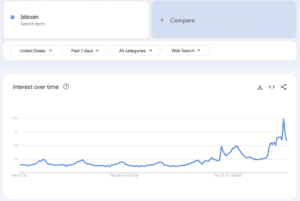

As a search term on Google in the U.S., “bitcoin,” had the maximum interest rating possible of 100 earlier today at 12:20 p.m. ET, before hovering under 60 more recently. Meanwhile, just seven days ago, its interest rating was below 15.

Read More: Coinbase App Crashes Amid Bitcoin’s Massive Rally

“We’re seeing huge demand from large buyers coming in and getting positions,” said co-founder of crypto index platform Phuture, Charles Storry, in a phone call with Unchained.

“What’s triggering that? Well, the fact that they don’t have exposure yet,” Storry added.

Despite this demand and the data from Google Trends, today’s chatter around BTC and crypto is not where it was at in 2021, Storry noted. “Look back at the previous cycle – DeFi Summer [2021] – what we saw was this mass retail demand, everybody was talking about crypto, right? … And that isn’t really happening in the kind of day-to-day life yet,” he said.

ETF Records

The recent rise of the largest cryptocurrency by market cap is “closely tied to the net ETF flows,” wrote Jim Hwang, COO at digital investment firm Firinne Capital, in a text message to Unchained.

At the halfway mark of the trading day on Wednesday, the “New Nine bitcoin ETFs [which excludes Grayscale’s GBTC] have already broken their all time daily volume record w/$2.6b,” according to Bloomberg ETF analyst Eric Balchunas on X. “We got 4 btc ETFs in Top 20. $IBIT is #4 overall, it’s gonna trade more today than in its first two wks combined. This is officially a craze.”

“These numbers are absurd, highly rare stuff here,” Balchunas added.

The adoption of BTC has been in part driven by people worldwide who see the need for a non-state digital store of value, but the advent of spot BTC ETFs allows for more institutional purchasing, according to Hwang.

Read More: 21Shares and Chainlink Team Up to Roll Out Proof-of-Reserve for Spot Bitcoin ETF ARKB

“ETFs are now catalyzing broader retail and institutional awareness and adoption. Over time, institutional presence will quite possibly surpass retail and although retail will have a minority role, it will remain significant,” wrote Hwang.

Not Euphoric, But ‘Justifiable’ Greed

According to the Crypto Fear & Greed Index, the market sentiment is at “extreme greed.’

The index is a single number between 0 and 100 that acts as a proxy for the emotional and sentimental state of a crypto market currently stands at 82, the highest level since 2021, indicating a feeling of extreme greed.

A crypto native undergoing their third Bitcoin halving who goes by “Virotechnics” on X concurred with the index, saying, “I don’t think the market is euphoric. I think the market is greedy.”

“I think it’s somewhat justifiable greed, because Bitcoin is good, crypto is good. We held out for quite a long time, so I would be shocked to see anybody who really held through the bear market and really believes in crypto to be selling off right now before big all-time highs, I mean, accounting for even inflation,” Virotechnics added in an interview with Unchained.