The transfer via the sanctioned crypto mixer could potentially create legal problems for BlackRock, the world’s largest asset manager.

BlackRock’s wallet received 0.97 ETH, worth about $3,324 at current prices, via Tornado Cash on Wednesday morning, according to Arkham Intelligence.

(Shutterstock)

Posted March 21, 2024 at 3:14 pm EST.

BlackRock’s new digital asset fund has drawn massive attention since the asset manager announced its first institutional crypto fund on Wednesday. However, it has also drawn a variety of questionable transactions to its now publicly-known Ethereum address, including an unsolicited transfer of ETH via sanctioned crypto mixer Tornado Cash that could create legal issues for BlackRock, the world’s largest asset manager.

BlackRock filed with the SEC on March 14 to offer its BlackRock USD Institutional Digital Liquidity Fund (BUIDL) with $100 million in seed funding. News reports about the fund first came out on Tuesday.

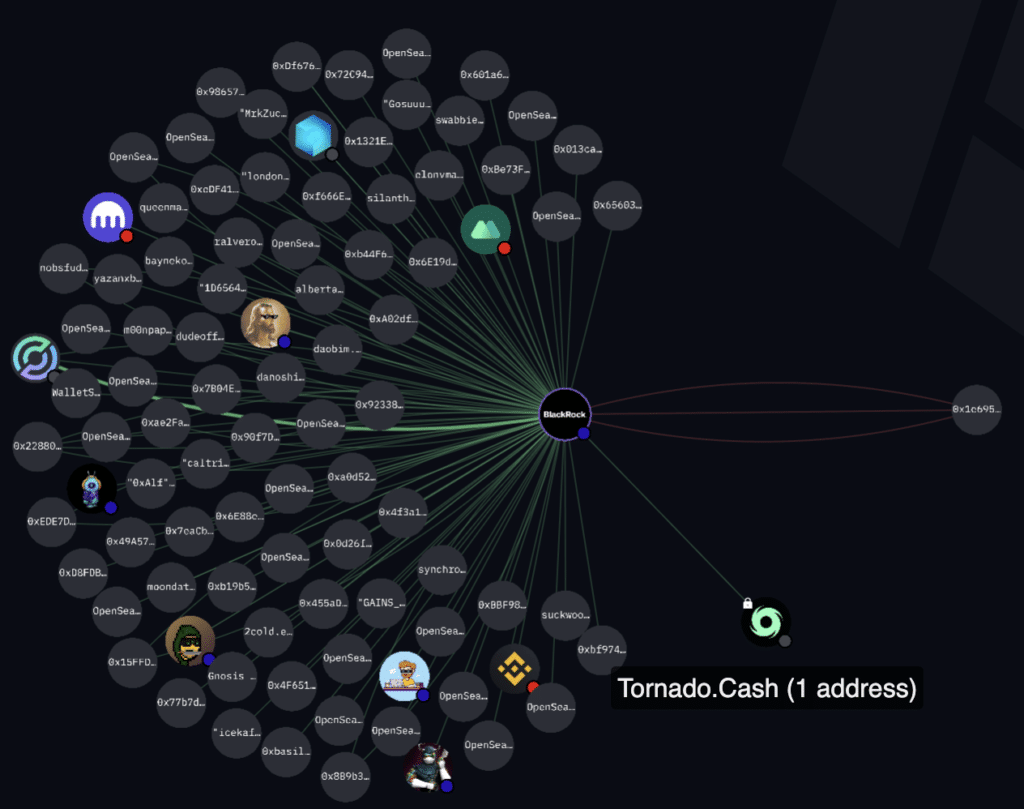

Within 24 hours of announcing the fund’s launch, BlackRock’s address had received tokens and NFTs from dozens of other addresses, including ETH moved through Tornado Cash. According to onchain analytics firm Arkham Intelligence, 0.97 ETH, worth about $3,324 at current prices, was transferred from Tornado Cash to BlackRock’s digital assets fund.

Read More: BlackRock Receives Memecoins and NFTs After Putting $100 Million USDC Onchain

The ENS domain “reltor.eth” initiated the transaction by interacting with the Tornado.Cash Router contract by calling the “withdraw” function. This function dictates the smart contract to withdraw funds from the privacy protocol to prepare to send the funds to their final destination, as shown by blockchain data from Etherscan. The Wall Street heavyweight then received ETH from Tornado Cash at 10:35 a.m. ET on Wednesday morning, several hours before BlackRock’s official announcement of the fund.

A diagram showing the addresses that have sent crypto assets to the Ethereum wallet held by BlackRock’s USD Institutional Digital Liquidity Fund. (Arkham Intelligence)

Potential Legal Issues

The transfer comes 18 months after OFAC sanctioned Tornado Cash for its use in helping North Korea’s state-sponsored hacking group, Lazarus Group, launder billions of dollars in cryptocurrencies. While any Ethereum address can receive coins or tokens from any other, holding ETH that recently moved through Tornado Cash can present real legal challenges.

Read More: Tornado Cash Cofounder Arrested, Another Sanctioned by U.S. Government

According to the U.S. Treasury, any U.S. person, including financial institutions, holding blocked property such as ETH from Tornado Cash are required to report their situation to the Treasury’s Office of Foreign Assets Control (OFAC). “Once a U.S. person determines that they hold virtual currency that is required to be blocked pursuant to OFAC’s regulations, the U.S. person must deny all parties access to that virtual currency, ensure that they comply with OFAC regulations related to the holding and reporting of blocked assets, and implement controls that align with a risk-based approach,” OFAC outlined.

This almost immediately presented potential legal challenges for wallets that had received unsolicited funds from Tornado Cash. Soon after the initial Treasury sanctions, unknown actors began sending ETH from Tornado Cash to addresses of well-known crypto personalities. In Aug. 2022, the privacy mixer was used to send small amounts of ETH to many addresses such as ones belonging to Ethereum co-founder Vitalik Buterin, Coinbase CEO Brian Armstrong, NFT artist Beeple, and late-night host Jimmy Fallon.

OFAC soon became aware of U.S. people receiving unsolicited ETH from Tornado Cash and put out a statement in September 2022 stressing that while these funds may technically fall within the scope of those regulations, it would not prioritize enforcement against such “dusting” attacks, perhaps acknowledging severe limitations on their enforceability in these cases.

Neither OFAC nor BlackRock immediately responded to a request for comment for this article.