Brazil’s central bank abstained from involvement in developing the government’s comprehensive consumer debt renegotiation program unveiled on Monday, two central bank directors said on Tuesday.

Speaking at a news conference, Renato Gomes, the director of the financial system organization, said that policymakers solely furnished information without actively contributing to the program’s design.

Diogo Guillen, the economic policy director, also announced that updated assessments regarding the initiative’s potential effects on default rates and credit volume would be disclosed through the bank’s customary publications.

In line with a campaign promise, the administration of President Luiz Inacio Lula da Silva has unveiled a program designed to renegotiate consumer debt for individuals earning up to two minimum wages and with a total debt of up to $1,015. The program is scheduled to begin in July.

Following the central bank’s earlier emphasis in its 2022 Banking Economy Report on the outflows from savings accounts in Brazil, while most funding instruments exhibited positive performances, Guillen stated that the bank continues to study potential changes in savings remuneration, considering the overall impacts involved.

WORLD’S LARGEST CHICKEN SUPPLIER, BRAZIL, UNLIKELY TO IMPOSE NATIONWIDE BAN ON EXPORTS OVER BIRD FLU

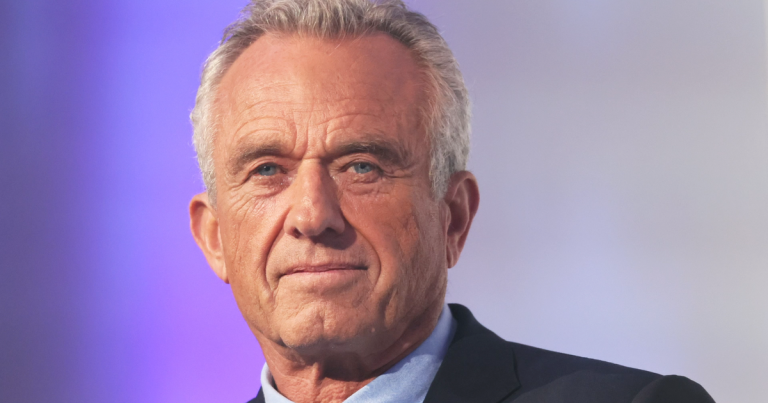

People walk in front the Central Bank headquarters building in Brasilia, Brazil, on March 22, 2022. (REUTERS/Adriano Machado)

CLICK HERE TO GET THE FOX NEWS APP

He added that any such adjustments would be implemented in a “very gradual” manner, considering the interests of creditors and debtors engaged in the process.

Higher interest rates make savings rates less competitive compared to other fixed-income investments in the country, helping to motivate outflows, which have continued throughout 2023.

The central bank has maintained its benchmark interest rate steady at a cycle-high of 13.75% since September to combat inflation.

During the press conference, Gomes also mentioned that the central bank was part of a joint study group with the Finance Ministry, exploring structural measures to encourage credit cards to offer lower rates in the country. However, he indicated that this project would take “at least months” to materialize.