New York brothers Jojo and Nicky Scarlotta share how they rose to TikTok fame after sharing relatable videos on inflation.

Consumers are trying out different strategies to stretch their food budgets, a new report shows, as prices continue to rise at grocery stores and restaurants across the country.

Inflation may be gradually cooling since it reached record highs in 2022, but the average American is still shelling out a lot more money for everyday necessities than they were even one year ago.

According to the Bureau of Labor Statistics, consumer prices rose 3.1 percent from January 2023 to January 2024. The typical U.S. household needed to pay $213 more a month in January to purchase the same goods and services it did one year ago, according to calculations from Moody’s Analytics chief economist Mark Zandi.

Hundreds of readers of The Wall Street Journal shared how they’ve changed their spending and eating habits to “cope” with high food costs squeezing their pocketbooks, including forgoing certain foods, meal planning, and harvesting their own food.

PA FOOD SUPPLIER WARNS AMERICANS GETTING SQUEEZED BY INFLATION ARE BECOMING ‘RESISTANT’ TO HIGHER PRICES

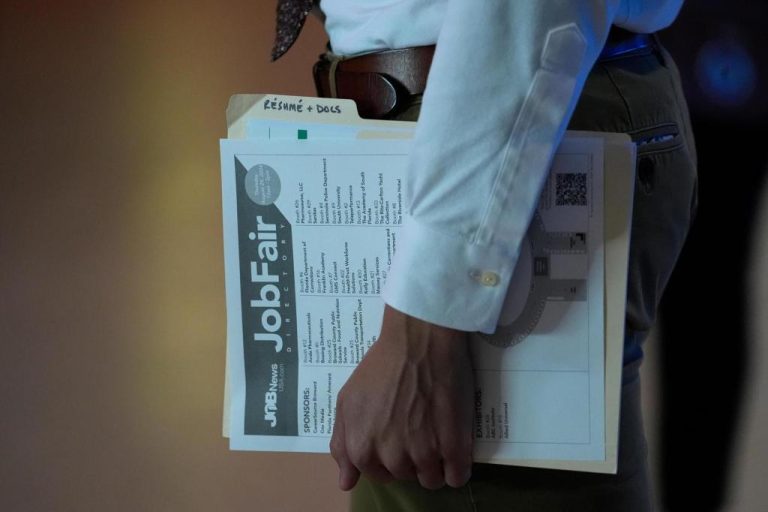

The average U.S. household paid over $200 more a month in January 2024 on the same goods and services they paid for one year ago. ((Photo by FREDERIC J. BROWN/AFP via Getty Images) / Getty Images)

Sarah Smith, 54, shared how she and her husband have traded their elaborate homemade meals made with fresh herbs and premium ingredients for simpler meals made from canned goods to cut costs.

The Las Vegas marketing professional said these days she often makes tuna-noodle casserole instead of chicken cacciatore, for instance.

“It’s not healthy, but it’s food,” she said.

Alexandra Blom and her husband Jason, from Chicago, started changing their spending habits after analyzing different grocery store prices. The 43-year-old massage therapist revealed they buy more in bulk now, and purchase less organic produce and locally sourced meat and eggs for their family of four. Their family limits food out now and eats more simple meals made with lentils, beans and rice that can be stretched for several days.

Nancy Randall shared how her family has managed to cut down their spending 30% per person to stretch their budget. The 56-year-old retired dietitian out of Houston used to make charcuterie boards but now skips the cheese aisle when grocery shopping. Her family relies more on consuming the deer they hunt and the fish they catch these days, rather than buying meats at the grocery store.

HIGH INFLATION IS STILL SQUEEZING AMERICANS’ BUDGETS

Readers told the WSJ about the ways they were trying to save money with their food budget. ((Photo by Spencer Platt/Getty Images) / Getty Images)

Bernard Brothman, a 67-year-old retired human-resources executive from New Jersey, also tries to rely on his own homegrown food to spend less at the grocery store. He’s saved hundreds of dollars in grocery bills by growing more than a dozen crops in a community garden and in a garden at his son’s home nearby, the WSJ reported.

He’s now teaching his grandchildren how to grow their own vegetables too.

Like other readers, Brothman also tries to stretch meals by cooking large batches and freezing meats when they’re on sale.

Kathleen Glindmeier, a 69-year-old registered dietitian out of Phoenix, says she plans her grocery store trips for when her local grocery store holds its monthly senior discount day. Her group of friends has traded eating out at restaurants for holding potlucks at each other’s houses.

“We are just getting more creative,” Glindmeier said told the Wall Street Journal.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

Americans are paying on average $605 more each month compared with the same time two years ago and $1,019 more compared with three years ago, before the inflation crisis began.

Earlier this month, President Biden took aim at grocery stores, blaming them for “ripping people off” with high pricing amid the continued inflation blame game.

FOX Business’ Megan Henney contributed to this report.