Panelists Scott Sperling and JC Parets provide insight on the consumer inflation number on ‘The Claman Countdown.’

Investors celebrated cooler-than-expected data on consumer inflation driving the Dow Jones Industrial Average to its best day since November 2023, while the Nasdaq Composite and S&P 500 had the biggest gains since April 2023.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| I:DJI | DOW JONES AVERAGES | 34827.7 | +489.83 | +1.43% |

| SP500 | S&P 500 | 4495.7 | +84.15 | +1.91% |

| I:COMP | NASDAQ COMPOSITE INDEX | 14094.381378 | +326.64 | +2.37% |

99.8% of market participants, as tracked by the CME’s FedWatch Tool, expect no further rate hikes this year and in a surprising twist, over 33% are betting the first-rate cut could come in March 2024 after the consumer price index was unchanged in October vs. the prior month, while rising 3.2% annually, less than economists expected and down from 3.7% previously.

10-Yr Treasury Yield: 4.40%

As stocks rallied, bond yields fell with the 10-year Treasury slipping to 4.44%, the lowest since September.

INFLATION COOLS MORE-THAN-EXPECTED

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| MSFT | MICROSOFT CORP. | 370.27 | +3.59 | +0.98% |

| NVDA | NVIDIA CORP. | 496.56 | +10.36 | +2.13% |

Tech-giants Microsoft and Nvidia hit fresh all-time highs, with annual gains now at 55% and 240%, respectively. These stocks have contributed to the 12% jump in the Nasdaq since its October lows.

INFLATION BREAKDOWN: WHERE PRICES ARE RISING/FALLING THE MOST

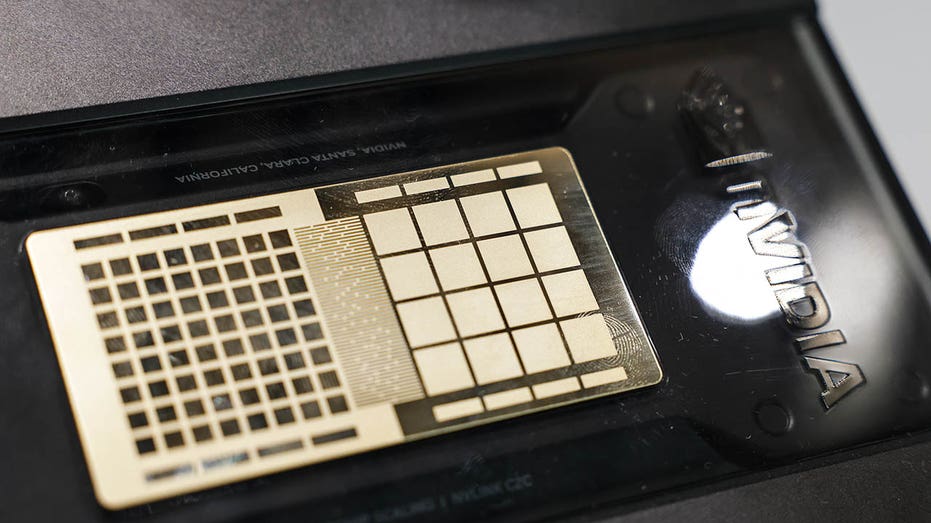

A Nvidia Corp. Grace Hopper Superchip (I-Hwa Cheng/Bloomberg via Getty Images / Getty Images)

The chipmaker, already leading the Artificial Intelligence race, rolled out a new suite of AI chips giving investors further confidence that its cementing its dominance in the space.

Home Depot shares posted the best percentage gain since November 2022 after quarterly earnings beat expectations.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| HD | THE HOME DEPOT INC. | 303.79 | +16.01 | +5.56% |

The home-improvement chain also narrowed its annual guidance, forecasting sales may decline by 4% less than a prior 5% dip forecast.

Home Depot Interiors (Getty Images: Staff Photo By Matt Stone/MediaNews Group/Boston Herald)

“We’re looking at it this year, this period of moderation for home improvement spend but couldn’t feel better about the business and our operations overall” said CEO Ted Decker on the company’s earnings call. While he noted some softness in professional projects, tied to higher mortgage rates, other parts of the business are solid. “We see great engagement — engagement in seasonal goods, engagement with smaller projects” he noted.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| TGT | TARGET CORP. | 110.69 | +4.49 | +4.22% |

| WMT | WALMART INC. | 167.62 | -0.06 | -0.03% |

GET FOX BUSINESS ON THE GO BY CLICKING HERE

Wall Street will get more details on consumer spending with Target earnings on Wednesday and Walmart on Thursday.