Fisher Investments founder Ken Fisher discusses whether the U.S. credit downgrade is a big deal for Wall Street as markets sell off on ‘Varney & Co.’

U.S. employers added 187,000 jobs during the month of July, less than the 200,000 economists were expecting and below the 209,000 created in June.

The unemployment rate dipped to 3.5%, still average hourly earnings rose 4.4% annually.

Sectors adding jobs included healthcare at 63,000, social services at 24,000, financial activities at 19,000, while hospitality gained 17,000. Jobs cuts were seen in manufacturing and employment services at 2,000 and 8,000, respectfully.

Last month, the unanimous decision by the Federal Reserve to raise interest rates put the key benchmark federal funds rate at a range of 5.25% to 5.5%, the highest since 2001, further restricting economic activity as the borrowing costs for homes, cars and other items march higher.

It marks the 11th rate increase aimed at combating high inflation since policymakers began tightening in March 2022.

FED HIKES RATE TO 22-YEAR HIGH

Following the Fed’s last meeting, Chairman Jerome Powell said policymakers will continue to monitor data points to assess another rate hike this year.

“Looking ahead, we will continue to take a data-dependent approach in determining the extent of additional policy firming that may be appropriate” he said during his press briefing.

81% of market participants currently expect the Fed to keep rates as is at the next meeting, according to the CME’s Fed Watch Tool.

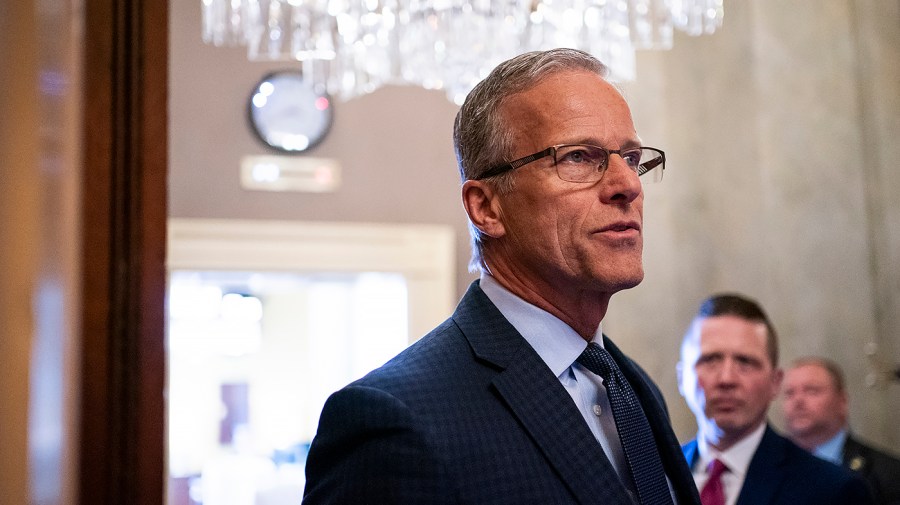

File – Federal Reserve Chair Jerome Powell speaks during a news conference following a Federal Open Market Committee meeting, Wednesday, June 14, 2023, at the Federal Reserve Board Building in Washington. Powell will testify Wednesday in front of the ((AP Photo/Jacquelyn Martin, File) / AP Newsroom)

The data follows Fitch’s downgrade of U.S. credit, which is creating a fresh wall of worry about the economy and financial markets, with the S&P 500 headed for a weekly loss.

FITCH DOWNGRADES U.S. CITING ‘FISCAL DETERIORATION’

The ratings agency pointed to America’s “erosion of governance,” rising deficits, and tightening by the Federal Reserve. It also said it expects the U.S. economy to slip into a mild recession in the fourth quarter.