Posted February 12, 2025 at 6:00 am EST.

The Ethereum blockchain and its community are facing an unprecedented challenge. They are losing ground to more user-friendly rivals like Solana, which is getting pumped up by millions of memecoins, and facing not-so-friendly competition from interoperable networks called Layer 2s (L2s) that are directly taking users, fees, and mindshare. On Tuesday Uniswap, the world’s largest decentralized exchange, launched its own L2 on top of the Optimism network called Unichain.

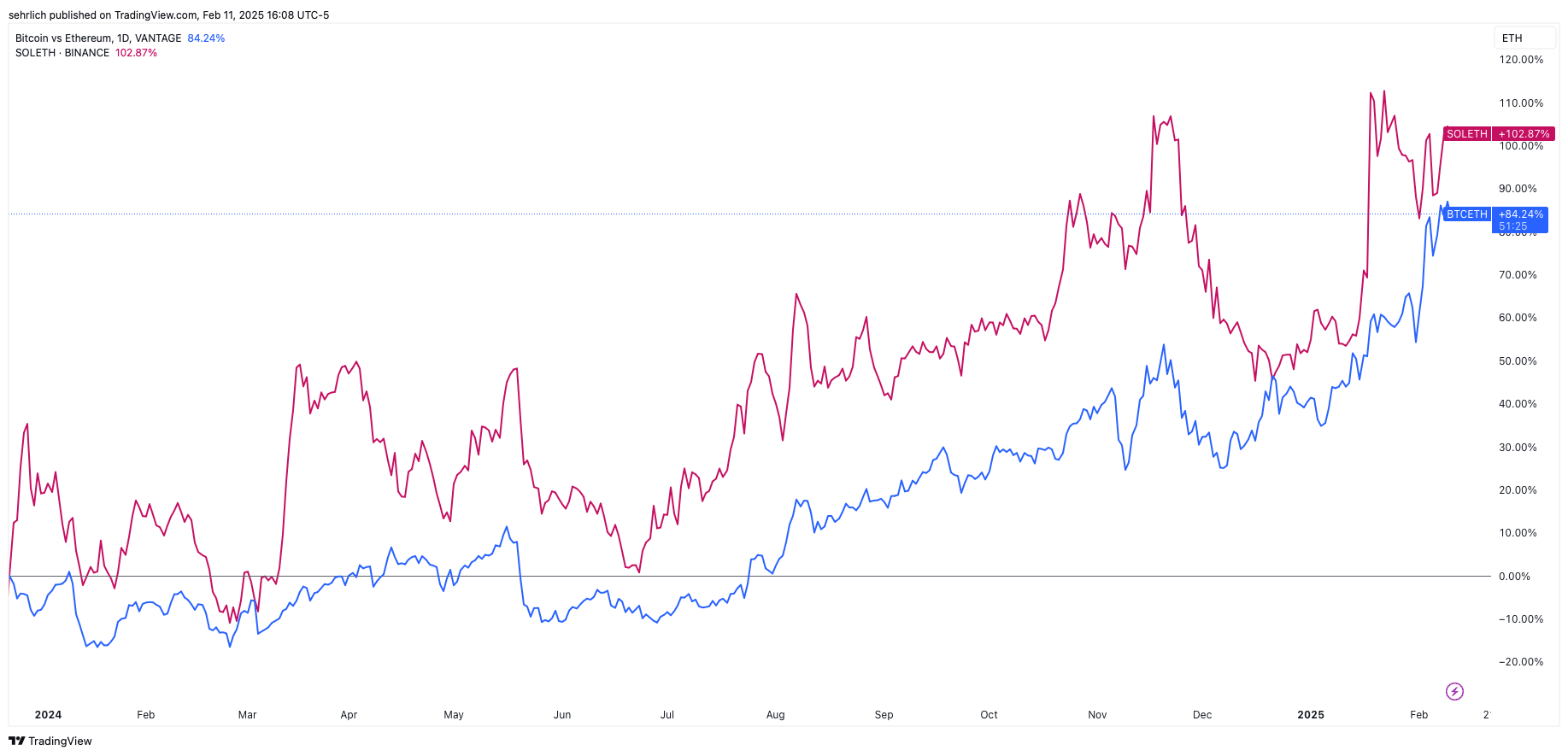

Ethereum’s token price is also being left in the dust by Solana and $1.9 trillion Bitcoin. It is up 5.9% over the last 12 months. By comparison bitcoin has surged 100.58% and solana is up 85%.

Even more telling, ether’s price (currently at $2,600) has been falling behind that of bitcoin and solana at a similar pace over the past six months—a clear sign that investors are starting to group those assets together at ether’s expense. “It is not obvious to me that there is broad demand among traditional investors for smart contract platform use cases,” says Zach Pandl, Head of Research at Grayscale Investments.

Ether needs to rewrite the narrative for both investors and its community, which can begin with finding a more precise product-market fit.

Stuck Between Bitcoin and Solana

Ethereum has been a sidekick to Bitcoin for so long that it had been taken for granted that it would always be the #2 blockchain.

But while bitcoin’s digital gold narrative has been a steady additive to its narrow functionality, throughput, and relatively high fees, Ethereum’s growth pushed against its similarly limited throughput that could only handle a few dozen transactions per second. The Ethereum Foundation, the non-profit steward of Ethereum, embraced a scaling strategy that would spawn hundreds of complementary L2 blockchains to dramatically increase throughput.

The strategy was successful, but it proved to be a double-edged sword. On the one hand, the network can now process more than 200 transactions per second, but it only accomplished this feat by outsourcing the core functions of Ethereum to a constellation of blockchains called Optimism, Arbitrum, Base, Mantle, Zksync, and many others. This transition also broke some of the mind-meld that existed between Ethereum and its users. “If you are an investor in Ethereum, but you are not using it directly, maybe you are thinking that you should be buying the Arbitrum token instead,” says Carlos Guzman, Vice President of Research at GSR.

The transition really accelerated in March 2024 when Ethereum implemented an upgrade incorporating a temporary data storage solution called blobs that made transactions on these networks virtually free. “You would never see a company give up 99% of its revenue to its affiliates,” said Gauntlet founder Tarun Chitra on The Chopping Block podcast.

And we are talking about real money. Coinbase’s L2 Base has earned the company almost $100 million in revenue since launching in the summer of 2023. That is value that accrues to the holder of Coinbase stock, not ether. Ironically, the embrace of L2s has made Ethereum more centralized, as nearly every L2 uses a single sequencer, or coordination mechanism like nodes on a blockchain, to organize transactions and post them to the mainnet. While L2s plan to decentralize over time, this setup is like having a single miner for the entire Bitcoin network.

The chart that best exemplifies this conundrum is ether’s circulating supply. In September 2022, Ethereum switched from a Proof of Work consensus mechanism to a Proof of Stake setup. Included in this upgrade was a provision to burn fees sent to the network, taking them out of circulation. Ethereum was still emitting new tokens daily to reward stakers, but the system was designed for the blockchain to become deflationary during times of high use because the money paid in fees by users would surpass staking rewards. As demonstrated in the chart below, the process worked as planned right up to the upgrade in March that cannibalized the Ethereum mainnet. Since then Ethereum has been inflationary and its total supply of circulating tokens exceeded the 120.5 million tokens that existed before the upgrade.

That was the first problem for holders of ether. The second is that all of these different blockchains created a headache of a user experience for anyone on Ethereum. By comparison Solana, whose growth this past year has been massive, is a smaller community with a much more user-friendly on-boarding process. It is a self-contained ecosystem—everything exists on the L1. In many cases people only need to use a single wallet and they do not have to keep track of which assets are on which L2s. Plus transactions on Solana only cost a couple of cents, making the blockchain become the natural home of the memecoin craze for over a year.

Developers are also starting to focus more on Solana. According to Electric Capital’s 2024 Crypto Developer Report, Solana increased its developer count by 83% in 2024. By contrast Ethereum lost 22% of its developers.

Head to Open Water

Ethereum could do more to restore faith among its community and investors. Some experts say that the community has been too focused on esoteric parts of technological development and has ignored aspects of basic marketing. By contrast, the Solana Foundation launched a smartphone and even rented a pop-up store in Hudson Yards on the west side of Manhattan.

Guzman suggested that in the coming years that conversations about scaling the Ethereum mainnet, perhaps by using a technology called zero-knowledge proofs, are going to continue. One proposal being debated will increase the gas limit per Ethereum block to allow more transactions. Ethereum founder Vitalik Buterin is already spearheading some of these efforts. But Guzman insisted that from his vantage point any significant scaling plans are years away. Tron founder Justin Sun also put forward a more radical proposal, albeit with limited detail, that would do things like put a tax on L2s and reduce rewards for validators to make Ethereum more deflationary. These discussions will surely continue.

In the meantime, more L2s keep coming off the assembly line. Aside from Unichain, the tokenized treasury fund issuer Ondo Finance announced plans to launch an L2 and gaming and entertainment giant Sony launched its own L2. “Eventually it should be all of the apps launching their own L2s on top of Ethereum having their own businesses,” says Christine Kim, Vice President of Research at Galaxy Digital. “The block space and ecosystem of the Ethereum mainnet is just too constrained.”

Kim thinks that Ethereum could lean into this trend and cease trying to become the main interface layer for users. For this strategy to work though, she admits, usage of the platform would need to scale exponentially higher. It is not clear that investors will reward this strategy anyway.

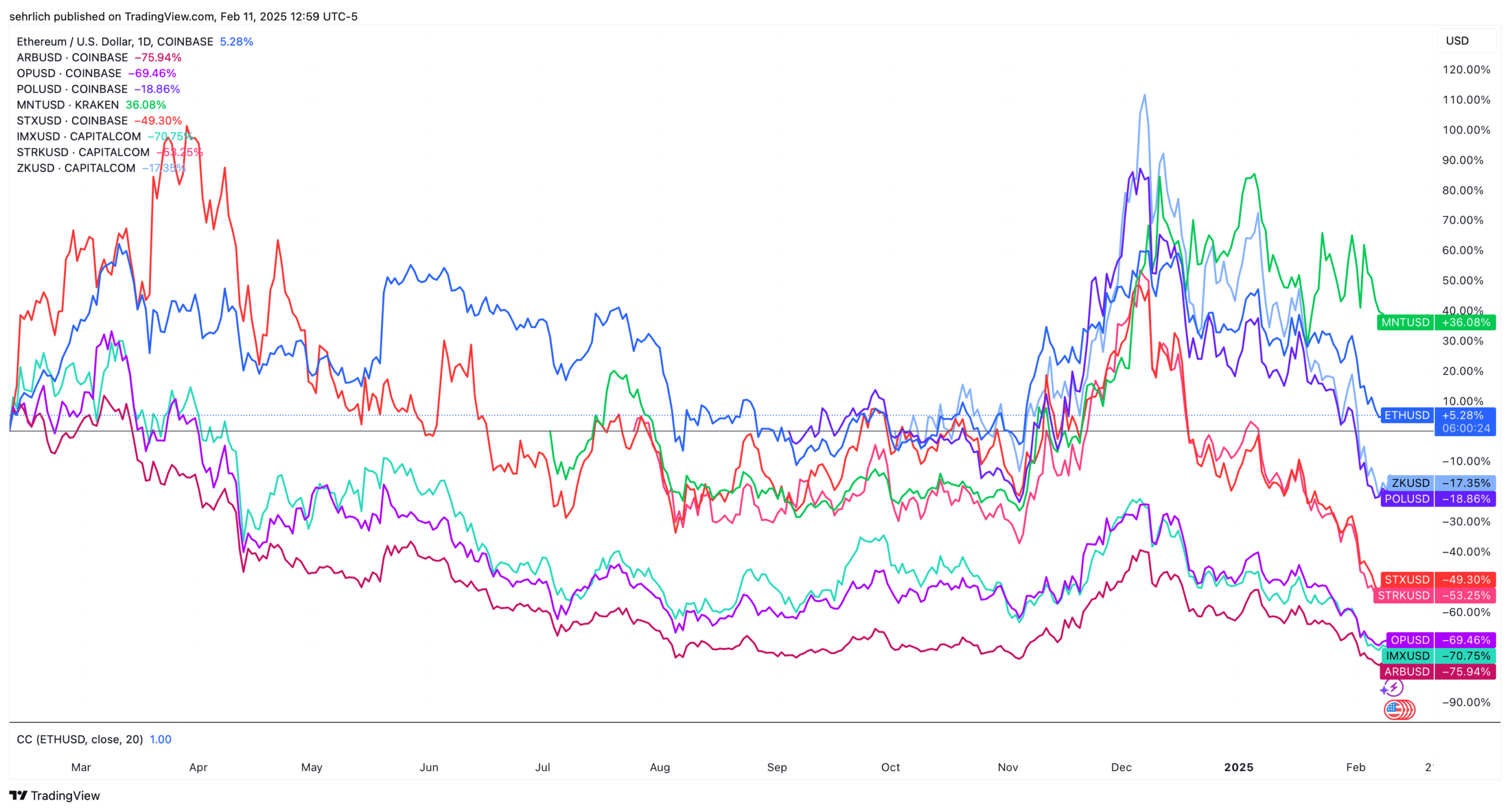

Tellingly, for as much angst as investors feel over the price of ether, it is still outperforming virtually every major L2 token over the last year. Because of token unlocks, which give insiders such as venture capital investors permission to trade their coins, two major tokens, Optimism and Arbitrum, are down 69% and 75% over the last 12 months despite rapid usage growth.

Another solution, according to Pandl, is for Ethereum to play into its core strengths of stability, security, and decentralization. It should let the L2s fight it out with Solana for low-value transactions. “Ethereum is the leading chain in terms of total value locked and economic security, and that makes it the natural platform for institutional finance,” says Pandl.

He specifically pointed to the fact that companies like $11.5 trillion asset manager BlackRock chose Ethereum to launch its $1 billion tokenized treasury platform BUIDL. In fact, Ethereum has more tokenized real world assets than every other blockchain combined according to data from RWA.xyz.

It also holds a similar percentage of TVL across all chains.

So clearly, high finance—decentralized and onchain—is one area that is defensible for Ethereum, and this trend is likely to grow. Not counting the $200 billion stablecoin market, only $17.1 billion worth of real-world assets have been tokenized. In 2024 the global fixed income and equity capital markets were worth $255.7 trillion. That is a lot of room for growth.

Perhaps then instead of trying to be the everything blockchain, Ethereum should devote its energy to developing this market segment. Other blockchains like Solana or the L2s are too new or centralized to win over mainstream financial applications for now.

Ethereum was the launchpad for governance tokens, NFTs, and memecoins. Real world assets are the next step in crypto’s evolution and they directly cater to Ethereum’s strengths. The two could be a match made in heaven. For ether investors, it might be their best hope.