Gavekal Research senior U.S. economist Will Denyer provides insight on the Fed’s policies on ‘Making Money.’

The Federal Reserve on Wednesday is set to release the minutes from its June policy-setting meeting, offering additional clues on where policymakers see interest rates headed over the remainder of the year.

Stocks traded lower ahead of the release.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| I:DJI | DOW JONES AVERAGES | 34309.87 | -108.60 | -0.32% |

| I:COMP | NASDAQ COMPOSITE INDEX | 13799.16284 | -17.61 | -0.13% |

| SP500 | S&P 500 | 4448.25 | -7.34 | -0.16% |

The U.S. central bank paused its interest rate hike campaign after a string of 10 increases that spanned 15 months. However, policymakers also opened the door to at least two more rate increases this year – a surprisingly hawkish projection that left Wall Street scratching its head.

In the weeks since then, several Fed officials – including Chair Jerome Powell – have signaled that rate increases are likely to continue as government data points to a slow retreat for inflation.

“We did take one meeting where we didn’t move,” Powell said during an event held by the Spanish central bank in Madrid last week. “We expect the moderate pace of interest rate decisions to continue.”

A FED PAUSE LIKELY WON’T HELP STRUGGLING CONSUMERS

The minutes, due at 2 p.m. ET, will likely indicate that a majority of officials anticipate more interest rate increases this year and possibly continuing into 2024, amid signs of underlying inflationary pressures within the economy. However, policymakers are likely to leave themselves some wiggle room by maintaining that any decision on rate moves will be data dependent.

“Minutes expected to show that members agreed to slow the pace of hikes, while still thinking more hikes were appropriate,” Bank of America strategists wrote in a Monday analyst note.

The Fed’s next meeting is set for July 25-26.

US HOUSING MARKET DEFYING CRASH EXPECTATIONS AS SUPPLY SHORTAGE KEEPS PRICES HIGH

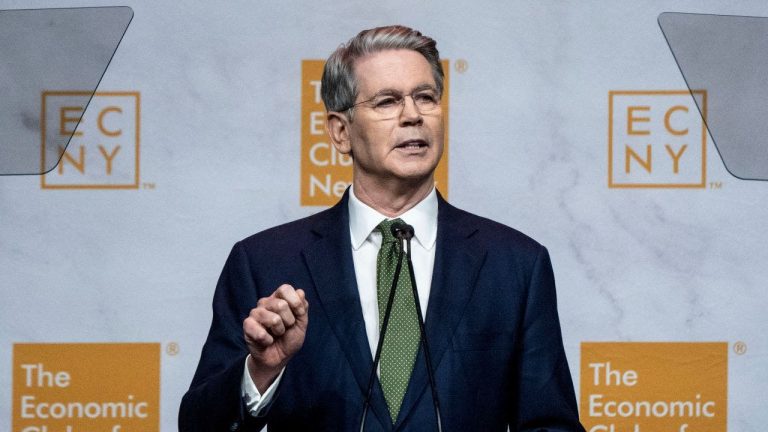

Federal Reserve Chair Jerome Powell speaks during a news conference Wednesday, Dec. 14, 2022, at the Federal Reserve Board Building, in Washington. (AP Photo/Jacquelyn Martin / AP Newsroom)

The probability that the Fed delivers another rate hike this month rose to more than 88% on Wednesday, according to the CME Group’s FedWatch tool, which tracks trading. That compares to about 11% of traders who expect the Fed to hold rates steady at the current range of 5% to 5.25%.

Hiking interest rates tends to create higher rates on consumer and business loans, which then slows the economy by forcing employers to cut back on spending. Higher rates have helped push the average rate on 30-year mortgages above 7% for the first time in years. Borrowing costs for everything from home equity lines of credit, auto loans and credit cards have also spiked.

Despite the rapid increase in rates, inflation remains stubbornly high. The Labor Department reported in June that the consumer price index, a key measure of inflation, rose 4% in May from the previous year, the smallest increase in more than two years. While that is down from a peak of 9.1% hit last summer, it remains about twice the Fed’s target 2% rate.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

Other parts of the report also showed signs of “sticky” inflation. Core prices, which exclude the more volatile measurements of food and energy, climbed 0.4%, or 5.3% annually.

“We don’t think we’re there with inflation yet,” Powell said during the June meeting. “If you look at the full range of inflation data, particularly the core data, you just aren’t seeing a lot of progress over the past year.”