CryptoLaw founder John Deaton joins “Making Money” and gives his take on the FTX meltdown.

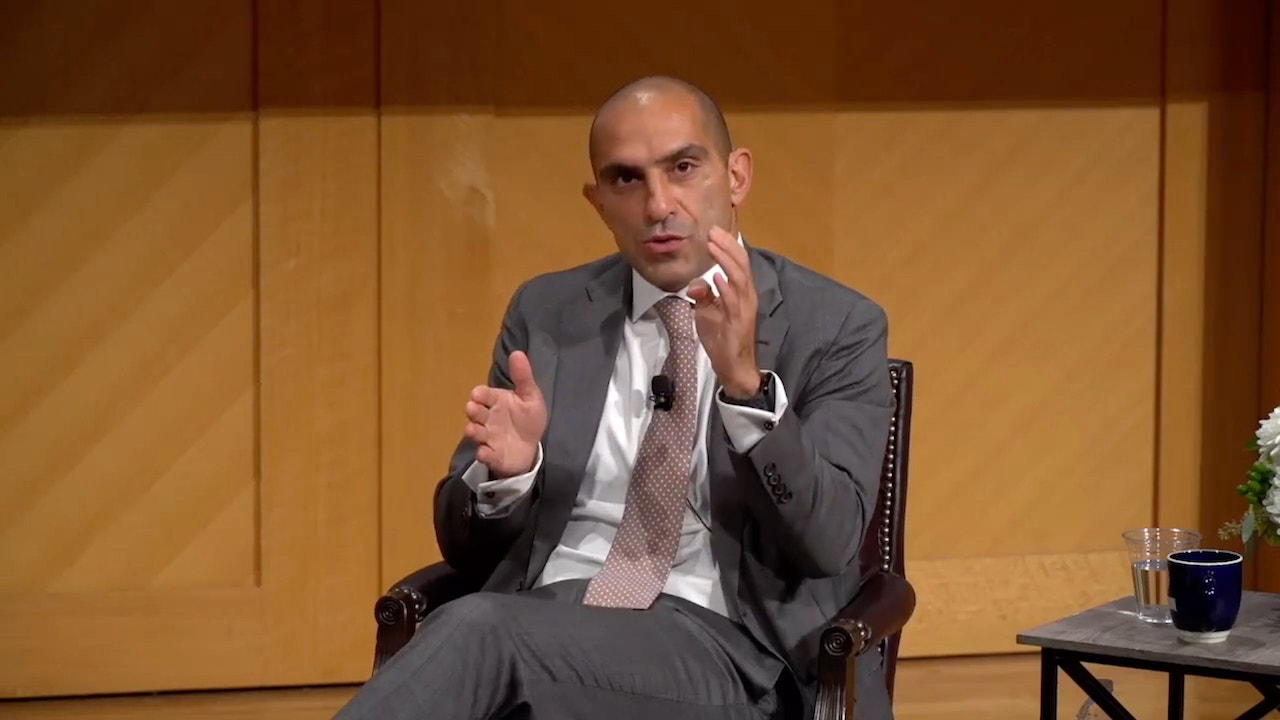

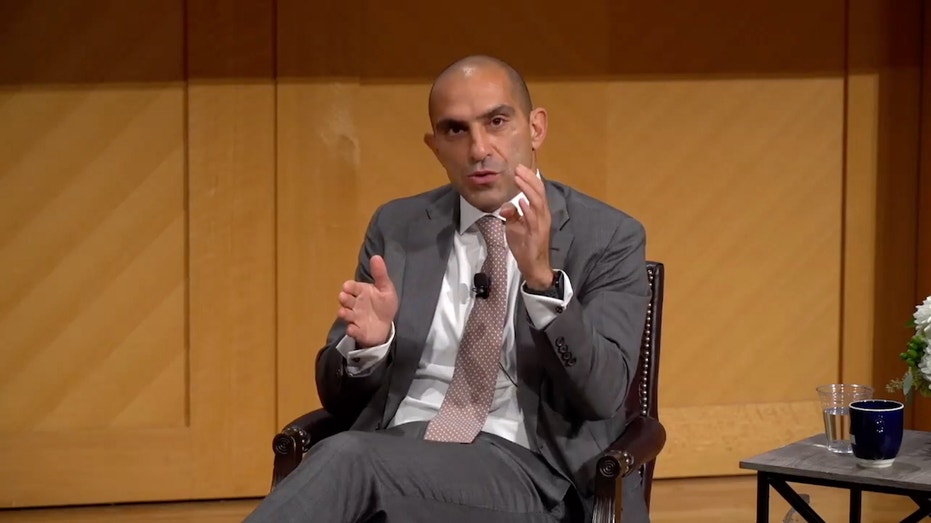

The collapse of cryptocurrency trading platform FTX has put a spotlight on Rostin Behnam, the chairman of the Commodity Futures Trading Commission (CFTC), a little-known independent agency tasked with overseeing commodity and derivatives markets.

Behnam, who was sworn into the position less than a year ago, is slated to appear during a hearing Thursday morning hosted by the Senate Agriculture Committee, the panel given oversight power over the CFTC, to discuss the FTX collapse. FTX declared bankruptcy in November after a competitor’s audit of the company’s finances revealed a significant liquidity crunch.

“The recent collapse of a major cryptocurrency exchange reinforces the urgent need for greater federal oversight of this industry,” Sen. Debbie Stabenow, D-Mich., the chairwoman of the committee, said in a statement in November. “Consumers continue to be harmed by the lack of transparency and accountability in this market.”

The collapse, though, came amid an ongoing public debate over how the federal government should go about regulating digital commodities such as cryptocurrency in the future. Behnam has argued vigorously in favor of Congress giving his agency more regulatory authority over the billion-dollar industry while FTX has similarly pushed for the CFTC to take on a greater role in regulating the space.

FTX FOUNDER SAM BANKMAN-FRIED ON HOT SEAT AS SENATE INQUIRIES, CRIMINAL PROBES MOVE FORWARD

Rostin Behnam, chairman of the Commodity Futures Trading Commission, speaks during an event at Georgetown University on Oct. 17, 2022. (Georgetown McDonough)

Currently, regulation of the industry involves both the CFTC and Securities and Exchange Commission (SEC). While the SEC is generally thought to be a tougher regulator of the industry, the CFTC has been characterized as a friendlier regulator by the industry.

“In my opinion, there are important principles missing from the current regulatory framework applicable to digital asset markets that we see in other federally regulated markets, particularly ones that primarily cater to retail investors,” Behnam wrote in a letter to Stabenow, Agriculture Committee ranking member John Boozman, R-Ark., and leaders on the House Committee on Agriculture in February.”

“A federal regulatory regime may ensure that certain safeguards are in place to address the risks to individual investors, market integrity, and systemic stability,” he continued.

FORMER FBI AGENTS WEIGH IN ON FTX INVESTIGATION, SAM BANKMAN-FRIED’S POSSIBLE EXTRADITION

One day after he sent the letter, Behnam attended a Senate Agriculture Committee hearing with Sam Bankman-Fried, the disgraced FTX founder who has since stepped down from his role as CEO. During the hearing, both Behnam and Bankman-Fried argued that the CFTC is “well situated to play an increasingly central role” in regulating the cash digital asset commodity market.

“FTX recommends broadening the CFTC’s jurisdiction to include, at a minimum, all spot transactions in (non-security) digital assets involving retail investors, regardless of whether the transactions currently fall within CFTC’s jurisdiction,” Bankman-Fried told the lawmakers on the committee.

FTX founder Sam Bankman-Fried speaks during a Senate Agriculture Committee hearing on Feb. 9, 2022. (Sarah Silbiger/Bloomberg via Getty Images / Getty Images)

Then, in August, Stabenow, Boozman and fellow committee members Sens. Cory Booker, D-N.J., and John Thune, R-S.D., introduced the Digital Commodities Consumer Protection Act, legislation that proposes to give the CFTC more tools to regulate digital commodities.

Both Behnam, who was previously a top aide to Stabenow, and FTX lauded the legislation as an important step in shoring up the federal government’s regulatory authority over the industry.

“It’s a nice combination of creating guardrails that gives us [a] steer and a direction of what we need to do,” Behnam said of the legislation during an event hosted by Georgetown University in October. “It enables us the flexibility to write rules that are adaptable over time, as we would imagine this technology changing and evolving and enabling to keep up with markets as they move.”

“Right now, the markets are largely unregulated,” he continued. “And as a regulator, my No. 1 concerns and issues and responsibilities are customer protections, market resiliency, and ultimately, depending on the size of the market, financial stability.”

FTX FOUNDER SAM BANKMAN-FRIED QUIETLY PURCHASED MAJOR DEMOCRATIC DATA FIRM

And shortly after the bill was introduced, FTX said it was “enthused about these developments because they indicate the broadening interest from the Congress in providing protections for investors in digital assets as well as regulatory clarity to the industry as whole.”

Macro Trends Advisors’ Mitch Roschelle speaks on the latest developments in FTX’s collapse on “The Evening Edit.”

In addition to his broad agreement with FTX and Bankman-Fried regarding the future of crypto regulation, Behnam has met on a number of occasions with FTX leaders, including Bankman-Fried.

Behnam hosted a CFTC roundtable in which Bankman-Fried participated in May, according to agency records, and, in September, Behnam attended a closed-door roundtable hosted by Rep. Josh Gottheimer, D-N.J., Politico reported. A FTX representative reportedly attended the meeting.

Over the course of the last several months, the CFTC chairman has also been reviewing a rule proposal from FTX for the agency to restructure crypto trades. Behnam had stated the proposal could mark a new phase in the evolution of the crypto industry but stopped short of publicly supporting the proposed rule change.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

“This is a unique intersection of the crypto space and traditional finance,” Behnam said during an event in October. “I think this is potentially — and I emphasize the ‘potential’ — another phase in the evolution of market structure, innovation and disruption.”

“I think it’s incumbent on regulators to be open-minded, cautious, deliberate and inclusive so that we have a conversation that includes everyone’s point of view.”

During an event this week hosted by the Financial Times, Behnam said CFTC was “not even close” to issuing a decision on the proposed rule at the time of the FTX meltdown, CoinDesk reported.