Cushman & Wakefield Chairman of Global Brokerage Bruce Mosler discusses President Donald Trumps impact on commercial real estate and how Americans are handling 7 percent mortgage rates.

The ability to buy a home has become increasingly difficult in the U.S. in recent years, and some experts are concerned about the long-term impact on young adults, who currently have a higher hill to climb to achieve the American dream than previous generations.

“Rising interest rates, inflated home prices, and stagnant wages are forcing many into a cycle of lifelong renting, where building equity feels increasingly out of reach,” said real estate investor Lori Greymont. “Without strategic shifts, we’re watching an entire generation get priced out of the American dream.”

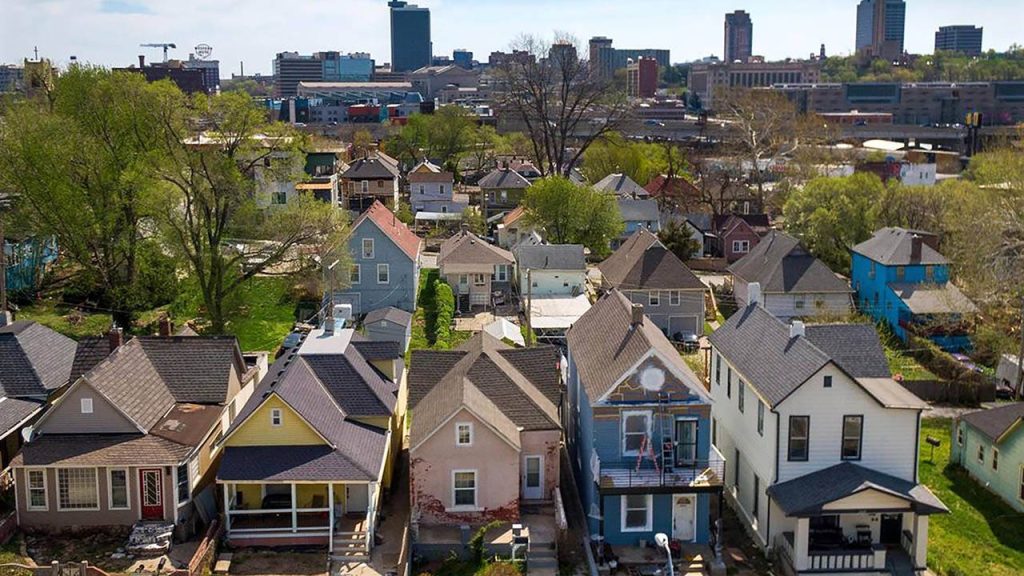

It’s a lot more difficult to buy a home in the U.S. than is used to be. That has some experts concerned about America’s young adults. (Tammy Ljungblad/The Kansas City Star/Tribune News Service via Getty Images / Getty Images)

Dr. David Phelps, a financial expert and founder of the real estate investing community Freedom Founders, told FOX Business that while some people have claimed Gen Z is lazy and entitled when they complain about the cost of housing today, he does not believe that is accurate.

“Gen Z is correct—housing absolutely has become unaffordable for a significant portion of our population, especially that generation,” Phelps said. “Wages haven’t kept up with inflation or the rapidly rising home costs, and that’s before you even factor in rising interest rates and tightening underwriting guidelines.”

EXISTING HOME SALES FALL TO LOWEST LEVEL IN NEARLY 30 YEARS

Phelps said that based on the average salary in the U.S., a home buyer can afford a home that costs $110,928, which is a fraction of the median home price of $420,400 today.

“In other words, it’s not just a matter of making coffee at home and skipping the avocado toast,” he said. “The math doesn’t work for Gen Z.”

The Connor Group founder and managing partner discusses what needs to happen to unleash the housing market and the impact of regulations on rebuilding California following the wildfires.

Tom Spaeth, owner of Easal Properties, said that in the last 10 years, the supply of homes that young families on a median income can afford to buy has gone from 50% of the available homes to a mere 15% as home prices and mortgage interest rates have risen.

TRUMP WANTS TO FIX THE HOUSING AFFORDABILITY CRISIS: WHAT IT WILL TAKE

He said that has happened “All while large institutional investors are purchasing a record number of homes, forcing young families into renting in lower quality neighborhoods, disrupting the education of their children, increasing the families financial stress and creating housing instability.”

Achieving the American dream has become increasingly difficult in recent years. (Photographer: David Ryder/Bloomberg via Getty Images / Getty Images)

Psychotherapist and author Jonathan Alpert says the housing affordability crisis isn’t just about economics—it also takes a serious psychological toll on young adults.

“Many Gen Zers are experiencing anxiety, frustration, and feelings of failure as they struggle to achieve what previous generations saw as a rite of passage,” Alpert said. “Owning a home has long been tied to stability and success, so when it feels out of reach, it can lead to self-doubt and a sense of being ‘stuck’ in life.”

GET FOX BUSINESS ON THE GO BY CLICKING HERE

Alpert says he is hopeful that as economic conditions shift, opportunities will open up.

“In the meantime,” he told FOX Business. “Resilience, adaptability, and a change in narrative around this topic is crucial for navigating these challenges.”