The ‘Fox & Friends’ co-hosts discussed the fallout from the student loan handout plan, which will cost a whopping $84 billion as Americans battle the sky-high cost of living.

The White House announced another student loan handout on Friday, bringing the total number of borrowers who have received President Biden’s debt relief so far to 4.3 million. According to the White House, the total student loan cancellation sum is a whopping $153 billion.

“Today, my Administration is canceling student debt for 277,000 more people, bringing the total number of Americans who have been approved for debt relief so far under my Administration to 4.3 million borrowers through various actions,” Biden said Friday via the White House.

As for who is footing the bill, Biden has proposed “no new revenue to cover the cost, which means it goes straight on top of the pile of what America owes to its creditors.”

So, how much do taxpayers have to pay to afford these programs? According to the Wharton School of the University of Pennsylvania, the sum tops a half-trillion.

FOOD COSTS SOAR AS BIDEN HANDS OUT MASSIVE $7.4B FOR STUDENT LOANS

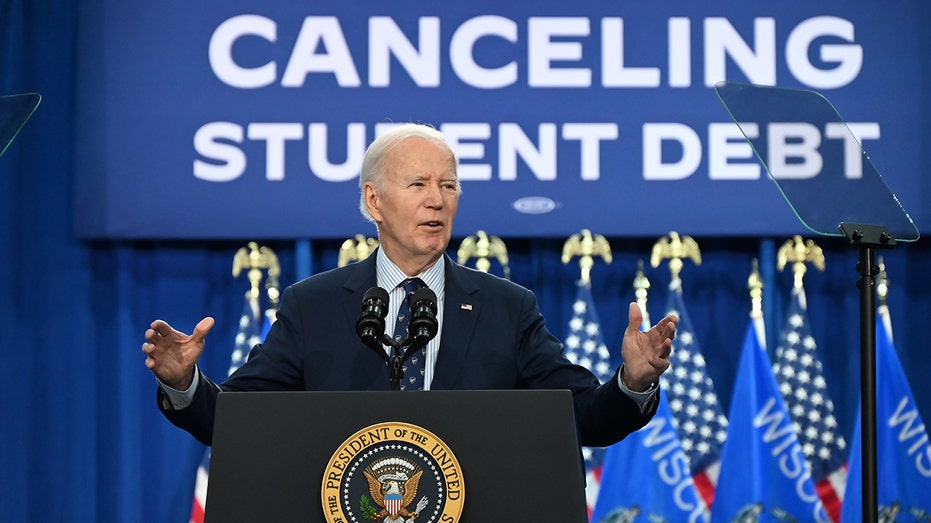

President Biden announced on Friday, April 12, that his administration was canceling student debt for 277,000 more borrowers. (Kyle Mazza/Anadolu via Getty Images / Getty Images)

On Thursday, the Wharton School’s newsletter Budget Model released an analysis of the student loan debt relief provisions which Biden announced on Monday and added that sum to a previous analysis of Biden’s new Income-Driven Repayment (“SAVE”) plan.

“We estimate that the New Plans will cost $84 billion in addition to the $475 billion that we estimated for President Biden’s SAVE plan, for a total cost of about $559 billion across both plans,” said the analysis.

White House Press Secretary Karine Jean-Pierre will announce on Friday that President Biden will cancel $7.4B in debt for 277,000 borrowers across the U.S.

Biden’s forgiveness proposal announced on Monday included five main provisions, the Department of Education said.

These include: Waiving accrued and capitalized interest for millions of borrowers; automatically discharging debt for borrowers otherwise eligible for loan forgiveness under SAVE, even for those who do not enroll in the program; eliminating student debt for borrowers in repayment for 20 years or more; helping borrowers who enrolled in low-financial-value programs or institutions; and, assisting borrowers who experience hardship in paying back their loans.

BIDEN TO UNVEIL NEW STUDENT LOAN HANDOUT THAT COULD SLASH DEBT FOR MILLIONS BEFORE ELECTION DAY

As college students around the country graduate with a massive amount of debt, advocates display a hand-painted sign on the Ellipse in front of The White House on June 15, 2021, in Washington, D.C. (Paul Morigi/Getty Images for We The 45 Million / Getty Images)

“These historic steps reflect President Biden’s determination that we cannot allow student debt to leave students worse off than before they went to college,” U.S. Under Secretary of Education James Kvaal said in Monday’s announcement. “The President directed us to complete these programs as quickly as possible, and we are going to do just that.”

According to the Wharton School newsletter, the plans include “debt relief for about 750,000 individuals residing in households that, on average, earn $312,977 in annual household income.”

Student loan borrowers stage a rally in front of The White House to celebrate President Biden canceling student debt and to begin the fight to cancel any remaining debt on August 25, 2022, in Washington, DC. (Paul Morigi/Getty Images for We the 45m / Getty Images)

The analysis also found most of the cost of these plans comes from waiving interest.

“Of the $84 billion, about $58 billion comes from waiving accrued and capitalized interest. The second-largest cost of $19 billion stems from eliminating debt for borrowers in repayment for 20 years or more (or 25 years with graduate student debt),” the analysis said.

SOME STUDENT LOAN BORROWERS ARE GETTING REFUNDS ON TOP OF LOAN FORGIVENESS

It continued: “The remaining $7 billion is associated with assisting borrowers who are experiencing hardship, which we interpret to imply shorter-term income or cost shocks that are otherwise not covered by the SAVE plan. The costs associated with the other two provisions have already been almost fully accounted for in our previous analysis of the SAVE plan, thereby producing no additional material costs for the New Plans.”

President Biden speaks about student debt relief at Central New Mexico Community College Student Resource Center in Albuquerque, New Mexico, on November 3, 2022. (SAUL LOEB/AFP via Getty Images / Getty Images)

Despite the U.S. Supreme Court ruling last summer that Biden’s sweeping student loan handout was illegal, he is forging ahead with additional loan forgiveness initiatives — and he’s not backing down.

“From day one of my Administration, I promised to fight to ensure higher education is a ticket to the middle class, not a barrier to opportunity. I will never stop working to cancel student debt – no matter how many times Republican elected officials try to stop us,” Biden said Friday.

The White House has contended the relief of debt would encourage those impacted to increase how much they spend, thus giving some return to the economy.