The decentralized exchange aggregator is the second-largest DeFi protocol on Solana by the amount of gas it consumes—a sign of substantial trading on the platform.

Jupiter’s native governance token JUP soared to an all-time high Monday.

(Shutterstock)

Posted March 18, 2024 at 4:00 pm EST.

The price of JUP, the native governance token for the Solana-based decentralized exchange aggregator, Jupiter, reached a record high Monday morning ET, jumping to as high as $1.59 before settling at $1.40 at press time.

According to data from CoinGecko, JUP has increased 10% in the past 24 hours and 86% in the past seven days. JUP’s market cap currently sits at $1.9 billion, while its fully diluted valuation stands at $14 billion.

Read More: How ‘Fully Diluted Valuation’ Can Be a Very Dangerous Metric for Crypto Markets to Rely On

JUP’s price action comes as Jupiter has consumed more than $888,000 worth of gas in the past seven days, making it the second-largest DeFi protocol on Solana, a sign of substantial trading on the platform, per blockchain analytics firm Artemis.

In March, Jupiter’s trading volume surged, in part, because of a sharp rise in the trading of memecoins on Jupiter.

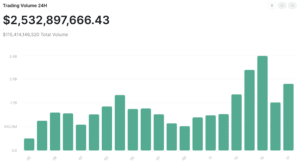

Over the past 24 hours, trading volume exceeded $2.53 billion, surpassing the sub-$1 billion volume seen on the first day of the month, according to self-reported statistics. Four of the top six trading pairs by volume on Jupiter involve meme coins, such as SLERF, BOME, NAP, and WIF.

Read More: Pro-Ethereum Crowd Slams Solana-based Jupiter Airdrop as ‘Absolute Trash’

“JUP token holders will have the ability to vote on critical aspects of the token itself, such as the timing of initial liquidity provision, future emissions beyond the initial mint, and key ecosystem initiatives, including determining the projects that will be a part of Jupiter Start,” according to a blog post written by the Jupiter team.