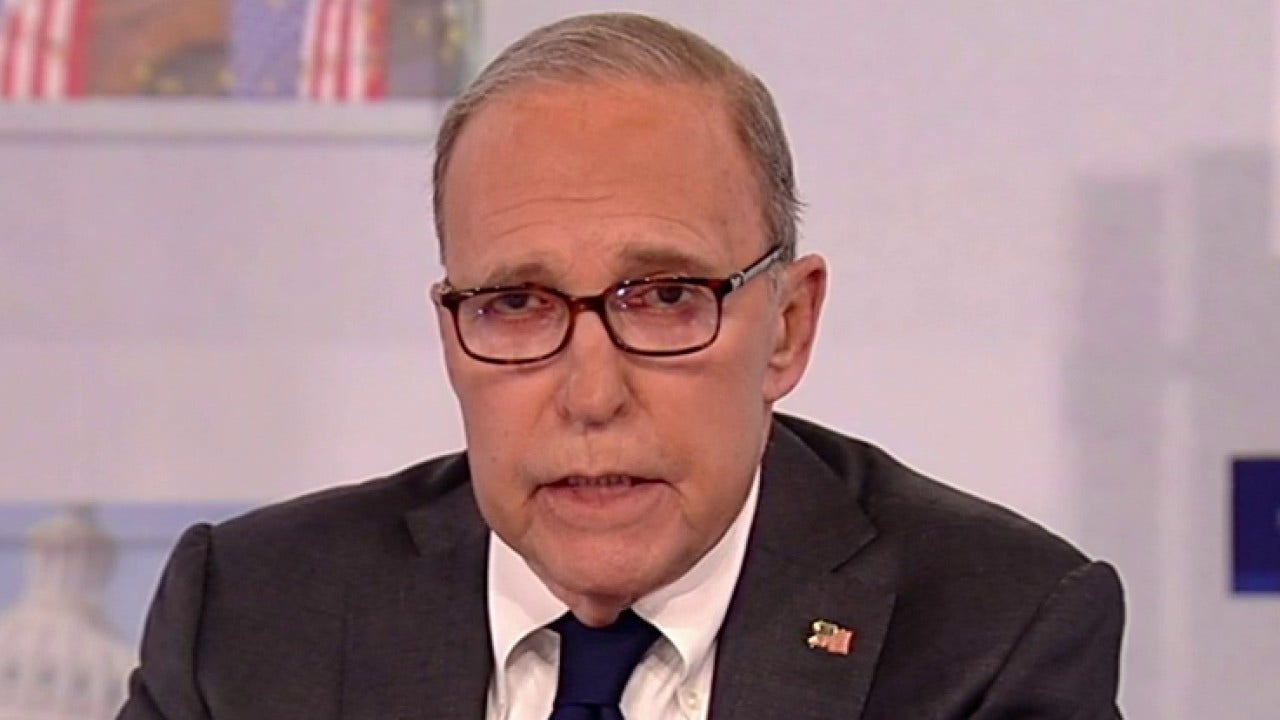

FOX Business host Larry Kudlow says the president’s ‘manic’ tax policies would ‘decimate’ the economy on ‘Kudlow.’

Sixty-four percent, or nearly two-thirds, of voters say their taxes are too high. That’s a record complaint and no surprise, because all Joe Biden does is run around the country at every stop telling folks he’s going to raise taxes.

Corporate taxes, individual taxes, capital gains, dividends, the death tax, small businesses. If it moves, he wants to tax it more. Now, here’s the catch: He always tells us he’ll only tax rich people. He talks about billionaires for starters, but then he caveats, if you make a hundred million, you qualify as a billionaire. That’s called Biden math, but it turns out, his promise only to tax people making over $400,000 is also phony — just take a look at the fine print of any of his legislative tax hike proposals.

If Mr. Biden were ever re-elected, his manic tax-hike policies would decimate the economy. One reason the economy hasn’t been decimated so far is despite Biden’s untruthful rhetoric, the successful Trump tax cuts have not been repealed and the biggest tax beneficiaries of the Trump tax cuts were middle- and lower-income Americans. Study after study has shown that.

Folks know that whenever politicians, particularly left-wing politicians, especially big-government socialist politicians, talk about tax cuts “only” for the rich, middle-income folks know what a lie that is and how their tax ox will be gored at least as much, if not way more than the wealthiest, and by the way, just for the heck of it, the truth is the top 1% already pay about half of the federal income tax.

Former 2024 GOP presidential candidate Vivek Ramaswamy tears apart the president’s energy and tax policies on ‘Kudlow.’

POWELL SAYS FED NEEDS MORE INFLATION EVIDENCE BEFORE CUTTING INTEREST RATES

However, the payroll tax, which supports Medicare and Social Security, is largely shouldered by the middle class, and that is why Donald Trump is taking a preliminary look at some middle-class payroll tax relief.

Meanwhile, if you look at Biden’s most recent budget, the tax revenue share of GDP goes from 16.5% last year in 2023, all the way up to 20.3% at the end of the budget window in 2034.

That would be a record high. That is one massive tax hike to support Biden’s massive big-government spending plans, and those spending plans come with unbelievable regulatory strings attached to them that will throw a lot of sand in our economic gears.

Meanwhile, remember the IRS story from the misnamed “Inflation Reduction Act”? The IRS would spend $80 billion in order to hire 87,000 new IRS agents, but the Treasury Inspector General for Tax Administration shows that 63% of new audits last year were aimed at the middle class with incomes of less than $200,000, according to the Wall Street Journal editorial today.

Instead of hiring 3,700 new agents in the first year of this dumb plan, it turns out that the IRS has only hired 34 in the first six months. Thirty-four! They’re chasing after the middle class. How’s that for big-government efficiency? They get great benefits, including a salary of $125,000 a year and $60,000 in student loan forgiveness.

Of course, student loan forgiveness, even though the Supreme Court just said that’s illegal. Wait a minute, didn’t I just see that same provision somewhere else? Oh, here it is! In Joe Biden’s domestic green-army “climate corps.”

CLICK HERE TO GET THE FOX NEWS APP

Spending $8 billion for 50,000 new, rabid, Green New Deal climate activists. Hang on! These little public service climateers will get benefits for housing, transportation, healthcare, child care and — wait for it… hang on a minute more… you guessed it! Student loan forgiveness. I knew it, with just a little DEI as a side order of fries. Yep. That’s what Biden is gunning for.

Here’s my bottom line: What you’ve got here is the potential for 50,000 little climateers who really will be 50,000 Democratic mail-in ballot activists who will be harvesting their little Green New Deals as fast and as often as they possibly can. This is even better than Zuckerbucks, and it’s a whole lot more crooked when Uncle Sam’s big government socialists are in charge. Just a few modest opinions on my side.

This article is adapted from Larry Kudlow’s opening commentary on the April 3, 2024, edition of “Kudlow.”