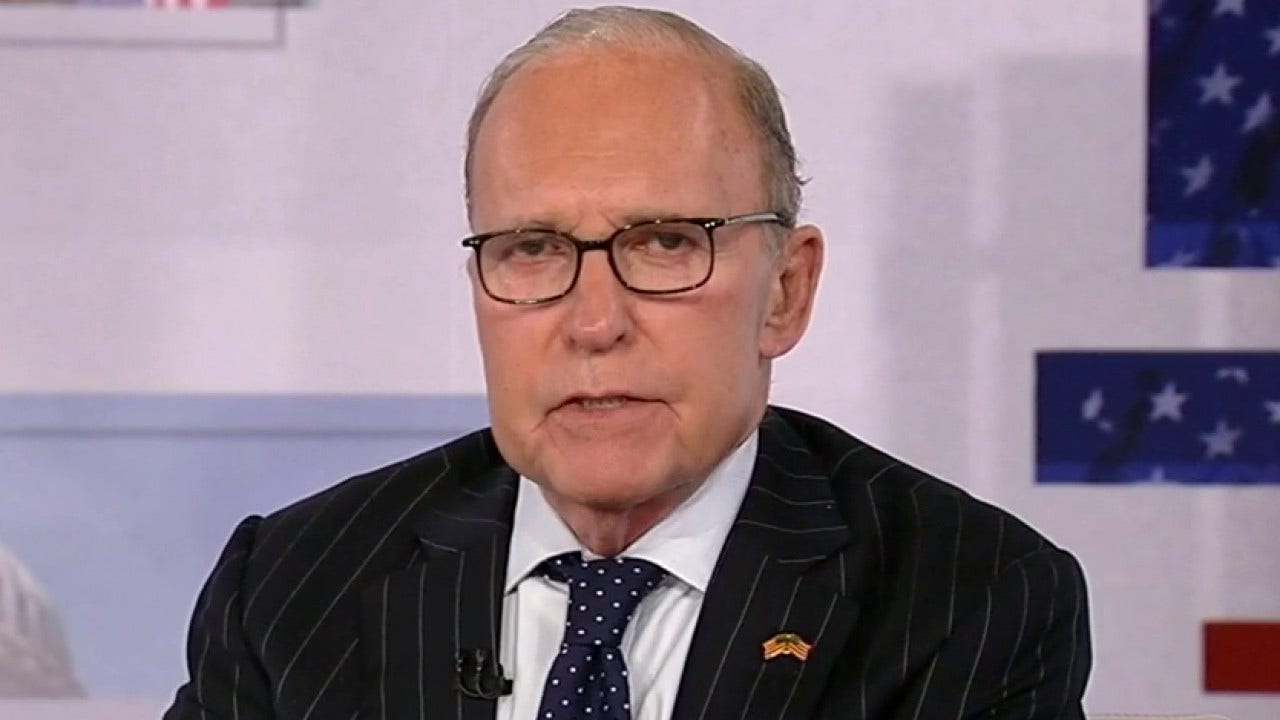

FOX Business host Larry Kudlow reacts to the controversial Federal Reserve rate hikes on ‘Kudlow.’

Why does this always happen on Fed Day? Fed-Head Jay Powell takes the podium at 2:30 — says a couple of good things — like the Central Bank’s going to bring the inflation rate down to 2%.

OK, that’s a good thing. Zero would probably be better, but let’s cut him some slack. Two percent is the global target, and markets rally. Everybody knew he was going to raise the target rate a quarter-point to 5.5%, which I think is a good number, but then, Mr. Powell talks, talks, talks and then talks some more.

That’s when stock prices and everything else starts gyrating wildly. Mostly because folks don’t know what he is saying. What does this guy mean? What is he talking about? Wages are too high. Then, they’re not.

We could have a soft landing, but maybe not. We might have to raise rates more in the future. Or, then again, we might cut rates. We need higher unemployment. Actually, no, we don’t! I mean, really. The more he talks, the less sense it makes. He’s a single-handed volatility producer.

FED SET TO RAISE INTEREST RATES TO 22-YEAR HIGH AFTER JUNE PAUSE

At one point, he said we don’t see inflation coming down to 2% until 2025 and the market sold off 200 points. Then, he said something else — and the market came back. Who knows. I yearn for the days when Paul Volcker would blow cigar smoke at Congress and basically tell folks nothing. That’s what a good central banker ought to do. Make it a surprise. Tell them nothing. Keep them guessing.

Here’s a thought: Keep your eye on gold and oil. Gold is a classic inflation indicator, telling you whether the dollar is fundamentally strong or weak. Gold was $1,600 last November and today it’s just south of $2,000. It was up $11 today after the Fed rate hike.

Maybe this is why the Fed keeps raising their target rate. It’s not a great sign for future inflation. Oil is up about $10 more or less, from $69 to $79. Some people think it’s going up another $10-15. If so, that would raise the topline CPI. I’m being overly simplistic here, but you could do worse than just track gold and oil as an indicator of interest rates, inflation and Fed policy.

Another point I’d make is that the Fed’s so-called balance sheet — which is basically the portfolio of government and mortgage-backed securities — is still too high. It’s still too big. The peak was $9 trillion during the pandemic. It has dropped toward $8 trillion, but it was at just about $1 trillion not long ago. I think the reason gold is still historically very high is that the Fed owns too many bonds and has printed too much money, even though it has been printing less new cash than before.

Another point I’d make is that the Fed should not be targeting the unemployment rate, or wage rates, or the number of people working. Their job is to keep an eye on money and prices. If you’re worried about the economy, that’s a function of fiscal policy, that is spending, taxing and regulating.

The Biden administration has done way too much of all three. So, while jobs have recovered from the pandemic, wage rates are still underwater from high inflation, which is 16% above February 2021, Mr. Biden’s base month as president. Groceries are up about 20%, energy up 30%.

The Fed was late to the party. Now they’re catching up. The real interest rate on two-year government paper is almost 3%. That’s good, but the real yield on 10-year treasuries is only 1.5%, which anticipates more stagnant economic growth and diminished capital formation.

CLICK HERE TO GET THE FOX NEWS APP

If Jay Powell had a backbone, like Paul Volcker and Alan Greenspan, he’d be out there telling Congress to stop spending. He would suggest that limited government would grow the economy from the supply side and that would bring down inflation — permanently — because you’d have less money-chasing, more goods, which is exactly the right policy mix.

So, the Fed should quit trying to control interest rates. It should reduce the size of its balance sheets, stop printing new money and Congress should spend less, tax less and regulate less. For this, we’d need a new cavalry. Wouldn’t we? Actually, we’d need a whole new army. Let us give Bidenomics the burial it so richly deserves.

This article is adapted from Larry Kudlow’s opening commentary on the July 26, 2023, edition of “Kudlow.”