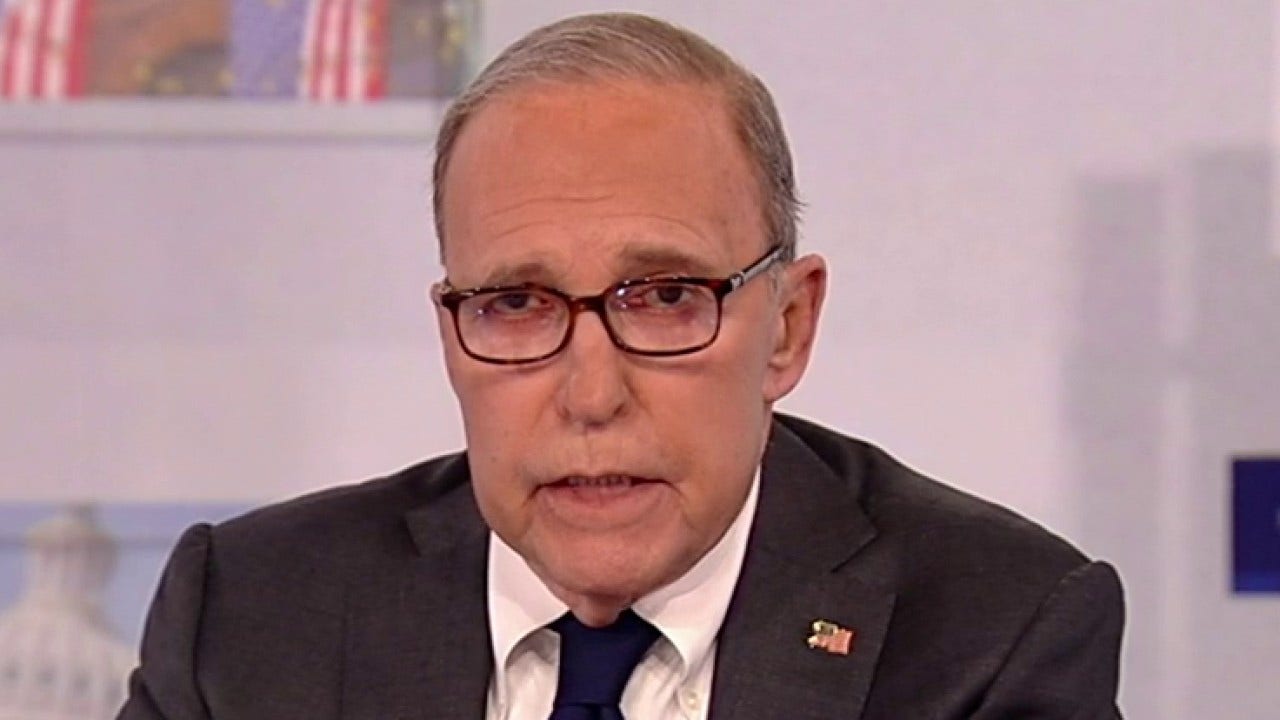

FOX Business host Larry Kudlow reacts to the White House’s plans to forgive student debt, despite the Supreme Court ruling on ‘Kudlow.’

There he goes again, again and again. Just this morning, President Biden announced another $7.4 billion in student debt bailouts for 277,000 borrowers. This comes to $153 billion in proposed student debt cancelations that would cover 4.3 million people. Of course… the Supreme Court ruled that Mr. Biden does not have the authority to cancel student loans, in a 6–3 decision entitled Biden v. Nebraska.

That specifically struck down use of the so-called 9/11-related HEROES Act for student loan cancelations. The court ruled against the president’s executive order because it lacked a clear mandate from Congress to be used outside of national emergencies.

This was somewhat similar to the Supreme’s decision in West Virginia v. EPA that ruled against extraordinary executive orders regarding fossil fuel and other climate-related cancelations without a specific congressional mandate. These latest rounds of student loan cancelations were based on the SAVE plan, which purports to regulate income-related loan payments, but this, too, is likely to be struck down by the Supremes because the executive lacks a clear congressional mandate to cancel the loan and interest payment altogether.

US CONSUMER SENTIMENT FALLS MORE THAN EXPECTED AS INFLATION FEARS RISE

Sen. Eric Schmitt, R-Mo., says the president’s student loan debt relief plan will ultimately be struck down on ‘Kudlow.’

The interesting thing about all this is that Supreme Court decisions were written in English. Clear English! It’s our mother tongue. Most people understand it, even President Biden purports to, and yet, as he has said several times, he doesn’t care what the Supreme Court says, and wants to go ahead with it anyway and cancel $153 billion worth of student loans.

If you think this is unconstitutional, or undemocratic, you would be right. Right now, the Education Department holds a portfolio of $1.7 trillion of student loans. So, Biden would be canceling roughly 9%.

Here is an interesting substory to this student loan drama. It was the Obama administration that socialized student loans and stuck them into the Education Department. Prior to that, these loans were made by banks and other private lenders. Well, here’s the thing: There isn’t a person among the 4,400 staffers in the Education Department who knows a thing about banking or credit analysis.

So, they’ve just been giving away free money, which, by the way, resulted in higher and higher tuition costs among colleges who enroll these debt-laden students.

Now, you might say the private banker who understands credit analysis would be much better at making these loans — and you would be right, but, that’s not what Obama wanted. He wanted to put all the loans in the Education Department so that — and get this — the interest payments would go to finance — wait a minute — Obamacare! How about that for a clever banking solution?

So now, Mr. Biden wants to cancel all these loans and the interest payments, which will of course underfund Obamacare, but no matter. He’ll just sell more debt to take care of that little problem. This is some high finance story, isn’t it? The dumb leading the blind into more dumbness.

Now, the final part of this sad tale is whether Biden and his genius advisers have figured out that — while they might believe this student loan cancelation to be a very clever way of buying votes for the election — not even that is going to work.

In round numbers, 60% of students across the country do not have college or grad school loans, or may have actually had them and paid them off legitimately, like a responsible person, but about 40% have these loans.

CLICK HERE TO GET THE FOX NEWS APP

So, you might say the 60% is financing the 40%. That’s not a good political ratio. One of my favorite Democratic pollsters, Doug Schoen, just wrote on Fox News Digital a column entitled: “Biden screwed up life for young voters and it could cost him dearly.” By the way, as a share of the total population in the United States, 13% have student loans and 87% have not. That’s an even worse political calculus for Joe Biden.

This is certainly the gang that can’t shoot straight. They can’t even figure out how to buy an election, but they sure know how to lose one.

This article is adapted from Larry Kudlow’s opening commentary on the April 12, 2024, edition of “Kudlow.”