Lloyds Bank has issued a warning after new research revealed that nearly a quarter (24%) of UK adults believe all their savings are tax-free, regardless of the type of account and the amount saved. This misconception could be costing people the chance to earn tax-free growth and returns on their savings or investments.

Currently, people in the UK can save and invest up to £20,000 tax-free each year in an ISA (Individual Savings Account). Holding money outside of an ISA means missing out on these benefits. Despite 86% of people claiming to know an ISA, 55% couldn’t identify the current ISA allowance, and 23% of ISA holders hadn’t made any contributions this tax year.

Interest earned on non-ISA accounts is subject to tax. Basic-rate taxpayers can earn up to £1,000 in interest tax-free, while higher-rate taxpayers have a £500 allowance.

Additional-rate taxpayers are taxed on all interest earned outside of tax-free accounts.

Simon Caddick, savings director at Lloyds Bank, said: “If savings are held in a ‘regular’ savings account, then tax is due on interest above the saver’s personal savings allowance. That means different things for different people – for every £100 of interest earned over the personal savings allowance, a basic rate taxpayer will pay £20 in tax, while a higher rate taxpayer it’s £40. Over time the tax bill can add up.”

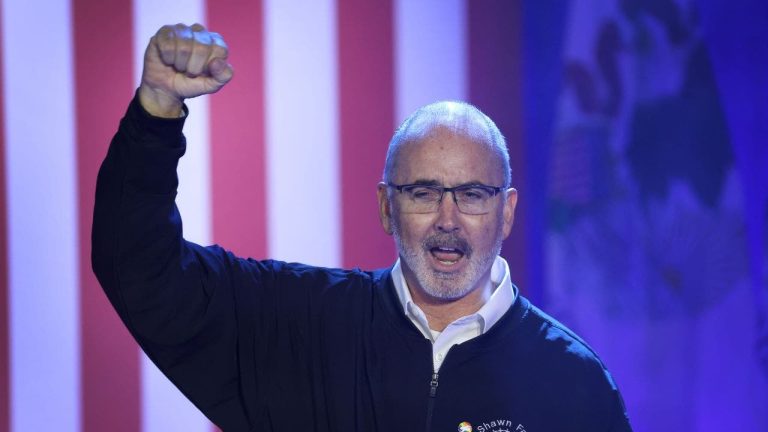

Due to these frozen personal allowance thresholds and higher interest rates currently on offer, more than 800,000 more savers could be pulled into paying tax on their savings this year, according to research from Shawbrook Bank.

With the tax year ending on April 5, 2025, Lloyds is encouraging people to maximise their ISA allowance – or lose it.

Mr Caddick said: “We’re passionate about empowering people to take control of their finances. It’s key that people feel they have the knowledge to make good, solid financial decisions – particularly as there are lots of options for different savings needs. Our message is simple as we approach the end of this tax year – think ‘ISA first’ to avoid losing money from your hard-earned savings. It’s a great way to start and build a savings pot for up to £20,000 each tax year, and, crucially, it’s tax-free.”

Lloyds’ research also highlighted barriers preventing people from using ISAs. The most common reasons were not having enough money to save (55%), believing ISAs lock money away (15%), and thinking ISAs are too complicated (12%).

Concerns about stocks and shares ISAs included the fear of losing money (61%) and not knowing enough about saving in this way (29%).

However, Lloyds reassured savers that opening an ISA is simple, with options starting from just £1, and that Cash ISAs offer flexibility, with instant access or fixed-term savings options.

The five types of ISA

Currently, there are five different types of ISA people can invest in: Cash; Stocks and Shares; Innovative Finance; Lifetime, and Junior.

Cash ISA

Mr Caddick said: “This is a popular ISA, offering lower growth and lower risk, but the balance is secure. There are also lots of options available – if savers can lock their money away for year and won’t withdraw funds, higher rates are available.”

Stocks and shares ISA

Savers looking for higher returns and willing to take on more risk could consider investing in a stocks and shares ISA.

Mr Caddick said: “These allow savers to hold a range of investments, with any income or gains made free from UK income tax and capital gains tax. Investing in a stocks and shares ISA for at least five years helps smooth out market movements.”

However, he added: “It’s worth remembering that investments can go down as well as up. Most providers offer stocks and shares ISAs – including Lloyds Bank through Ready Made Investments. People can either choose from three different levels of risk based on what they feel comfortable with, or pick their own investments while managing their own level of risk.”

Innovative finance ISA

Mr Caddick said: “We get a little more niche with this one – in simple terms, an innovative finance ISA is where savers can invest in peer-to-peer lending and crowdfunding projects.

“It’s much riskier than the likes of a cash ISA or stocks and shares ISA but returns are likely to be higher.”

Lifetime ISAs

Lifetime ISAs have existed since 2017 and are designed to help people save for their first home or retirement. Savers could earn a Government bonus of 25% on their savings, but they can only use part of their ISA allowance each tax year.

Other terms must be met to make withdrawals penalty-free. For example, the property purchased cannot exceed £450,000. It’s important to understand all these terms before investing in a Lifetime ISA.

Junior ISAs

Finally, the Junior ISA is available to save for children and can be a great way to help them get into a savings habit.

Mr Caddick said: “There’s an annual savings limit of £9,000, but they’re exempt from the individual £20,000 savings limit, meaning a saver could max out their personal annual allowance and still save into the junior account for their child on top.”

However, Britons may need to act fast to make the most of the more generous thresholds, as the current ISA allowances could be under threat.

The Treasury is reportedly considering ways to reform the tax-efficient savings tool, and one controversial suggestion is to slash the tax-free allowance to £4,000 per year.

Lobbyists have also been calling for the scraping of cash ISAs altogether to divert more money into stocks and shares ISAs and investments that would benefit the wider economy.

If any changes are to go ahead, Chancellor Rachel Reeves will announce them during her spring statement on March 26.