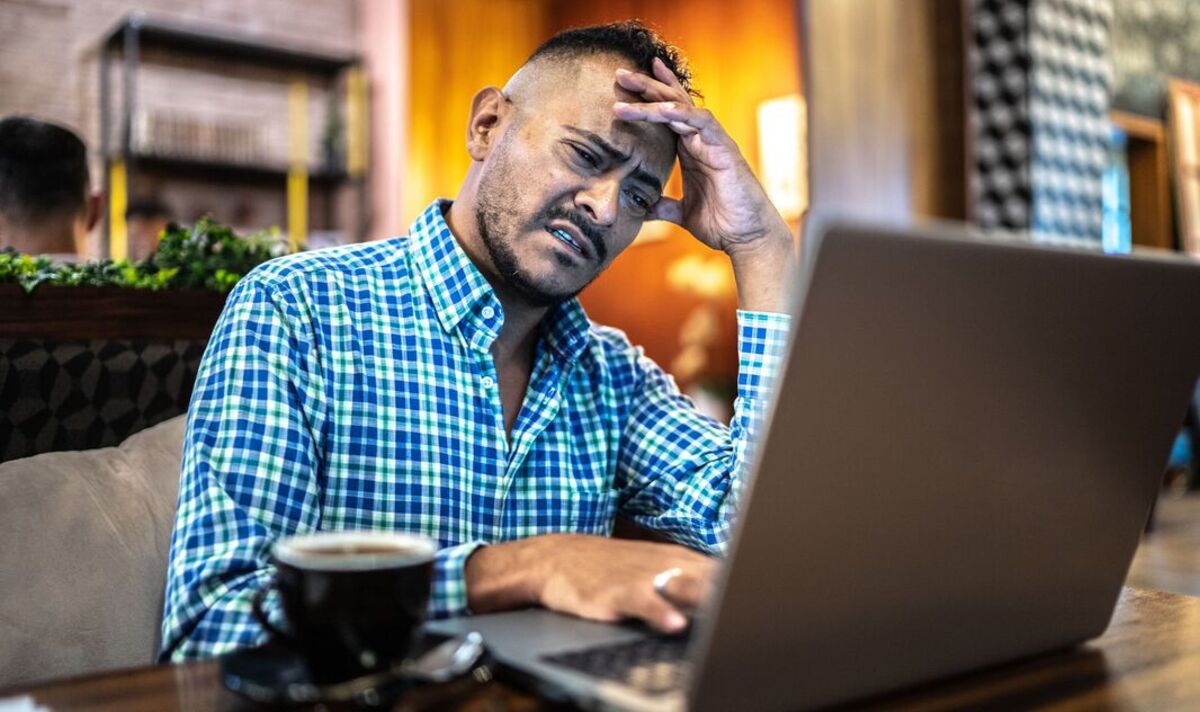

As interest rates remain high, those coming to the end of their mortgage deals face huge repayment costs when their terms come to an end.

As higher interest rates will mean higher mortgage payments, experts say more people are at risk of falling into debt or losing their homes.

With different types of mortgages available, many people are stuck on what their options may be if they can’t afford to remortgage.

One reader has expressed concerns over their interest-only deal coming to an end in seven years.

The bank they took out the interest only mortgage with went under a few years ago so they are worried if they will obtain another deal as they have a bad credit history.

David Hollingworth, mortgage expert at L&C Mortgages answered the mortgage dilemma on This is Money, suggesting what options the reader may have.

They wrote: “I have an interest-only mortgage with Mortgage Express (Bradford & Bingley), which comes to an end in seven years’ time. Mortgage Express is unable to offer me a remortgage, as it went under years ago.

“My mortgage is for £180,000 and the interest rate is currently 7.5 percent. The monthly payment of £1,038 is affordable, and the house is now worth £422,000, according to Zoopla.

“I’m worried about getting a mortgage elsewhere as I don’t have a great credit history, and what’s more worrisome is that I have no endowment to pay it off when it ends. I realise I could sell up and downsize, but what other options do I have? I am 55.”

My Hollingworth explained that the traditional approach to taking an interest only mortgage was that a separate repayment vehicle would run alongside. Separate payments made into that repayment vehicle would then gradually grow over the life of the mortgage, to provide a lump sum that would be used to pay it off at the end of the term.

However in the readers case there has been no formal repayment vehicle made meaning they have a much more limited time-frame to make inroads into raising the capital.

He said: ” Switching the mortgage to repayment would of course be the ideal, and mean that the balance would be paid off over the remaining term. However, on the current term and rate that would see a very substantial uplift in monthly payments. The monthly cost of £180,000 at a rate of 7.5 per cent over seven years would rocket to £2,761.”

Another option for those who haven’t paid off any capital with their interest only mortgage is put part of a mortgage on repayment with the remainder on interest only. This will limit the rise in monthly cost but also still gradually reduce the amount one needs to repay.

Splitting the current balance half and half on the current terms would still see the payment rise to £1,943 per month and also leave £90,000 remaining in seven years’ time.

Additionally, the expert suggested the reader could consider downsizing, make overpayments and explore the options with other lenders – both from the perspective of improving the rate they are on and in exploring any option to extend the mortgage term.

He continued: “Alternatively, their age opens up solutions aimed at older borrowers, whether a standard mortgage over a longer term or a more specialist deal such as Retirement Interest Only.

“This would remain on an interest-only basis, but remove the need for a specified term and require the mortgage to be repaid on sale of the property, death or a move into long term care.”