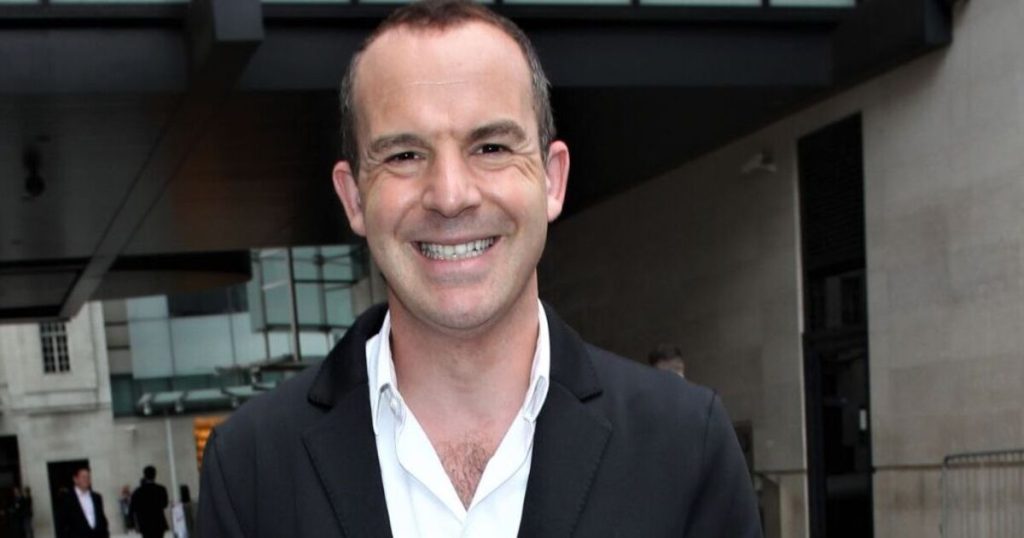

Money saving expert Martin Lewis has shared advice on how to locate some of the pension funds millions of Brits have missed out on.

Many people across the nation are missing out on “lost pensions” they have lost track of after moving jobs.

On an episode of Money Show Live, Martin was joined by a panel of retirement experts who explained to viewers and audience members the process of private and workplace pensions on an episode of Money Show Live.

One of the key pieces of advice Martin revealed was not to withdraw cash from your workplace pension because of its significant role in providing financial security during retirement.

He also let Brits know that you should make sure your expression of wish form is current. This is because pensions cannot be included in your will, resulting in an unintended lump sum going to an ex-partner.

He added that around three million people across the country have not claimed a cash from a “lost” pension pot.

However, auto-enrolment is a method that ensures those aged 22 and over are automatically enrolled into a workplace pension scheme.

Since that came into play in 2012, if you have switched jobs since then and have no knowledge of what’s going on with your previous pension, then it’s time to find out.

“Nearly three million pensions are thought to be ‘lost’. These are worth £10,000 – this is not trivial money. So, try contacting your ex-employer if you know who they are and digging out your paperwork if you can,” Martin explained

If you aren’t sure where to start, that’s fine; Martin pointed people in the right direction.

He said: “If not there are a number of pension tracing services, an easy one is the Pension Tracing Service Tool on Gov.uk, it can list over 200,000 pension schemes.”

The consumer champion then explained how the process of getting back those lost pots works.

“So really you want to do is list who is my old employer? What was its scheme? Has that scheme changed?”, he added.

“Is it someone different? and then once you know, you go and contact them and you try and prove it was you, and you dig it out.”

Following Martin’s advice, savers should check previous employers and old paperwork, get onto the Government’s Pension Tracing Service, and get in touch with previous employers to find out if they have any information.