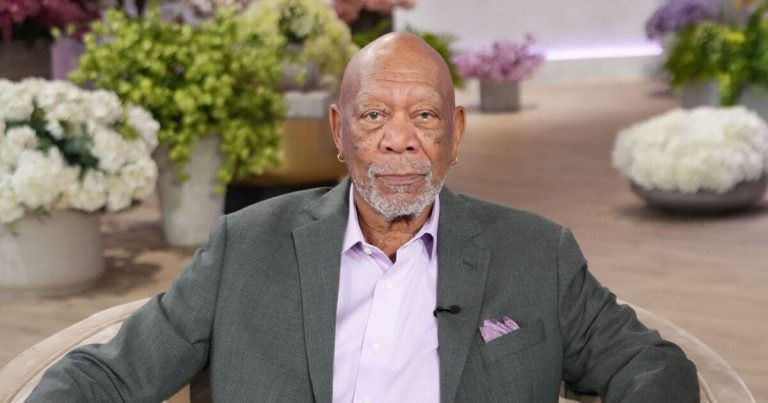

Martin Lewis has urged people to deposit at least £1 into a savings account to get the ‘clock ticking’ so they can secure a bonus up to £1,000.

He told viewers of his ITV show they should open a Lifetime ISA now even with the minimum amount so they can get the 25 percent bonus.

The financial journalist said: “You may as well put £1 in now in case you want to use it in the future. Then the clock’s ticking and it’s been open a year.

“Great if you have kids and you want to put money in for them – get them to put a quid in now. The clever thing to do right now.”

A person can put up to £4,000 a year into a Lifetime ISA, with a 25 percent bonus on any savings, up to £1,000 a year.

But the bonus is only payable after the account has been open for a year, so it makes sense to open a Lifetime ISA even with only a small amount, to get moving towards the one-year mark when you can get the bonus.

The funds have to be used to go towards buying a first home or can otherwise be used when a person reaches the age of 60.

You have to be over 18 and under the age of 40 to open a Lifetime ISA, and you can save into it up until the age of 50.

The top-paying Lifetime ISA is currently with Moneybox, at 4.4 percent. Interest is paid monthly.

Another rule for the savings account is the funds can only go towards buying a property worth £450,000 or less.

Martin Lewis recently criticised the Spring Budget for not changing this rules given the recent spike in house prices.

However, Chancellor Jeremy Hunt did announce some changes to ISAs, with a new additional £5,000 ISA allowance to be introduced for a British ISA.

Funds put in this new savings account will go towards investments in UK companies to help grow the economy.

Also as announced in the Budget, NS&I is to offer a British Savings Bonds, to go on sale early next month.

For the latest personal finance news, follow us on Twitter at @ExpressMoney_.