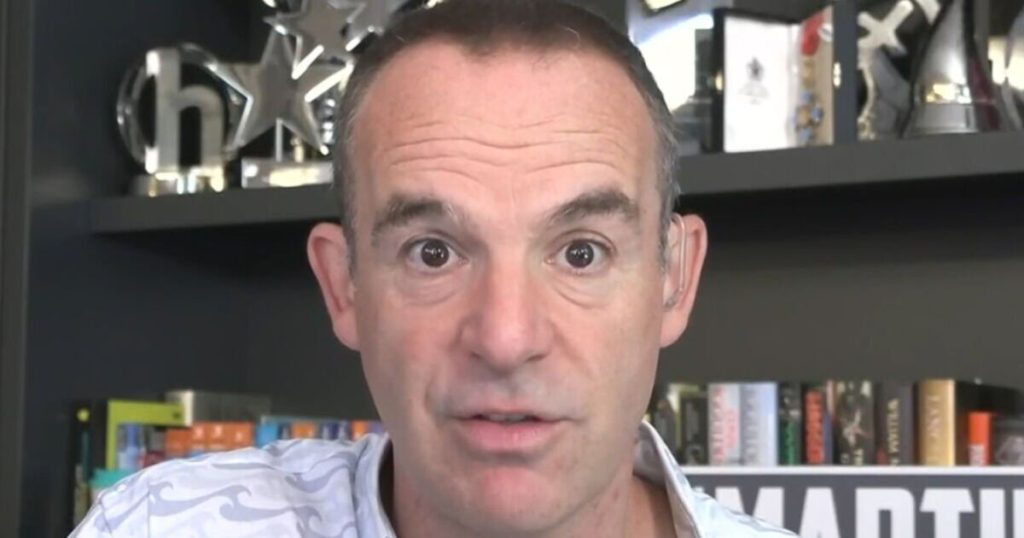

Martin Lewis has issued an alert that a staggering 800,000 people are missing out on a £2,000 Government benefit designed to ease childcare expenses.

The scheme, dubbed ‘Tax-Free Childcare’, provides parents up to £2,000 annually for each child, which can be used for various childcare services such as nurseries, childminders, and select holiday camps.

The Money Saving Expert clarified: “Tax-Free Childcare is appallingly named, don’t let it confuse you. Calling the scheme Tax-Free Childcare was a political spin to ensure government gets credit for the scheme.”

He continued: “Unfortunately, the name is appallingly misleading and probably partly responsible for the scheme having a much lower take-up than it should.

“It’s not about tax in any way, and isn’t linked to the tax rate you pay. A better name would be ‘Working Families Childcare Top-up’, because it’s effectively a discounted childcare savings scheme where you save and then pay for childcare with a 25% top-up.”

While as many as 1.3 million families qualify for the Tax-Free Childcare scheme, Mr Lewis has highlighted that roughly 800,000 are missing out on this Government boon.

He pointed out that the initiative allows for a tidy 20% top-up, effectively giving 20p for every 80p saved, which could see parents nabbing up to £2,000 annually per child, reports the Mirror.

In an astounding boost for family budgets, Mr Lewis highlighted that families can use the scheme to cover up to £10,000 of childcare costs per child annually, with parents receiving up to £2,000 extra per child or £4,000 if the child is disabled.

According to the Money Saving Expert, parents can open an online Tax-Free Childcare account using their Government Gateway ID. For every 80p deposited, the Government adds 20p as a top-up. However, he cautions that there is a quarterly cap, with the maximum Government top-up limited to £500.

Mr Lewis noted that all categories of workers, including the self-employed, can access the programme.

He clarified: “If you’re single, you qualify for Tax-Free Childcare if you’re in work, including if you’re self-employed. If you have a partner, you usually both need to be in work to qualify. But there are some circumstances where you’d be eligible even if you are not working.”

He said individuals on sick, annual, shared parental, maternity, paternity, or adoption leave should qualify. Additionally, if you or your partner are employed and the other cannot work and claim specific benefits such as incapacity benefit, carer’s allowance, or severe disability allowance, you should be eligible.