Millions of people will receive an extra £902 in their bank accounts from April due to a long-standing rule. This additional cash will be included in their usual payments within days, as part of a Department for Work and Pensions (DWP) shake-up amid the ongoing Cost of Living crisis.

The new weekly rates for the full new state pension are set to rise to £221.20 from £203.85, which is an increase of £17.35 per week. The old or basic state pension will increase to £169.50 from £156.20, an increase of £13.30 per week, thanks to the triple lock.

This means that a full new state pension will now be £11,502 per year, an increase of £902 on the previous yearly amount of £10,600. The government has explained: “The Government is legally required to increase the basic and new State Pension each year at least in line with average earnings.

“The ‘triple lock’ is a commitment, beyond this legal requirement, to increase State Pensions by whichever is highest of average earnings growth, CPI inflation, or 2.5 percent.”

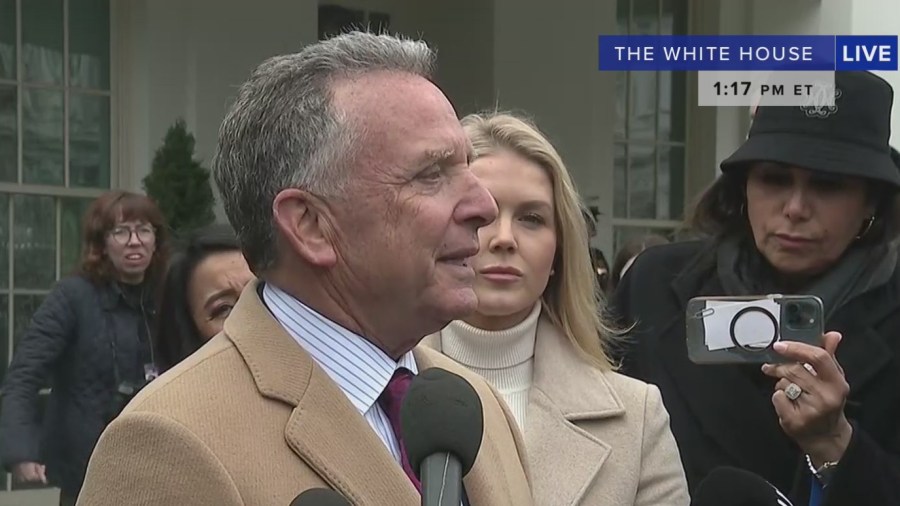

John Palmer, Director of Influencing and Engagement at the older people poverty charity Independent Age, said: “Although we welcome the Conservative Party’s commitment to keeping the ‘triple lock’ if they win the election, we recognise that it’s not a perfect long-term solution for the millions of older people facing financial insecurity right now and into the future.

“Protecting the value of their often dangerously low income is vital, helping them cope with the elevated cost of living.

“In 2021/22, 13 percent of pensioners, rising to 20 percent of single pensioners, are solely reliant on only the State Pension and benefits. We also await the Labour Party’s plans for pensions with interest, following Anneliese Dodds’s announcement that they do not commit to the ‘triple lock’ but will set out a plan in their manifesto.

“We are calling for a cross-party review to agree on the income everyone should have in later life to avoid poverty. The review could recommend the support required for older people already facing financial hardship, give long-term assurance to people planning for retirement and suggest what steps Governments across the UK should take to ensure everyone receives this support.”