I take on all significant credit cards as well as Charge, Credit card, Come across and American Express. After placed, the funds come quickly on the incarcerated cherished one otherwise pal. The newest downside is that you you would like internet access and you can plans to own keeping track of and that inspections your’ve deposited.

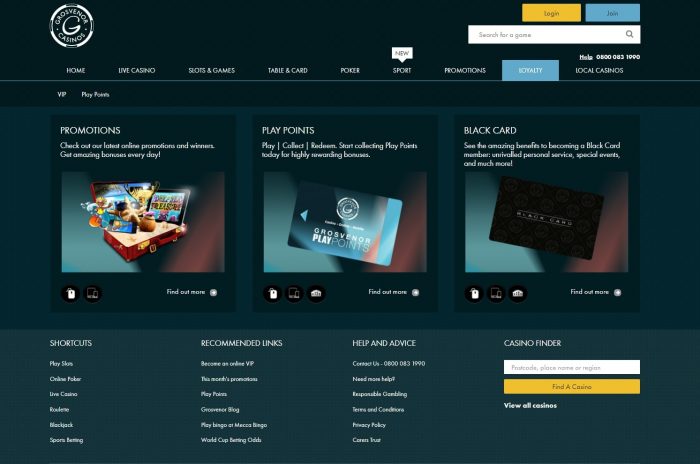

They have been cellular percentage tips useful for withdrawals and dumps, currencies recognized, software team, game provided, customer support, defense and you may licenses. Offered you’lso are using a secure and signed up United states online casino, such as those i encourage, this procedure is really as safe while the having fun with one e-wallet. Places with cellular phone expenses choices keep your checking account suggestions, credit card amounts, and every other economic investigation from the image entirely.

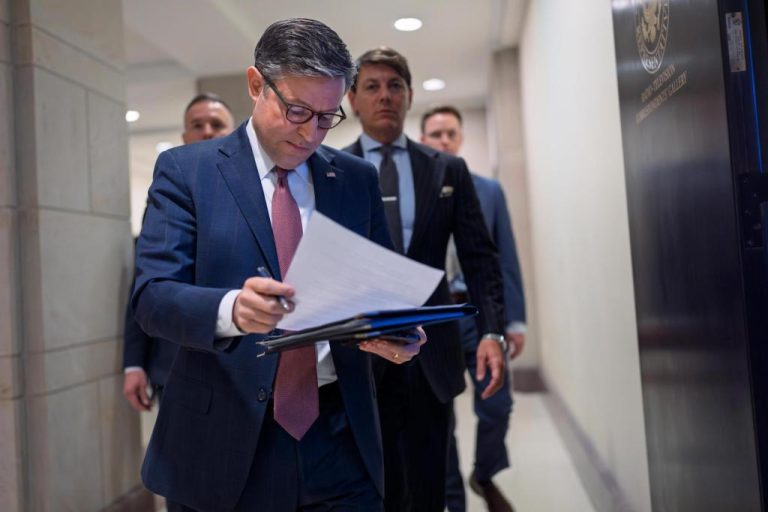

Ways to put inspections at any place, at any time by using a graphic of your own consult the newest HFS App. | play classic 243 online

“A light check up on a light table is extremely difficult for the machine observe,” Helcl claims. Busy designs — even the speckly grains away from a stone home countertop — generate a detrimental background to own a pictures. You to denied make sure that Helcl examined was snap “at the top of a plastic material bag away from walnuts which had been on the a Batman printing tablecloth,” he says. The reflections and you may bases designed for an awful photos and you can a hit a brick wall deposit.

Exactly how Santander Cellular Look at Put Functions – Santander

- Which tool allows banking institutions take on places playing with digital pictures of the back and front away from a instead of requiring the first paper take a look at to be personally transferred at the a part otherwise Atm.

- All of our Electronic Defense Visibility covers you from responsibility for not authorized play with of your profile.

- The brand new charges for places may differ according to the shell out from the cellular telephone service as well as the on-line casino you utilize.

- Immediately after recognized, the deposit goes into your account.

- Tablets are available for really prisoners allotted to general people, in addition to Safe Keeping (Dying Line).

They merely needs an unknown number so no identity theft can be occur. Just be sure that your particular costs play classic 243 online matches that which you’re pregnant in case your invoice happens. So you can deposit the fresh view due to a financial application, get an image of each party. The new View Clearing for the 21st 100 years Act ran for the effect within the 2004, establishing another judge tool named a replacement consider.

Cellular view deposit performs using remote put capture technical. When you take an image of one’s consider, it’s like studying a photo or file to make a great digital copy on your personal computer. For each pay-by-cellular phone local casino experiences thorough opinion from the at the least a couple of the team’s editors, making certain that the new gambling enterprises i encourage are genuine or more so you can go out.

Estás ingresando al reciente sitio online de U.S. Lender en español.

See this information on the account’s prior/current purchases. Running Photos.You authorize us to process people Picture which you send us otherwise move a photo so you can a photo Replacement Document. You authorize all of us and any other lender to which an image is distributed in order to techniques the picture or IRD. “Account” form the deposit otherwise investment account with our company that your are subscribed making in initial deposit playing with a catch Device.

Medical Personal Financial

There are many ways to put your check if your consider matter exceeds your own cellular put limit. For many who’ve open a merchant account within the last ninety days, the deposit restrictions is as reduced since the $50. Just after very first ninety days with our team, your everyday and each week limitations will likely improve.

Depositing inspections utilizing your smart phone can be much more available and you can less time-ingesting than driving in order to a part or Automatic teller machine. And in case your lender having an on-line-only financial with no bodily branches, cellular take a look at put is generally quicker than just mailing within the a. For individuals who’re signed in to their financial’s cellular software, you need to be capable look at the put restrictions. Otherwise, you should check your account agreement otherwise contact your lender to help you ask about restrictions to have mobile consider put. Mobile look at put tends to make incorporating currency for the savings account simple and fast, without paying a visit to a department.

The fresh money restriction varies from financial to financial, but you can usually put several thousand dollars 30 days. Specific checks already support the mobile deposit vocabulary on the back of the take a look at, next to a great checkbox; from the checking the box, you will possibly not need to produce it out. Missing approval can lead to waits in enabling your finances, and have to promote and lso are-deposit they. An example of such an acceptance is “To own mobile put just to my personal [identity from lender] account.” For the defense, keep up with the unique seek at the very least 5 days Just after acquiring confirmation that it might have been accepted. After you’re willing to dispose of it, mark it “VOID” and dispose of they in a manner that suppresses they from being shown to have percentage once more.

financial basicsWhat try mobile banking?

Therefore, you could reach out to your lender otherwise credit union to query if the app is down and you will, therefore, whenever cellular look at put is generally restored. You may also inquire about other put alternatives in the meantime if you would like are the look at for your requirements Asap. You may make mobile consider dumps at your convenience, at any time of go out, all week long.