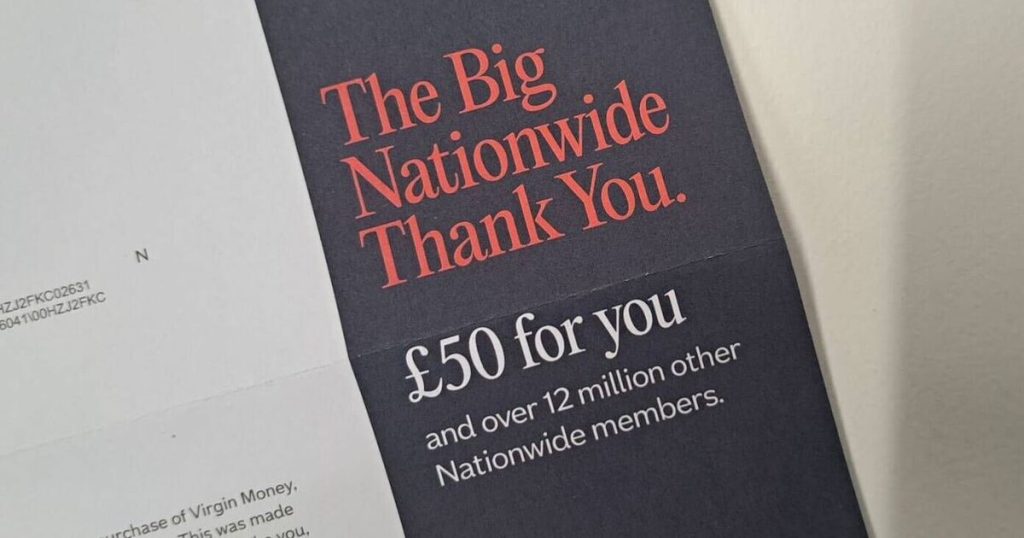

Nationwide has announced that it will be gifting £50 to 12 million of its members, including myself, as revealed in a letter I recently received. The gesture is certainly welcome amid the tough economic times we’re facing.

The letter I got proudly proclaims: “The Big Nationwide Thank You.” It adds: “£50 for you and over 12 million other Nationwide members.”

This generous act follows Nationwide’s successful acquisition of Virgin Money, serving as a token of gratitude to its loyal customer base. The letter explains why: “On October 1, 2024, we completed the purchase of Virgin Money, becoming an ever-stronger force in UK banking,” attributing this milestone to the financial solidity cultivated by Nationwide’s members, reports Lancs Live.

It goes on to say: “To say thank you, we are pleased to be sending you and over 12 million of our Nationwide members a one-off payment of £50 as part of The Big Nationwide Thank You.” Debbie Crosbie, Nationwide’s CEO, expressed that this distribution is a nod to the customers’ significant role in the bank’s expansion, hailing it as “one of the genuine advantages of membership.”

Nationwide is set to commence the rollout of the £50 payments starting from next month, with customers being informed about their eligibility via post or email.

How do I receive the payment?

As of Tuesday, March 11, eligible members will begin receiving communications from Nationwide Building Society about their entitlements. Members can assess their eligibility by using Nationwide’s online eligibility checker.

To be entitled to the payout, you must satisfy certain conditions, including:

- You must have a Nationwide current account, savings account, or mortgage established by September 30, 2024.

- You should have completed at least one transaction or maintained a balance of £100 or more in the year prior to September 2024.

- You must still possess your Nationwide account or mortgage at the time the payment is issued.

Nationwide has assured members: “You don’t need to do anything. We will send the payment to you by cheque, which we will post to the address above by March 14, 2025. You will still need to be a Nationwide member when we send the cheque. You are a member if you bank, save, or have a mortgage with us.”

The letter concludes: “If, for any reason, you do not want to receive the payment, call 0330 123 1104 and let us know by March 31, 2025. Otherwise, your £50 is on its way.”

The team at MoneySavingExpert.com, founded by financial guru Martin Lewis, say that these £50 bonus payments will be going out between Wednesday, April 9, and Sunday, April 30. They will be distributed automatically depending on what kind of product members have with Nationwide.

If no communication is received by March 20, eligibility confirmation can be done through Nationwide’s online banking services. According to MoneySavingExpert.com, it’s critical for customers to remain vigilant against “scams inviting you to claim or apply for the payment or asking you to hand over your personal details, as fraudsters may jump on the opportunity to trick you”.

Nationwide has clarified that the £50 payment received by those holding a current or savings account is taxable savings income, akin to interest earned from an account. Consequently, most people won’t have to worry about tax on this incentive.

Basic-rate taxpayers can enjoy up to £1,000 of savings interest tax-free each year thanks to the personal savings allowance. Yet, higher or additional rate taxpayers, or those with substantial non-ISA savings, may need to pay tax on the bonus.

MoneySavingExpert. com’s team also noted: “The society also revealed that it hopes to announce the continuation of its £100 Fairer Share payment in May this year, depending on financial performance.”

Wondering if non-Nationwide customers can benefit?

For those not yet with Nationwide, there’s still a chance to snag their £175 switching bonus. Time is ticking, though – the deal ends on March 31.

To qualify, you must:

- Transfer your account from a bank that is not Nationwide using the Current Account Switch Service.

- Transfer at least two active Direct Debits.

- Deposit over £1,000 within 31 days and complete a debit card transaction.