People are being warned of the multiple dangers of borrowing from unregulated moneylenders, as new research by Ipsos from not-for-profit operator Fair4All Finance shows that over three million people may have resorted to this over the past three years.

Results from a new online survey of adults aged 18 to 75 said that to the best of their knowledge, they or someone in their household has borrowed from an unlicensed or unauthorised informal money lender who charges interest (often known as a loan shark).

And a new report shows that far from being hidden, most illegal lenders are ‘fairly prominent’ in their community, may present themselves as friends to their customers or out of seemingly legitimate businesses like cafes, beauty salons and pubs.

The findings show that most borrowers know of more than one illegal lender in their community.

In response, experts have issued a warning to hard-pressed households to consider a credit union or responsible lender rather than an illegal lender, if they need a loan.

The report, from financial inclusion body Fair4All Finance and specialist researchers We Fight Fraud titled “As one door closes -experiences of illegal moneylending during an emerging cost of living crisis”, presents a candid insight into illegal lending based on rare access to both illegal lenders and nearly 300 people using them in Port Talbot, Preston, South Glasgow and South London.

One illegal lender in South London told researchers: ‘I didn’t actually go looking for punters. If punters know there’s a money lender out there, they throw themselves at you. It is purely word of mouth and there is more lenders than could possibly lend.”

A borrower in Glasgow said: “I knew the man [the lender] and I knew of violence that has been dished out by the man, he just needed to tell me that I had to grow [cannabis] because I owed him money and I needed to pay my debt. Violence was never directly said but I had seen him give someone a leathering with a metal pole.”

With households across the UK struggling and at risk of becoming the target for illegal lenders, Fair4All Finance is urging people to:

1. Remember the Stop Loan Sharks campaign’s six questions to ask about a lender, including; did they offer you a cash loan, did they not give you paperwork, and are you scared of people finding out?

2. If you are borrowing or considering borrowing from someone, check the Financial Conduct Authority register of regulated firm which lets you search by the lender’s name. It provides warnings when an unauthorised lender is known to them.

3. Remember that if you need credit and your bank cannot help, you should consider the UK’s community finance sector, made up of credit unions and other responsible lenders. These providers have been supporting communities for decades and will always do their best to provide a loan if it’s the right thing for you. Find Your Credit Union helps people find a credit union near them or one that works with particular employers. Finding Finance is the place to go to find simple, fair, small affordable loan providers.

The report also highlights that:

- While users of illegal money lenders generally borrowed hundreds rather than thousands of pounds at a time, the total amount of debt per borrower was significant at around £3,000 on average. Repayment rates were different but invariably involved paying double. However a lack of transparency or awareness of the total cost of credit was commonly reported.

- With increasing numbers of people struggling through the cost of living crisis, illegal moneylenders appear to have moved upmarket targeting low income workers with a median customer income of £20,000 – £24,999. This group is better off than the poorest fifth of the population and may not have considered this option until recently.

- Many borrowers believe their bank would never give them a loan, and one said that they turned to illegal lending because their bank wouldn’t give them an overdraft, despite being a longstanding customer with an income of nearly £1,500 a month

- Another reported that she was forced to clean the office of the lender that she owed money to, after telling them she wasn’t able to pay them back

- Other borrowers had been used as money mules in money laundering operations – with some then losing their bank account as a result.

- There were reports of parallel lenders, who previously worked for a legitimate doorstep loan firm that has gone out of business yet continue to lend and collect repayments from the same clients.

- Many borrowers reported harassment, such as repeated phone calls or visits at home or work, and some were threatened with violence or violence against their family

- Just one per cent of borrowers have reported an illegal lender to the UK’s illegal moneylending teams

- While regulated lenders are required to perform affordability checks on applicants, one illicit provider said that they actively looked out for those unable to pay as they would be more profitable in the long term, saying: “The longer they couldn’t pay you back, the better.”

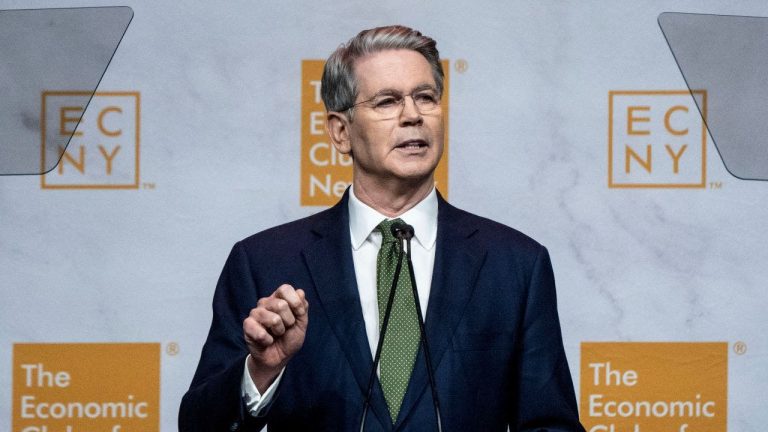

Sacha Romanovitch, chief executive of Fair4All Finance says:

“This worrying research shows that most people in financially vulnerable circumstances can all too easily get cash from an illegal lender.

“They are often lulled into a false sense of security by someone they think wants to help them.

“It also shows that there is an urgent need for ethical, affordable credit to be made more widely available to avoid more people falling into the trap of illegal moneylenders.

“Credit unions and responsible lenders already exist and have been supporting communities for years, but too many people are still using illegal lenders rather than these safe and fair options.”

The report presents seven recommendations for policy reform to accelerate people’s access to fair credit from both commercial and community finance providers, to introduce a credit broking exemption to third sector organisations and to further resource the Illegal Money Lending Teams. www.fair4allfinance.