NS&I has released a new issue of its Green Savings Bonds today paying 3.95 percent gross/AER fixed rate over a three-year term.

Launching in 2021, the Bonds are used alongside gilts to raise funds for green projects as part of the UK Government’s Green Financing Framework.

The minimum investment in Green Savings Bonds is £100, with a maximum limit of £100,000 per person for each Issue. Investors need to be aged 16 or over to purchase the Bonds, and the full amount deposited will be held for three years and cannot be withdrawn during this time.

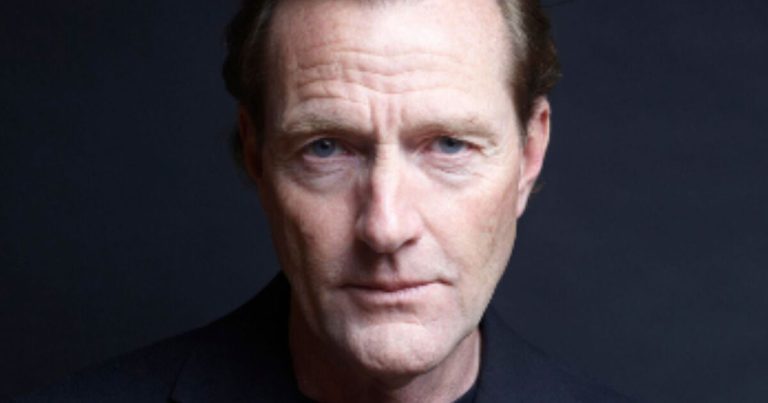

However, Myron Jobson, senior personal finance analyst, interactive investor, pointed out the new rate is much lower than what was previously on offer. In August the Government-backed account was offering 5.7 percent.

He said: “The NS&I has once again hacked away at its savings rates, with its Green Savings Bonds, which uses savers cash to fund green infrastructure projects, feeling the sharp end of the blade this time round.

“The news comes just over a month after the Government-backed bank pulled its hugely popular and market-leading one-year fixed rate accounts.

“It is clear that the Government-backed bank is wary of the impact of keeping its competitive savings products on the market would have on its bottom line.”

Rachel Springall, finance expert at Moneyfactscompare.co.uk told Express.co.uk: “This latest deal from NS&I will likely be an enticing option for savers who are content to lock their cash away for three years. However, the rate can be beaten by alternative brands, including a deal from Gatehouse Bank who pay 5.5 percent, as an expected profit rate, which is a Woodland Saver.”

With a Woodland Saver, a new tree is planted in UK woodland per bank account opened or renewed. Ms Springall continued: “The market-leading three-year fixed rate comes from JN Bank that pays 5.9 percent gross.”

JN Bank’s three-year fix can be opened with a minimum deposit of £1,000 and interest is paid annually.

Ms Springall added: “It will be interesting to see the demand this bond receives from savers, as NS&I are a trusted brand.”

As of March 31, 2023, more than £915million has been invested in Green Savings Bonds, compared to £288million at the same point the year before.

Mr Jobson said the top savings deals are “dropping like flies” following the Bank of England’s decision to hold interest rates at 5.25 percent after 14 consecutive Base Rate hikes.

He added: “The prevailing sentiment among economists is interest rates have peaked. If this is the case, the best savings deals will not be around for long. As such, savers should act swiftly to secure the top deals while they still can.

“Those who can afford to put money away for five years or more [could] consider investing for the potential of inflation-beating returns that far outstrip savings rates

“Investing can be volatile on a day-to-day basis and while the potential for greater returns from the stock market comes with inevitable risk, taking a long-term view means you can smooth out some of those highs and lows whilst benefiting from the long-term potential that comes with this approach. But everyone needs a low-risk buffer too.”