Posted January 23, 2025 at 5:10 pm EST.

President Trump declared crypto a national priority in an executive order signed Thursday, and set an intention to evaluate a strategic bitcoin reserve, while in recent days, many on social media had speculated he might establish one.

The order aims to deliver on multiple promises made to the crypto community, starting with some core and strongly held beliefs about coding, self-custody, and fair access to the banking system.

It also establishes an organization, the President’s Working Group on Digital Asset Markets, to steward the policies that will implement the intentions set forth in the order.

“The digital asset industry plays a crucial role in innovation and economic development in the United States, as well as our Nation’s international leadership,” the executive order reads. “It is therefore the policy of my Administration to support the responsible growth and use of digital assets, blockchain technology, and related technologies across all sectors of the economy.”

A Sweeping Directive to Promote Crypto in the U.S.

The executive order, which had been the subject of much speculation in the crypto world, took a deliberate, foundational approach with its priorities.

First, it states an intention to protect crypto developers contributing to public blockchains, miners, validators, and individuals who self-custody their assets.

Additionally, the order promises to protect “fair and open banking services for all law-abiding citizens and private sector entities alike”—a reference to Operation Chokepoint 2.0, which the crypto community has long suspected was policy of the Biden Administration’s to discourage banks from servicing individuals and banks affiliated with crypto.

Read More: Regulators Are Limiting Banks Serving Crypto Clients. Does That Violate the Law?

The executive order additionally prohibits federal agencies from creating Central Bank Digital Currencies and revokes the Biden administration’s Digital Assets executive order and former Treasury Department’s Framework for International Engagement on Digital Assets, which previously directed the Biden administration to promote the development of central bank digital currency technologies.

A Crypto Working Group

In order to implement the goals of the order, it establishes a crypto working group which includes the Secretary of the Treasury, the Chairs of the SEC and CFTC, and several other federal department heads.

Notably, the executive order stops short of establishing a strategic bitcoin reserve, something the industry has been eagerly awaiting since his election, though it states an intention to engage with a first step: evaluate the possibility. Trump promised at the Bitcoin 2024 conference in Nashville that he would not sell bitcoin the federal government currently holds, a promise which he has the ability to ensure unilaterally via executive order.

On social media, the crypto community commented on the word choice of “crypto” stockpile, rather than one focused on Bitcoin, with Bitcoiners expressing disappointment and other crypto tribes seemingly hopeful. Some also noted the distinction between a “stockpile,” in which the government would retain crypto that comes into its possession, vs a “reserve,” in which it would intentionally purchase digital assets.

The order states that within the first 180 days, the Working Group will submit a report to the president focused on a regulatory framework for market structure and stablecoins, both pieces of legislation that the crypto industry has requested for years.

The Working Group is to be chaired by the Special Advisor for AI and Crypto, who, although unnamed in the order, Trump had previously nominated to be David Sacks, a longtime venture capitalist, currently of Craft Ventures.

It is notable that the Commerce Secretary is to be part of the Working Group. If he is confirmed, it would likely be Howard Lutnick, the CEO of Cantor Fitzgerald and current nominee who owns a minority stake in Tether.

Prohibiting Central Bank Digital Currencies

To support the growth of digital assets within the U.S., Trump ordered his administration to protect the sovereignty of USD by promoting the development of “legitimate dollar-backed stablecoins worldwide.”

It also states that agencies are prohibited from working toward the establishment, issuance or promotion of a central bank digital currency in the U.S.

Read More: House Resolution Could Overturn Rule That Declares DeFi Projects ‘Brokers’

A New Era for Crypto

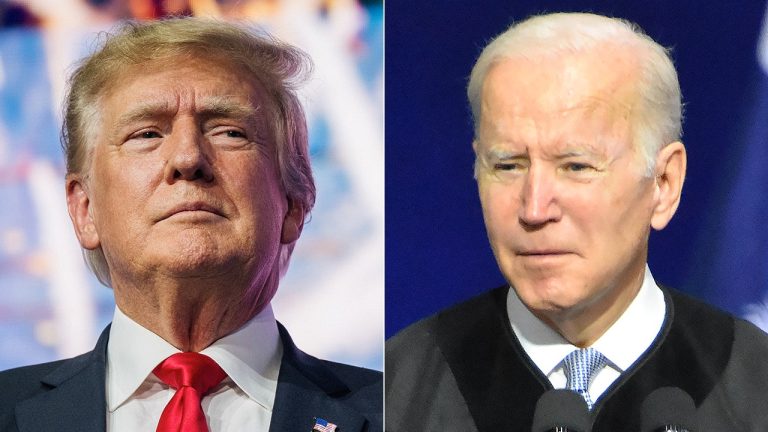

Though the majority of the order formalizes promises previously made, Trump’s prioritization of crypto is an about-face from the Biden administration, which drew the industry’s ire for its antagonistic approach to cryptocurrencies. Regulators appointed by the administration, and in particular Gary Gensler, cast crypto companies as skirting the law, though many companies felt that existing regulations were unclear.

Frequent enforcement actions from the SEC and also the CFTC and Treasury (albeit less often) led many crypto advocates to claim that the administration supported a policy of “regulation by enforcement.”

The Biden administration’s stance also drove major crypto industry executives, like Gemini founders Cameron and Tyler Winklevoss, Kraken founder Jesse Powell, and Ripple Chief Legal Officer Stu Alderoty to donate generously to Donald Trump’s campaign. Several crypto firms also gave millions to Trump’s inaugural committee. Today’s executive order, in addition to the nomination and appointment of pro-crypto regulators at several federal agencies, is one way Trump is repaying the industry.

The news caused the Bitcoin price to jump from $104,000 to just under $106,000, before falling to $102,670 at press time, market data from CoinGecko shows.

Bitcoin enthusiasts at the Bitcoin Policy Institute and Satoshi Action Fund had also brainstormed potential ways Trump could also unilaterally pave the way for the federal government to acquire more bitcoin by using the Exchange Stabilization Fund (ESF), a Treasury-operated fund which currently includes U.S. dollars, foreign currencies, and an international reserve asset created by the International Monetary Fund. The fund exists to, as the name suggests, stabilize U.S. exchange rates, provide funds to foreign governments, and buy and sell foreign currencies, and using it to acquire cryptocurrency would have been unprecedented.