Posted April 1, 2025 at 11:23 am EST.

One of President Trump’s signature economic policies, aside from tariffs, is the promotion of a weak U.S. dollar. He believes that a weaker dollar can promote economic growth by making it cheaper to borrow money and lower the price for U.S. exports around the world. But unlike tariffs, which are very much the domain of the president, the executive branch has little control over the price of the dollar.

That power primarily resides with the U.S. Federal Reserve, whose Federal Open Markets Committee meets eight times a year to adjust the federal funds rate, which impacts the price of the dollar.

However, an unorthodox proposal is making its way through Washington, D.C., that could change this limitation for President Trump.

Stephen Miran, chair of the White House’s Council of Economic Advisors, the administration’s top economic policy advisor, authored a paper in November 2024 suggesting that the U.S. government charge foreign purchasers of U.S. Treasuries as a way to depress the U.S. dollar. The goal would be to circumvent the government’s reliance on the U.S. Federal Reserve to reduce interest rates to stimulate growth. This proposal is part of a broader plan to develop what Miran called the “Mar-a-Lago Accord,” which is designed to make the U.S. dollar drop in value vis-a-vis other world currencies.

“The Mar-a-Lago Accord is a description of a cooperative endeavor that the U.S. and our trading partners can use to basically intervene in foreign exchange markets against the dollar to reduce the value of the dollar,” says Steven Kamin, senior fellow at the American Enterprise Institute (AEI) and the former director of the Division of International Finance at the Federal Reserve.

While all of this may seem like an academic discussion about the international political economy, it has very real implications for the $240 billion stablecoin industry. This ambitious plan has the potential to wreak havoc on the $28 billion U.S. treasury market that is the oil of global capital markets and a rapidly growing keystone of the crypto economy. Depending on how the plan gets implemented, it could also discriminate against foreign stablecoin issuers, most notably Tether, to the benefit of its closest rival, Circle. And it could also indirectly give a boost to Bitcoin.

The Origins of an Unprecedented Proposal

Miran’s policy suggestion is rooted in the International Emergency Economic Powers Act (IEPPA), signed into law by President Jimmy Carter in 1977, which provides the president with broad authority to regulate a variety of economic transactions following a declaration of national emergency “to the national security, foreign policy, or economy of the United States.”

In his paper Miran states, “If the root cause of dollar overvaluation is demand for reserve assets, Treasury can use IEEPA to make reserve accumulation less attractive. One way of doing this is to impose a user fee on foreign official holders of Treasury securities, for instance withholding a portion of interest payments on those holdings.”

He doesn’t immediately jump to this step, perhaps in acknowledgement that it would be unprecedented in the U.S. The more immediate goal would be to convince foreign governments, many of which the government is threatening with tariffs, to willingly cooperate in a way to lower the value of the U.S. dollar and the government’s debt burden. A key part of the plan would be convincing governments to extend the durations of their securities to as much as 100 years, dubbed century bonds.

The inspiration for this proposal is the 1944 Bretton Woods agreement, where representatives from 44 nations met in New Hampshire and agreed to peg their respective currencies to the U.S. dollar, which itself was pegged to gold. That system lasted until 1971, when President Richard Nixon took the country off of the gold standard.

But, if the other countries refuse to cooperate, Miran’s proposal would have the U.S. taking unilateral steps such as charging a user fee.

Treasuries Pricier for Tether?

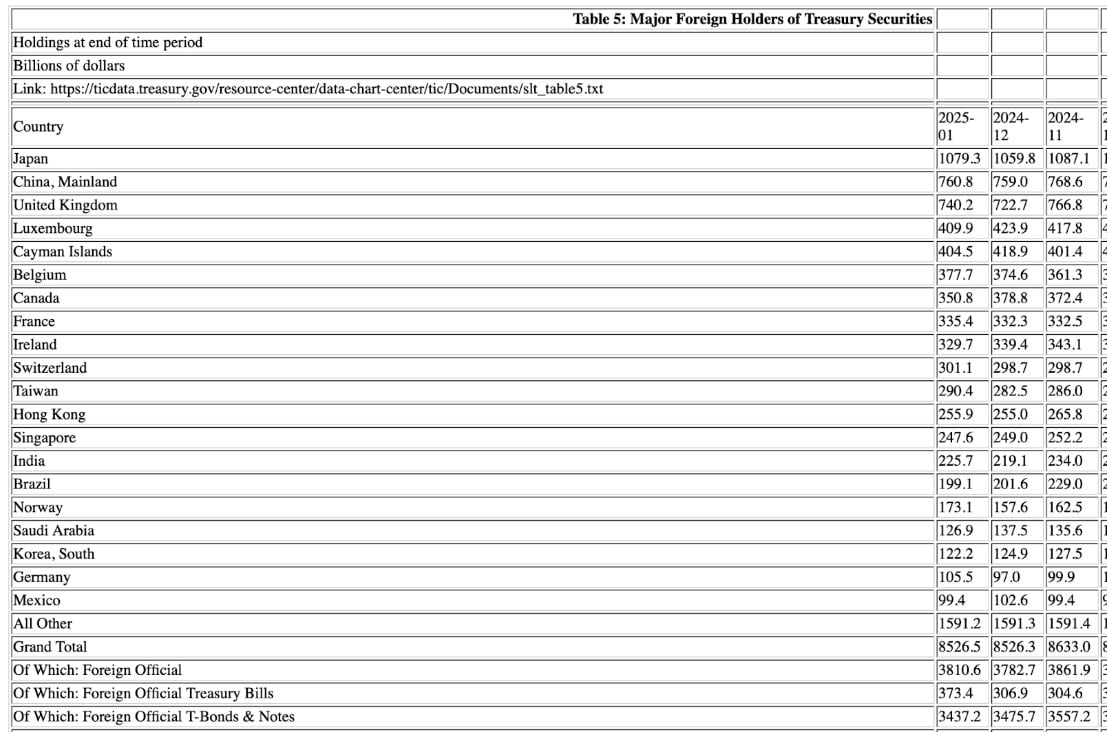

If implemented, the proposal to charge foreign buyers of U.S. treasuries could add direct costs to Tether, the Salvadoran-based company behind the $140 billion USDT stablecoin, though at this point it seems unlikely. The paper suggests that the government would target foreign “official” holders of treasury securities, which would seemingly exempt private purchasers such as Tether, which purchased $33.1 billion worth of treasuries last year and holds over $94 billion worth of the assets in total, not far from Mexico’s $99.4 billion worth. These holdings place Tether on the doorstep of the top 20 nation-state purchasers of treasuries.

The direct cost for Tether or any other foreign buyer could be difficult to calculate, and nobody that Unchained spoke to for this article would even guess what the potential fees could be, underscoring the plan’s unorthodox nature. In his paper, however, Miran suggested starting with a 1% fee and then gradually increasing the size until treasury demand falls to an acceptable level. What does that mean in practice? Tether made a $13 billion profit last year from investing the collateral underpinning USDT into short-term treasuries and other assets. A 5% haircut on this profitability would cost the company $650 million. A 10% charge could cost $1.3 billion.

Plus, it is hard to take the proposed restrictions to just “official” buyers as gospel. “That particular phrase or clause of the sentence is not worth the paper it’s printed on because it’s not an actual plan,” says Kamin.

Even if Tether ends up in this proposal’s crosshairs, it still has an ace up its sleeve. U.S. Commerce Secretary Howard Lutnick is an investor and long-time business partner with Tether. It would seem unlikely that he would be willing to let the administration place a discriminatory tax on his portfolio company. After all, the biggest beneficiary of such a step would be Circle, its New York-based rival behind the $60 billion USDC stablecoin that was noticeably absent from the White House’s inaugural Crypto Summit on March 7. A source familiar with the event planning told Unchained that Circle CEO Jeremy Allaire was excluded at the behest of Mr. Lutnick.

The White House and Circle declined to comment on this story. Tether did not respond to a request for comment.

If USD Loses Reserve Currency Status

The potentially bigger implication is what a user fee or Mar-a-Lago Accord could mean for the U.S. dollar and future of the U.S. Treasury market in the long term. Peter Tchir, Head of Macro Strategy at Academy Securities, put it succinctly in an interview with Unchained. “The worst part of it [user fees] is that it really does push you away from the dollar as a reserve currency. People might say, ‘Okay, well this is weird and new and maybe this particular fee is insignificant.’ But then you have to say, ‘Okay, well, what’s happening next?’”

The U.S. government has played chicken multiple times in recent years with the U.S. debt ceiling, going right up to the stroke of midnight before passing agreements to pay debt obligations and avoid a default. If it were to actually default, meaning the U.S. would fail to pay interest or the principal on its outstanding treasury debt, it would be cataclysmic for the entire financial market. In 2023, when negotiations were particularly fraught, both Tether and Circle had to move funds into overnight repurchase agreements (repos) to de-risk themselves from holding bad debt. After all, if their collateral dropped in value or became illiquid the companies would not be able to redeem their stablecoins for fiat, which could cause the price of their stablecoins to drop from their dollar peg.

In fact, there is a way that implementing this plan could lead to at least a partial default on U.S. debt. Kavin suggested that these fees may have to be placed onto these treasuries on an ex post facto basis, which means that purchasers would not get all of the interest promised to them when they purchased the securities. “If a foreign country has already bought our U.S. treasuries expecting certain repayments, and then the user fee is imposed on them, in my view, that’s a default,” he says. “Conversely, if the user fee only applies to future purchases of these U.S. treasuries, and so everybody — all the purchasers of these treasuries — know that in advance, then it’s really a nothing burger because then in the market, the yield would have to go up to compensate for this user fee.”

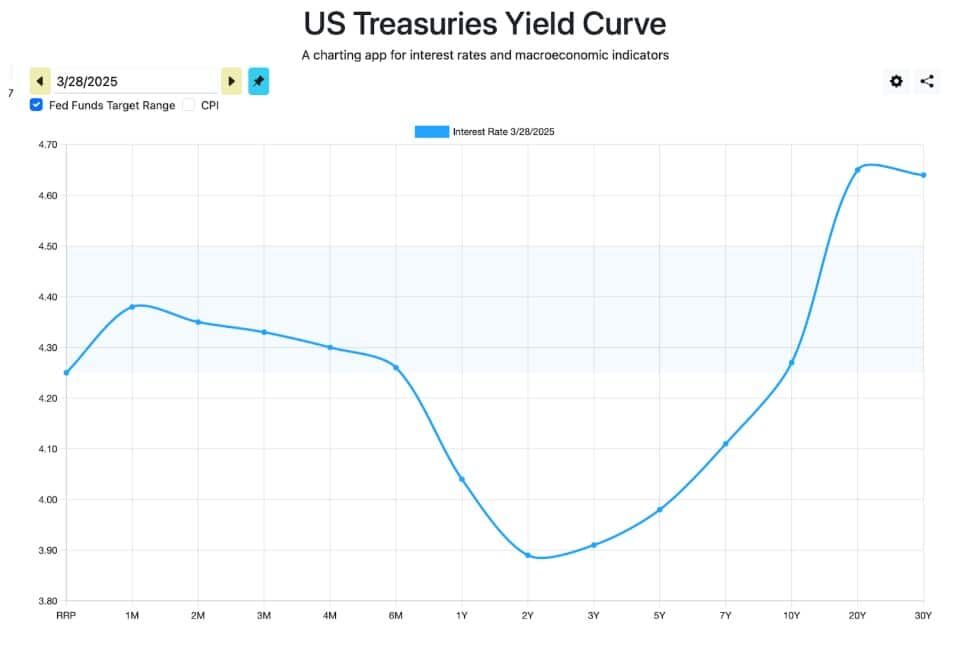

Such a policy could also play havoc with the yield curve, which plots out how much it costs the U.S. government to borrow funds at various durations, especially if governments push back on these policies, which would seem likely. If the long-tail of the yield curve gets pushed down, meaning that long-term debt is cheaper to service than short-term debt, it could lead to capital losses for short-term holders, potentially impacting Tether and Circle equally (user fees notwithstanding). In bond markets, such as treasuries, yields move inversely to prices. But if U.S. treasury markets face a crisis of confidence, it could harm the collateral strategy for the entire stablecoin market by making treasuries seem less safe.

A Bitcoin Silver Lining

As analysts ponder all of the possibilities and permutations of this radical proposal, coincidentally, or perhaps serendipitously, BlackRock CEO Larry Fink issued a warning in his annual shareholder letter on Monday that the U.S. dollar risks losing its status as the world’s reserve currency to Bitcoin. “If the U.S. doesn’t get its debt under control, if deficits keep ballooning, America risks losing that position to digital assets like Bitcoin,” he wrote.

This warning seems particularly prescient given all of the financial and policy engineering being proposed to manipulate what is supposed to be the safest and most liquid security on earth — a U.S. treasury. Bitcoin offers a stark contrast — and in fact was invented as an antidote to the profligate lending that precipitated a housing crisis in 2007-2008.

It also seems unlikely that any other type of stablecoin would grow to replace tokenized dollars, such as the pound, euro, yen, or yuan. None are remotely close to usurping the U.S. dollar. The yuan may be the closest but China’s tight capital controls prevent it from being freely tradable.

So perhaps the biggest winner in all of this could be bitcoin — at least in the long run. During previous periods of uncertainty, like March 16, 2020, or the unwinding of the Japanese yen trade last August, bitcoin has fallen like every other asset as investors rushed into the dollar. But especially in this period of time, where policy emanating from Washington seems so unorthodox and erratic, investors may finally have enough.

“What they really do to me is in all these things, is whatever the initial reaction is, people will kind of have to grin and bear it a little bit and say, ‘Okay, yes sir, I have another,” says Tchir. “But behind the scenes, they will start figuring out ways around that. And so I think that’s a real risk if they go down [a path] like this.”