Posted March 29, 2025 at 9:00 am EST.

Every once in a while privacy issues come to the forefront of the news cycle.

It happened again this week when news broke that senior government officials, including Vice President JD Vance, National Security Advisor Mike Waltz, and Secretary of Defense Pete Hegseth, along with about a dozen others including one national journalist, were included in a private chat on the encrypted Signal messaging application that was used to share detailed attack plans against a terrorist group in Yemen.

Questions are swirling around Washington, D.C. trying to figure out why such sensitive data was shared on a free commercial application. After all, the government has secure rooms and tools to discuss and disseminate such information (Editor’s note: I served as a senior intelligence analyst for the Defense Intelligence Agency from 2008-2013 and held a Top Secret clearance for the duration of my employment).

The fallout from this scandal is far from over, but briefly stepping outside the palace intrigue, it has particular importance for crypto as well. After all, there is a lot of crossover between crypto enthusiasts and privacy advocates, but it never seems like privacy grows at a similar pace to crypto acceptance.

And unfortunately, the answer for why privacy in crypto shows limited adoption is the same reason why detailed military plans were shared over a commercial app. It was just easier. “People prefer convenience over security and privacy,” said Harry Halpin, CEO at Nym Technologies, a privacy-focused blockchain company that just released a virtual private network (VPN), in an interview with Unchained. “This includes government officials and corporate executives, including people with access to the top level secrets.”

Vitalik Buterin, founder of the $227 billion Ethereum blockchain, put things more succinctly in a July 2024 interview with Forbes when talking about why privacy tech has struggled to take off in crypto. “The bulk of the financial value of many of these blockchains comes from average people that want to trade cats and dogs,” said Buterin. “Privacy, in general, is definitely the sort of thing that never really succeeds.”

Privacy Isn’t Paying

Perhaps the best representation of privacy tech’s struggle to take off in crypto comes back to Signal itself.

It is a widely used application in government circles (clearly), but its funding relies on donations. The project itself was originally funded by government grants from groups like DARPA, the Defense Advanced Research Projects Agency, which helped first create the internet. It also received funding from the Open Technology Fund, which was affiliated with Voice of America and had its funding briefly cut off by the Trump administration before reversing course on Thursday after being sued by the group.

“The most absurd thing is that it seems like everyone in the Trump administration is using Signal, but they literally cut Signal’s primary historical funding sources,” said Halpin.

In crypto the problem is even more challenging because there are no platforms with usage commensurate with something like Signal, let alone achieving sustainable economics.

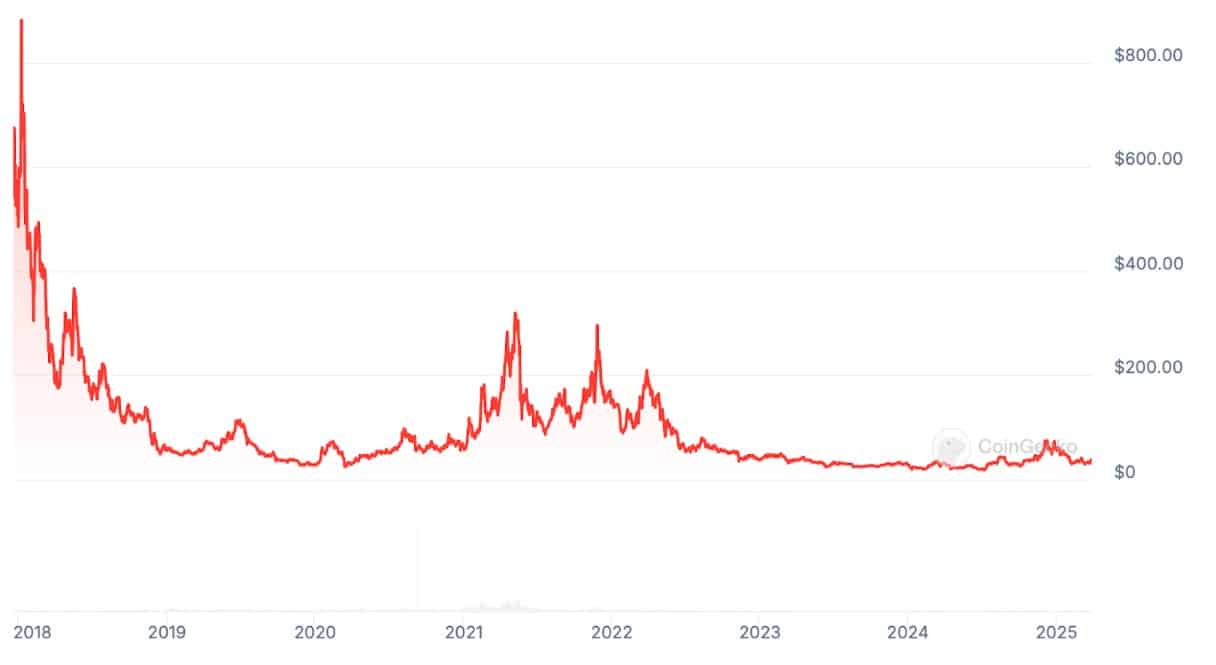

Take Nym for example. The company went against the grain by creating a tool that has nothing to do with financial transactions, a VPN. This is a potentially huge market, worth over $50 billion annually with more than a billion users across commercial and retail applications. However, right now Nym’s VPN, which was released just weeks ago, has about 6,000 users and only 1,000 paying customers forking out $6-$12 a month, which Halpin says is actually high for a VPN subscription. Nym’s token (NYM), which at $.05 is down 99% from its all-time high in April 2022, is languishing despite the launch of the first product.

Nym’s Price Drop

Zcash is another prominent privacy-focused project that continues to search for its first breakthrough. Founded in 2016 by Zooko Wilcox, this blockchain is notable because it allows users to select whether or not to shield their transactions, i.e., make them private. This means that Zcash provides as much of a controlled experiment as possible in the world of crypto to test user appetites for privacy.

Here are the numbers. In August 2024, there were 16.3 million zcash tokens in circulation. Of that supply just 1.48 million were in shielded pools, meaning that they can be used in private transactions. Put another way, as of last summer over 90% of zcash tokens were not available to be used in private transactions. Additionally, in 2024 the blockchain only earned $19,190 in fees from users submitting transactions, according to Token Terminal. Its token, zcash, is down 94.5% from its price of $580 in 2018.

Zcash’s Slippery Slope

Zcash’s Annual Fee Earnings

Part of the reason why could come back to the same issues with user experience that led the White House officials to use Signal. “Historically, the user experience for Zcash has been really poor,” said Josh Swihart, CEO of the Zcash development firm Electric Coin Company, in a 2024 interview with Forbes. “You have early adopters who are quite comfortable with technology, but for most normal people worldwide, it’s just not accessible.”

Privacy’s One Killer App in Crypto

Arguably the only place where privacy tech has found product-market fit in crypto are applications known as mixers, such as Tornado Cash, Blender.io, Sinbad.io, and Samurai Wallet, which use various cloaking tools to break the linkages between the sender and receiver of a transaction.

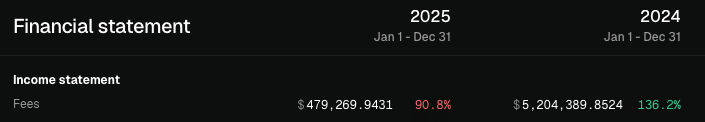

In contrast to Zcash, Tornado Cash generated $5.2 million in fees in 2024 — and that’s down from nearly $13 million in 2022, when the software program was sanctioned that August by the U.S. government, specifically the Treasury Department’s Office of Foreign Assets Control (OFAC).

Tornado Cash’s Annual Fee Earnings

Mixers are controversial because there is supposed to be no mechanism for the creators of these protocols to censor or distinguish between legitimate and illicit transactions. For this reason they have caught the ire of the federal government, which has shut down the latter three applications mentioned above.

Though Tornado Cash took a hit in 2022 due to the U.S. sanctions, just this week, in a major win for the industry, the department removed smart contract addresses associated with Tornado Cash from the OFAC sanctions list.

However, a prosecution is still taking place against Tornado Cash’s founder Roman Storm, given that North Korean hackers are alleged to have laundered $7 billion through the platform over the years.

The issue cropped up again following North Korea’s $1.5 billion hack of crypto exchange Bybit last month, where it allegedly laundered $900 million worth of stolen ether.

Crypto Privacy Keeps Pushing Forward

For now the privacy community is moving ahead, perhaps hoping that the attention on the industry will give it some sustainable momentum. In today’s world that means trying to build entire private smart contracts and applications, not just transactions, as well as verified clean pools of funds that can interact with mixers without running afoul of the law.

In terms of clean pools, one project that has gotten attention is a “Proof of Innocence” project implemented by another mixer called Railgun, which ensures “tokens entering the RAILGUN smart contract are not from a known list of interactions, or actors considered undesirable by respective wallet providers.” The project has even drawn praise from Vitalik Buterin, who commended the protocol in February by preventing the laundering of $9.5 million worth of crypto with the new feature. “This is a solid demonstration of Railgun’s privacy pools mechanism working in practice, allowing Railgun to avoid serving proceeds of crime without using any snooping / backdoors,” Buterin wrote.

Halpin expects usage of these types of tools to grow. “I’m very excited personally about private smart contracts,” he said. “I know the Midnight Network by Cardano [which will use zero-knowledge proofs to protect personal data] is going to launch fairly soon. They will offer a private smart contract. Aleo is offering private smart contracts today. And I think once we have the ability to shield the contracts with various guarantees, we can actually then move to private smart contracts as well. And that’s going to be a huge win.”

But if history is any guide, none of this will matter unless the user experience becomes commensurate or better than mainstream applications like Google, Facebook, or ChatGPT. Just ask Mike Waltz.