Users paid roughly $1.1 million on March 7 in gas fees to transact on the Solana blockchain, with a large part of those fees stemming from memecoin trading on decentralized exchanges.

Dog-related memecoins appeared to be responsible for much of the recent trading on Solana.

(Unsplash/Patrícia Hellinger)

Posted March 8, 2024 at 6:46 pm EST.

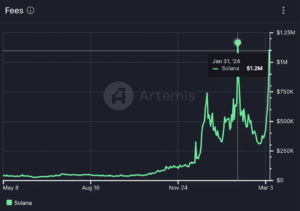

Layer 1 blockchain Solana had the second-highest day in total transaction fees paid by users yesterday, data from blockchain analytics firm Artemis shows.

On March 7, users paid roughly $1.1 million in gas fees to transact on the Solana blockchain, with a large part of those fees coming from memecoin trading on decentralized exchanges.

Solana’s second-highest day in fees generated comes a little over a month after the blockchain network recorded its high of $1.2 million in daily fees on Jan. 31.

Read more: Cloud-Based Smartphone Application APhone Rolls Out Mainnet on Solana

Per Artemis, of the top five applications of Solana ranked by gas consumption, three of them are DeFi protocols, specifically trading platforms: Raydium, Jupiter, and Drift. The three collectively have generated almost $470,000 in gas fees over the past 24 hours.

A Dune dashboard created by data scientist Andrew Hong shows that the second most traded pair on Solana-based decentralized exchanges in the past seven days is SOL-WIF with a trading volume of $1.04 billion, behind SOL-USDC with $5.14 billion. Additionally, of the top 10 trading pairs by volume on Jupiter, five of them include dog-based memecoins, namely WIF and BONK.

“Our hypothesis [for the spike in fees generated] is overall higher usage due to memecoins — there’s also a spike in wallet transfer gas usage so likely folks moving SOL to and from CEX to trade,” said Artemis co-founder Jon Ma in a Telegram message to Unchained.

The price of SOL, the native token for Solana, currently sits at $145, an 11.2% increase in the past week. Moreover, BONK and WIF each have a market cap of over $2 billion, according to data from CoinGecko.