FOX Business’ Charlie Gasparino has the details on Paramount’s cash flow problems on ‘The Claman Countdown.’

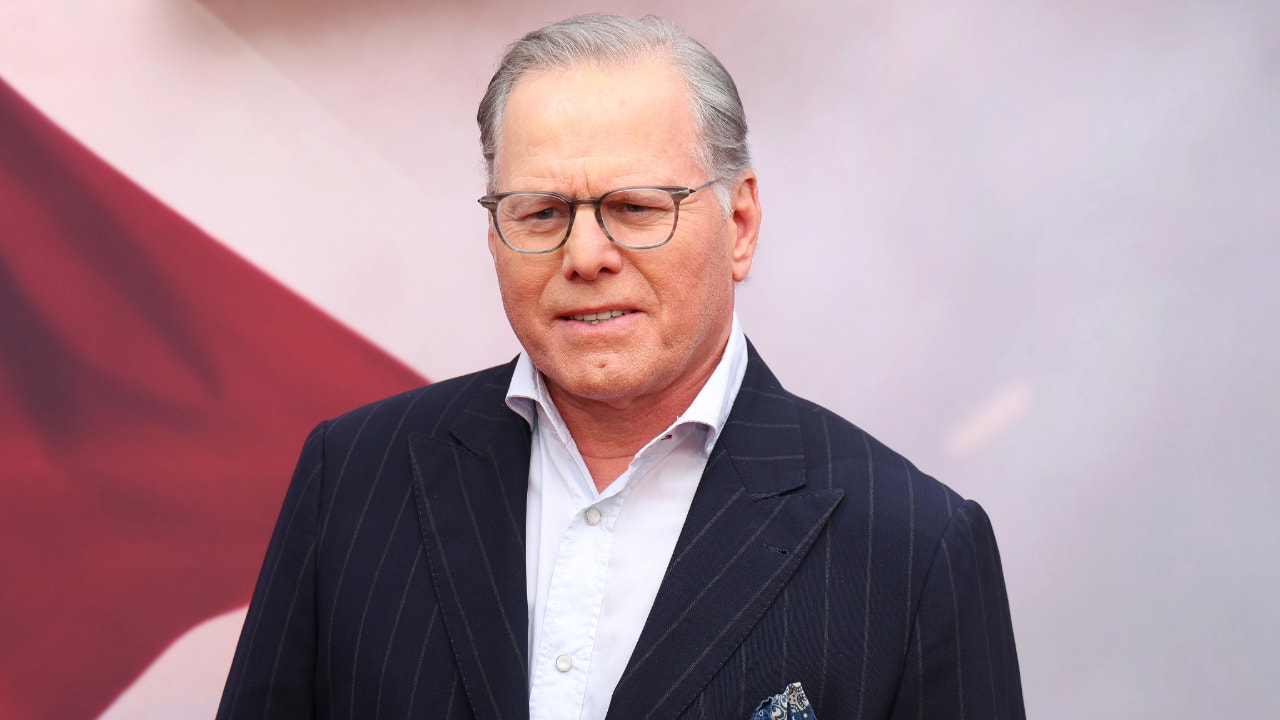

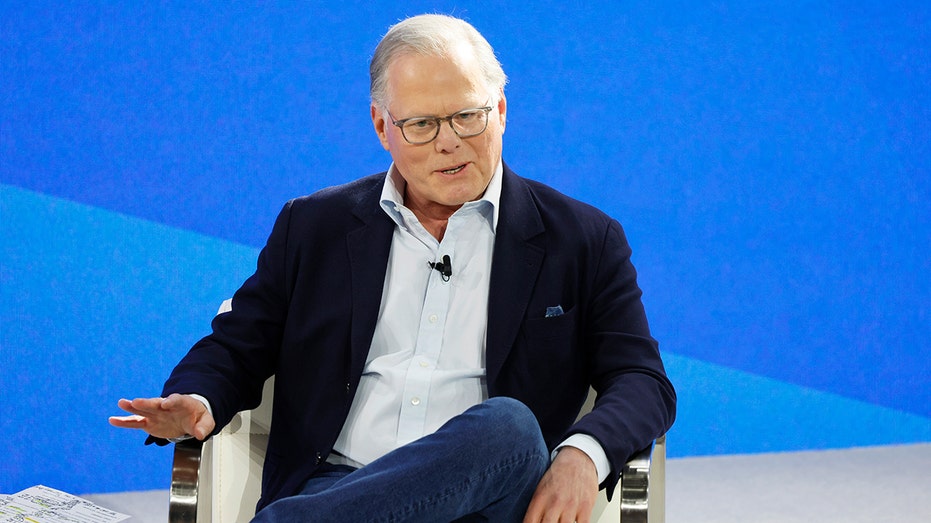

Warner Bros. Discovery CEO David Zaslav “is not in deal mode” and his conversations about a potential tie-up with rival studio Paramount Global are said to be more exploratory, suggesting the speculation of a near-term mega media merger between the two outfits is more wishful thinking than real, according to people with direct knowledge of the matter.

That doesn’t mean such a deal is completely off the table, and that there might not be a way to consummate some partnership that ultimately leads to a combination, these people say. Zaslav met with Paramount CEO Bob Bakish on Tuesday, but the conversation largely involved the possible sale of Shari Redstone’s stake in Paramount’s parent, National Amusements, the holding company for her slowly deteriorating media empire that includes CBS, its sports programming, MTV, Comedy Central, Nickelodeon and money-losing streaming platform Paramount+.

Redstone holds the so-called controlling or voting shares of National Amusements, making her the de facto boss of Paramount, the legacy asset of her father, the famed takeover artist Sumner Redstone, who died in 2020 and left her in charge of the media empire he created. Her stake in National Amusements translates into owning about 80% of the voting shares of Paramount. It is said to be worth anywhere from $1.5 billion to $2 billion, according to people with knowledge of the discussions.

PARAMOUNT, WARNER BROS DISCOVERY DISCUSS MERGER; WOULD CONSOLIDATE STREAMING SERVICES

The purchase of Redstone’s stake in National Amusements and Paramount would make it easier for Zaslav to start to absorb the media company, which has a market value of around $10 billion, people close to the matter say. He also has spoken with advisers about a straight takeover of the company, though that seems to be a heavier lift, they say.

Warner Bros. Discovery CEO David Zaslav speaks during the New York Times annual DealBook summit on Nov. 29, 2023, in New York City. (Michael M. Santiago/Getty Images / Getty Images)

One problem is debt. Warner Bros. Discovery has $40 billion of it on its books. Paramount also has a heavy debt load; $15 billion, and the rating agency Standard & Poor’s earlier this year lowered Paramount’s bond rating to just above investment grade, citing possible cash flow problems arising from the costs of its expansion into streaming programming, which hasn’t resulted in a significant uptick in revenues.

In addition to the heavy debt load, Zaslav is particularly worried about the high costs of renewing sports rights, such as NFL games, these people say. One Zaslav associate called some of Paramount’s programs, properties such as MTV, a “melting ice cube” because of significantly declining audience share in the face of cord cutting, or consumers eschewing so-called linear or traditional programming viewed through cable, which is a major source of revenues for media companies.

In the era of cord cutting, cable providers pay lower distribution fees to programmers. Another concern: cable advertising remains depressed.

Attractive to Zaslav is the Paramount movie studio, and its library of films, people close to him say, and the economies of scale that can be achieved through the integration of Paramount+ with Warner Bros. Discovery’s streaming service Max. Plus, he might be able to pick up some premium media properties on the cheap since Paramount has let the world know it’s desperate to sell as its business conditions deteriorate.

Zaslav and a Warner Bros. Discovery press official didn’t return a call for comment. A spokesman for Paramount had no comment.

“This is all b——t, it has a zero percent chance of happening,” said Rich Greenfield, a veteran media analyst at LightShed Partners, who has long predicted the demise of linear TV of the type offered by both Paramount and Warner Bros. Discovery.

Greenfield says Paramount is being forced to shop itself out of desperation as its business model slowly collapses, and most big media companies will take a look at its books. The problem is that there are too many unknowns about the future of its programming, he says.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| WBD | WARNER BROS. DISCOVERY INC. | 11.46 | -0.20 | -1.76% |

| PARA | PARAMOUNT GLOBAL | 15.19 | -0.32 | -2.03% |

“Nobody is buying this thing for the next six months because its major [cable] distribution deals are expiring and no one knows what they will be,” he said. “What you’re seeing now is just leaks from Paramount because these guys are in a scary position.”

Other outfits have signed non-disclosure agreements with Paramount, thus their talks are more formal. They include Redbird Capital, Skydance Media, and acting on his own, soon-to-be retiring Activision Blizzard CEO Bobby Kotick. But those talks have been reported for weeks, and a deal, as of now, remains elusive.

Zaslav, a long-time media executive, was the architect of the Time Warner-Discovery merger completed in April 2022, which combined media properties such as HBO, CNN, the Food Network, the Cartoon Network and Warner Bros. Studio.

He’s considered particularly adept at integrating businesses, a skill honed as a long-time executive of NBCUniversal, then owned by General Electric and led by CEO Jack Welch, the late and legendary cost-cutter known as “Neutron Jack.”

Zaslav is a Welch protégé and, in Welchian fashion, he has eliminated nearly $12 billion in debt since the Time Warner deal, and now has $5 billion in free cash flow to pursue acquisitions, people close to him say. Zaslav has said he is interested in expanding Warner Bros. Discovery through acquisitions.

“[Zaslav] is actually in a good position to buy something,” said one person close to him. “But as of now, he’s just looking and this deal.”