A fund of funds is an investment vehicle that invests in mutual funds, exchange-traded funds or even hedge funds. When you invest in a fund of funds, you get an entire diversified investment portfolio at once, featuring broad exposure to many different asset classes with less risk involved.

How a Fund of Funds Works

With mutual funds, ETFs and hedge funds, investors buy shares and fund managers put the capital to work in assets like bonds and stocks, depending on the fund’s investment strategy.

A short-term municipal bond fund, for example, would use its investors’ money to build a portfolio of short-term municipal bonds. This gives participants the benefit of having a professional manager select investments for them while spreading out the risk across many individual securities.

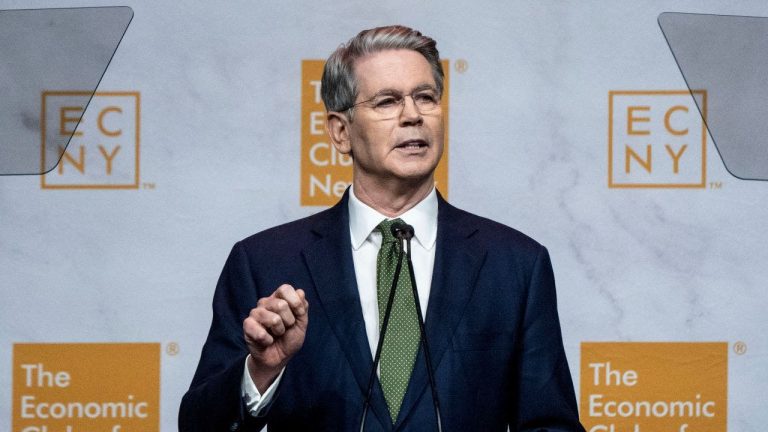

“A fund of funds is just an iteration of this, but rather than investing in a particular mutual fund, you are investing in a group of funds chosen, filtered and selected by the fund of funds company,” says John Matina, co-founder and director of finance at PARCO, a startup aimed at helping Americans prepare for retirement and manage their pensions.

In a sense, when you invest in a fund of funds, you’re “hiring a ‘general contractor’ to complete research on other managers, balance overall risk and make sure the entire ‘project’ runs smoothly,” says Brent Weiss, CFP, co-founder of Facet Wealth.

Types of Funds of Funds

Funds of funds are available to meet a range of investment styles and goals. In each separate type of fund of funds, you may find fettered funds—meaning they only invest in funds held by the same management company, like Fidelity or Vanguard—or unfettered funds, meaning they invest in funds held by any management company.

Target Date Funds

Target date funds are the most popular type of fund of funds, says Steve Athanassie, CFP.

“These are designed primarily for retirement plans and created for the plan participant who does not want to implement, monitor and adjust their mix of investments,” says Athanassie. These days, you can find target date funds just about anywhere, from workplace retirement plans to taxable investment accounts at major brokerages.

When investors choose a target date fund, their asset allocation and diversification automatically adjusts as they near their target retirement date. Practically speaking, this means target date funds start more heavily invested in stock-based funds and gradually shift to a higher percentage of bond- and fixed-income-based funds as you approach retirement age.

Target Allocation Strategies

Instead of targeting a date, some funds of funds home in on a particular asset allocation strategy.

“In this strategy, there is a specific stock to bond weighting, like 60/40 or 80/20,” says Weiss of Facet Wealth. “A portfolio manager then selects the underlying mutual funds that comprise the stock or bond allocation.”

The portfolio manager has discretion over which funds to include, when to make changes to the investment strategy and how to manage the portfolio over time—so long as the allocation of stocks to bonds stays within the fund’s goals.

Hedge Fund of Funds

Hedge funds are perhaps the least accessible type of investment. In exchange for the latitude to invest in more asset classes and provide less transparency to investors, the SEC limits them to only accredited investors with high incomes or net worths.

To get around this, publicly traded hedge funds of funds allow everyday investors to invest in a diversified mix of professionally managed hedge funds.

“When an investor can invest directly in one hedge fund, it is often desirable from a risk management standpoint to diversify into more than one fund,” says Athanassie. “A fund of a variety of hedge funds can facilitate this and help mitigate some of the manager and strategy risk.” While they offer less risk than individual hedge funds, hedge funds of funds do still take on considerably more risk than traditional index funds and generally also charge substantially higher fees.

Business Development Companies

Business development companies (BDCs) are probably the least well-known (and least understood) type of fund of funds, says Athanassie, even though they’ve been around for about 40 years.

BDCs are a type of closed-end fund that makes investments in a pool of private or public companies with valuations under $250 million. The goal of BDCs is often to help distressed companies regain a more solid financial footing.

“Many of the companies that BDCs invest in provide various forms of financing for lots of other companies,” says Athanassie. “For example, one large BDC has a $2.6 billion portfolio, providing financing to 147 different companies. This BDC provides those companies an alternative to traditional bank lending.”

BDCs make money when the companies they invest in or finance repay debts or when their stocks appreciate in value. Like REITs, BDCs must pay out almost all of their profits to shareholders, making them rich in dividend payments.

That said, because the companies BDCs invest in are small, often financially struggling and not as frequently traded, BDCs take on a lot of risk, which extends to your investing rupees. Some BDCs are listed on a publicly traded exchange, making them available to non-accredited everyday investors.

Fund of Funds Advantages

If you like the idea of a single investment to achieve multiple investment goals, a fund of funds can offer several advantages.

- Set-it-and-forget-it potential. Funds of funds can be ideal for “savers who don’t want to deal with watching the markets, making adjustments and creating their investment allocation,” says Athanassie. A single investment today in a target date fund, for example, can be potentially held until you retire—or later.

- Professional fund selection and risk management. Funds of funds can be the perfect choice for those without the knowledge or desire to pick individual funds or strategize ways to minimize their risk, says Weiss. “The right funds will provide a properly allocated, risk-appropriate and well-diversified strategy that can support a well-designed financial strategy,” he notes.

- Diversification in the alternative investment space. If you’re looking to test the waters in the alternative investment space, like hedge funds or BDCs, Weiss says a professional money manager can provide a great deal of expertise in a highly nuanced and less understood investment class. “In theory, having a portfolio manager in this space can add more value given the ‘black box’ style of investing you often find in this space,” he says.

Fund of Funds Disadvantages

While a fund of funds might look like a complete investing win-win on the surface, there are distinct disadvantages to consider:

- Fees. “The key knock against funds of funds is the stacking of fees,” says Mantia of PARCO. “Suppose you are invested in a fund of funds that charges a 1% [management] fee. Your fund of funds is also invested in mutual funds, hedge funds and other alternative investments that charge a [collective] 1% fee. This means that, net all fees, you have a 2% drag on your portfolio performance that your investments must overcome simply to break even.” To stay on top of all of the fees you may owe, be sure to review the “Acquired Fund Fees and Expenses” for any fund of funds.

- Lack of transparency. While not an issue for more traditional investments like mutual funds, transparency can be an issue in the hedge fund space. “Most alternative managers claim to have some form of ‘secret sauce’ when it comes to their investment strategy,” says Weiss. That sauce will rarely be made public, meaning you might not know the entirety of what your money is invested in.

- Illiquidity. While some funds of funds can be traded on exchanges, others may have more limited liquidity. Investors should understand the liquidity (or lack thereof) before putting their money to work in alternative investment products, says Weiss.

- Watered-down returns. Holding multiple funds of funds could result in watered-down returns due to too much diversification, Athanassie cautions. “If owning 30 positions is better than owning 15, is owning 100 positions even better?” he says. More isn’t always better when it comes to investing. You might wind up buying into the same companies multiple times or paying higher fees for the same or lower performance.

How to Invest in a Fund of Funds

If you’re interested in exploring the different funds of funds available, your online brokerage can probably help. Its investment research tools, such as fund screeners and databases, can help you identify and then compare your options.

Once you’ve located a few potential funds, check out their Morningstar ratings, expense ratios and even evaluations of the funds inside the funds you’re evaluating. Then simply buy shares of your fund of funds of choice through your brokerage.

When used correctly, a fund of funds can be a powerful way to help you achieve an asset allocation and diversification strategy to meet your goals.