The 47th president equates his job performance with the stock market more than any predecessor. Was he really going to convene an industry event with bitcoin down 23% in recent weeks?

Posted March 2, 2025 at 7:56 pm EST.

Through Saturday the crypto market was down 14% in 2025.

Despite all of the hype and promise from the Trump administration, the industry had been left disheartened by a few memecoin scandals as well as a lack of tangible progress from the government outside of the dismissal of some cases from the Securities and Exchange Commission and the release of a somewhat vague Executive Order on January 23.

But that disappointment just got a reprieve. Two days ago the White House announced that it will host its first ever crypto summit this Friday, which “will be chaired by the White House A.I. & Crypto Czar David Sacks, and administered by the [President ‘s Working Group on Digital Assets] Executive Director Bo Hines.” (Unchained was the first to report that the Trump administration had pivoted to summits on specific crypto issues rather than convening a crypto council, as had been the original plan.)

This news garnered excitement from the community, as it promised to lay the groundwork for some of the goals outlined in the Executive Order, which is designed to “promote United States leadership in digital assets and financial technology while protecting economic liberty”.

But for a president who deeply cares about the stock market and sees its performance as a barometer of his success, this announcement about the summit was likely not enough. The market barely bumped on news.

That may be why Trump decided to reveal the first five tokens to be included in a future crypto reserve: bitcoin, ether, cardano, ripple, and solana.

Bull Markets = Popularity for Trump

Trump goes out of his way to equate his job performance to a bullish market whenever possible. On December 5th Trump posted on Truth Social after Bitcoin crossed the $100,000 mark for the first time, “CONGRATULATIONS BITCOINERS!!! $100,000!!! YOU’RE WELCOME!!! Together, we will Make America Great Again!”

Looking out at the broader market, JPMorgan observed that the president tweeted favorably about the stock market’s performance 156 times during his first administration. However, since 2024 he has posted about the stock market just once. According to the bank, “Most of the current posts [by Trump] regarding the ‘US economy’ are on debt ceiling, government spending/efficiency or tariff benefits.”

It doesn’t help his case that the S&P 500 is down 1.47% since he took office on January 20th.

What better way to put the market and industry in a good mood than name-dropping some crypto coins? In a series of two posts on Truth Social Sunday the president announced that work would immediately commence on building a strategic crypto reserve.

The first post read, “A U.S. Crypto Reserve will elevate this critical industry after years of corrupt attacks by the Biden Administration, which is why my Executive Order on Digital Assets directed the Presidential Working Group to move forward on a Crypto Strategic Reserve that includes XRP, SOL, and ADA. I will make sure the U.S. is the Crypto Capital of the World. We are MAKING AMERICA GREAT AGAIN!”

After generating shock and surprise within the industry that the post omitted the two most established crypto assets, bitcoin and ether, the president followed up with another post, “And, obviously, BTC and ETH, as other valuable Cryptocurrencies, will be the heart of the Reserve. I also love Bitcoin and Ethereum!”

Making Tokens Great Again

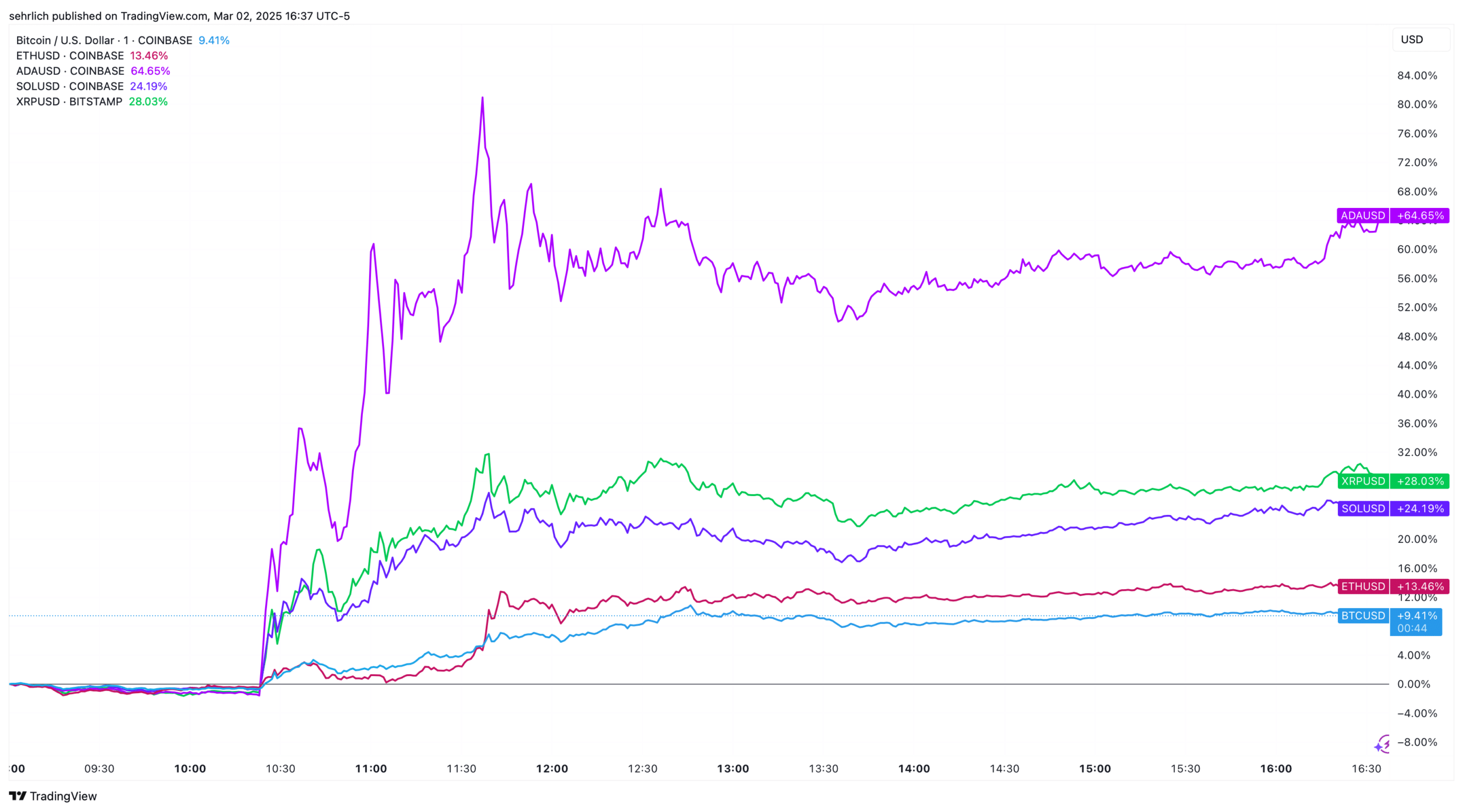

Each of the crypto assets soared after the posts. As of this writing bitcoin is up 9.41% and has recovered to $94,070 after falling below $80,000 last week. Ether jumped by 13.46% as it tried to shake off the $1.5 billion Bybit hack and a broader industry narrative that it is losing ground to rival Solana. Solana surged 24.19% on the news and ripple, which has benefitted more than any other major token by tying itself to the Trump administration (in the last 12 months it is up 452%), jumped another 28%.

But the biggest winner from today’s news was Cardano, a native proof-of-stake blockchain that theoretically offers a similar value proposition to users of other multipurpose blockchains like Ethereum or Solana, which is up 64.65%.

It is worth noting that Solana, Cardano, and Ripple all appear to be slated to receive spot ETFs this year. However, according to recent analysis from Unchained many of these tokens have been buoyed in recent months as part of the Trump trade and that investors should use caution before buying any tokens.

A Pile of Additional Questions

Trump’s social media posts provide hardly any other details on the planned “reserve,” as he called it in his posts Sunday, but the choice of the word “reserve” seems to mark a change from the administration’s stance in January’s executive order.

The word “reserve” suggests that the government will proactively purchase more assets, whereas the intention stated in January’s executive order to “evaluate the potential creation and maintenance of a national digital asset stockpile” would be more about holding onto the $19.1 billion in crypto, 97.9% of which is in bitcoin, that it already has from seizures across dozens of tokens.

If Trump’s new intention is that the government purchase new assets on the open market, that raises the question of whether that could require an act of Congress, and whether the teams and foundations behind tokens like XRP and ADA would donate assets to the reserve. If the government is going to purchase assets then the timing of any procurement program would be critical as many traders would likely try to front-run the government.

However, one thing that is clear is that when President Trump steps up to the podium on Friday for opening remarks at the White House summit, he will be speaking to an industry with renewed wind in its sails.